Nearly all Asian high-yield debt issued in the first quarter came from Chinese property companies

By Mike Bird

Asia’s high-yield-bond market is being overwhelmed by Chinese real-estate companies, leaving it increasingly dependent on the questionable health of a single sector.

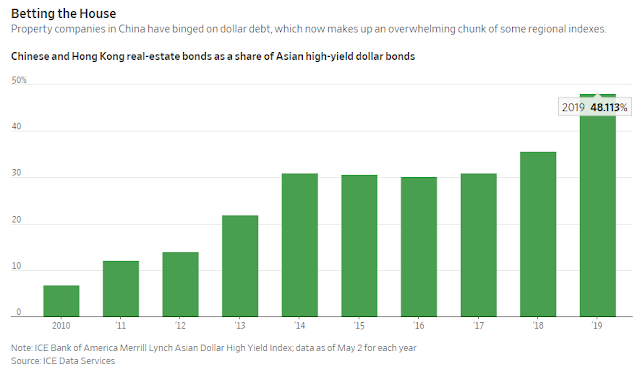

Nearly all Asian high-yield debt issued in the first quarter came from Chinese property companies, according to ratings company Moody’s. Their bonds now represent 48% of the ICE Bank of America Merrill Lynch Asian Dollar High Yield Index, which tracks securities worth $162 billion—outweighing every other sector by miles.

This isn’t your grandfather’s Asian high-yield credit market, or even your older brother’s. As recently as 2010, Chinese real estate made up an almost-negligible 7% slice of the index.

So when fund managers say they like Asian high yield, they’re effectively now saying they like Chinese property developers. Nothing else in the index is anywhere near large enough to act as a counterweight.

The vacant apartments of tomorrow. Photo: thomas peter/Reuters

The rapid expansion of Chinese property debt tells the story of a sector that has been incredibly profitable, but has become highly leveraged and in many ways dysfunctional.

At China Evergrande Group ,a developer that alone accounts for more than 11% of the bond index, total debt amounted to more than twice equity at the end of 2018. In general, China’s property developers make riskier investments than in the past, and the quality of their debt has declined, according to Moody’s.

Demand is also speculative. Chinese property purchases have come to be dominated by families buying second and third homes that they often leave empty, according to research by China’s Southwestern University of Finance and Economics. The national vacancy rate now sits at 21.4%, up 3 percentage points since 2011 and around double the international average. That’s in a country where house prices, relative to average income, are higher than in New York or London, according to Citi analysts.

Investors would be wise to take a close look at their exposure to Asian high-yield debt. Index-tracking bond funds may have changed markedly in recent years and bear a fresh inspection.

0 comments:

Publicar un comentario