Just Sell This Bounce

by: David H. Lerner

Summary

- I went out on a limb calling this bounce, and I am going out on a limb again calling this a temporary bounce.

- Special mention to Tesla, up almost 16. I am confident and excited that now TSLA has put in a bottom.

- I want you to take profits starting tomorrow morning, especially if the futures are up strong. I want you to take 30% to 50% of the gains from this past Thursday.

I Went Out on a Limb Calling this Bounce, and I am Going Out on a Limb Again Calling This a Temporary Bounce

- Special mention to Tesla, up almost 16. I am confident and excited that now TSLA has put in a bottom.

- I want you to take profits starting tomorrow morning, especially if the futures are up strong. I want you to take 30% to 50% of the gains from this past Thursday.

I Went Out on a Limb Calling this Bounce, and I am Going Out on a Limb Again Calling This a Temporary Bounce

It's gratifying to have called this rally and see it come on so strong. I was a little early, it started last Thursday and got stopped in its tracks. With this crazy FTC and DOJ declaring war on America's Tech crown jewels, the market had to discount the idea that the USA can cannibalize its own progeny all because of politics.

One of our loyal readers asked me that, "now that the Fed has come out with language supportive of lowering interest rates to support the market, would that justify a longer rally?" He did find it quizzical that Powell made no mention of actually lowering rates so he wanted my take. I have to be honest, I was a bit surprised that he made this connection. I was actually working for a client on my real vocation and turned down the babble of market chatter. I took a listen and, sure enough, the commentators are making that connection. I am not a dyed in the wool, 100% chartist, but when the charts are talking loud enough, they should be heeded. The rally's cause to me was broadcasted in the charts a week ago. We were plainly way oversold and it was only natural that we had a bounce. I was not expecting such a strong bounce, but if you take into account that this little rally was building for a few days, it does make sense somewhat. We may see more of a rally for Wednesday, and even going into Thursday. As I said earlier, this is a countercyclical bounce and we are very likely to retreat again to continue exploring true support at a lower level. Yesterday, the all-important level on the S&P 2,750 did not hold, we got down to 2,730. So this is what I suggest, you speculators (my definition) where you are expected to develop a position over weeks or months, and of course, you fast money traders, I'm going to want you to sell harder than usual. There were some fantastic winners on the list this morning, The Trade Desk (NASDAQ:TTD) was up 25 points, Arista Networks (NYSE:ANET) up 13, MongoDB (NASDAQ:MDB) up almost 7, Intuitive Surgical (NASDAQ:ISRG) up 16, Illlumina (NASDAQ:ILMN) up 10, yes, there were others that were not so great. Special mention to Tesla (NASDAQ:TSLA), up almost 16. I am confident and excited that now TSLA has put in a bottom. Can it give up these gains, yes? Will we see $280 to $320 before we see $130-$150? I say yes. Fast traders and speculators should start setting up a long trade in TSLA that should give nice returns going into the latter half of the summer.

Take Profits

I digress, I want you to take profits starting tomorrow morning, especially if the futures are up strong.

I want you to take 30% to 50% of the gains from this past Thursday. Look to hold onto 25% of these recent positions. I think the top end of this rally could be 2,830. Do you remember this number? When we were in the high 2,800s, I said support should start at 2,830-2,820 with a really important level around 2,810 and a hard base at 2,800. Now an important rule is; "past support becomes resistance". This all sounds nonsensical, but I covered this a few weeks ago and I don't want to bore my old readers. I will get to the underpinning of this rule, I will cover this in my longer Sunday piece. If this doesn't sound like my usual pattern, it's not, I never like taking huge profits on a speculation, fast money traders do this out of habit. Perhaps this suggestion underlines my certainty that this bounce does NOT have legs. Sadly, I don't think 2,700 holds when we start declining again.

Calling BS on the DOJ and FTC. Unicorns Will Become a Fairy Tale Once Again

Now I want to pick up on this DOJ and FTC nonsense, this is a Potemkin village of phoneyness.

I challenge anyone to give me a real coherent argument that there is a monopolistic practice that can only be remedied by breaking up Apple (NASDAQ:AAPL), Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN) and Alphabet (GOOGL/GOOG). At most, there will be some fines, even in the billions, which any of these companies can fund that out of their couch cushions.

What this will do and have tremendous influence in the stock market is via IPO. The fact that none of these companies and I suspect none of the next level companies like an Adobe (NASDAQ:ADBE) or a Salesforce (NYSE:CRM) will be able to buy a Unicorn or even take a major percentage of an investment round of one, ever again. So let's face it, the VC bubble is going to burst long and strong. First, the fiasco of Lyft (NASDAQ:LYFT)/Uber (NYSE:UBER), now SoftBank (OTCPK:SFTBY) (OTCPK:SFTBF) is having trouble raising the next $100 billion Vision fund. Now with this government mandated buyers strike, startups will HAVE to take the IPO route. The stock market is our concern and focus, obviously, for the VC world, we are about to see a cataclysmic adjustment. Profits and cash flow now matter most or it should soon. I suspect that more, and even promising startups will die on the vine. The WeWorks of the world will have to change or die. It might actually work out for the small investor if they understand technology. So for us, this will work out fine, not so much for the VC and startup world. I will bring the popcorn and watch how WeWork (VWORK) goes the way of the Hindenburg on IPO.

I challenge anyone to give me a real coherent argument that there is a monopolistic practice that can only be remedied by breaking up Apple (NASDAQ:AAPL), Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN) and Alphabet (GOOGL/GOOG). At most, there will be some fines, even in the billions, which any of these companies can fund that out of their couch cushions.

What this will do and have tremendous influence in the stock market is via IPO. The fact that none of these companies and I suspect none of the next level companies like an Adobe (NASDAQ:ADBE) or a Salesforce (NYSE:CRM) will be able to buy a Unicorn or even take a major percentage of an investment round of one, ever again. So let's face it, the VC bubble is going to burst long and strong. First, the fiasco of Lyft (NASDAQ:LYFT)/Uber (NYSE:UBER), now SoftBank (OTCPK:SFTBY) (OTCPK:SFTBF) is having trouble raising the next $100 billion Vision fund. Now with this government mandated buyers strike, startups will HAVE to take the IPO route. The stock market is our concern and focus, obviously, for the VC world, we are about to see a cataclysmic adjustment. Profits and cash flow now matter most or it should soon. I suspect that more, and even promising startups will die on the vine. The WeWorks of the world will have to change or die. It might actually work out for the small investor if they understand technology. So for us, this will work out fine, not so much for the VC and startup world. I will bring the popcorn and watch how WeWork (VWORK) goes the way of the Hindenburg on IPO.

Aside from the charts, why are we selling off?

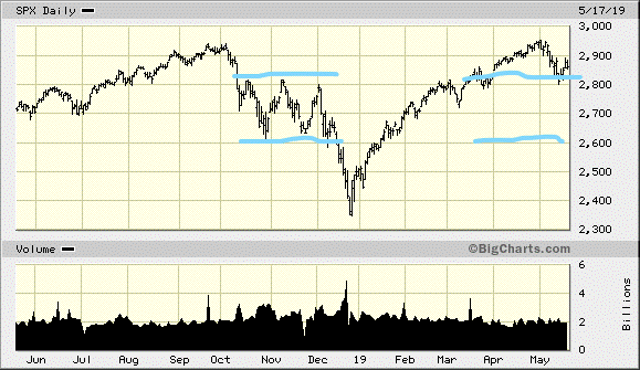

Let's start with the chart below and my crude markings and then talk fundamentals. I drew this chart May 2, way before the sell-off and the bounce. Look on the left side. Again, apologies to my loyal long-time readers for the rehash. When I refer to congestion it was all that up and down motion on the left side of the December drop. I drew the right side predicting our current volatility, based on experience, and just how charting predicts behavior. Just simply look at this chart; we mapped out a clear double top, which is "Snake Eyes" to a chartist. You noticed that I felt compelled to share this chart once that second top clearly rolled over (another bad sign) and had that bounce at 2810. Today, a newer chart would be showing that we broke that 2,810, and major support at 2,800. Just scan your eyes across this chart and look how prominently the chart shows failure and support at the 2,800 level. Earlier in this article, I said this bounce should fail around 2,810 to 2,830. Doesn't that make more sense now?

Okay, now for the fundamentals

The market is selling off because conditions have changed:

- The Chinese are not interested in making a deal in 2019. They want to wait right up to Election Day. This gives them the ultimate advantage. Right now they are trying to manage Trump so that he doesn't go crazy and ban all imports from China or install nuclear weapons in Taiwan. Basically, no one knows what Trump is capable of and that is just the way he likes it.

- The economic numbers are slowing down. Everyone expected the economy to slow in the first half, but now we are seeing the slowdown and market prices need to adjust

- The 10-year is collapsing. Call it what you want, but this points to a failure at the Fed. The stock market would rather see the Fed drain liquidity from the economy but be in control than to get loose and NOT be in control.

- My corollary to the above thesis is that it would be an unmitigated disaster for the Fed to lower rates right now. Powell can jaw-bone all he likes and the market can throw the biggest tantrum, but the moment he lowers rates because of the market bitching is the day I tell you to sell all your speculation plays and go to 100% cash.

- I don't want to get political, but the Mexico Tariff scares the crap out of the markets. It didn't expect that coming at all, it makes no economic sense, and there is no visibility whether Trump extends the tariff war to other partners.

- The economy needs infrastructure and Trump threw Chuck and Nancy out of the Oval Office.

I'm Still a Bull, I Promise!

I am hardly a bear. China will fade into the background later in the summer, and the economy will stop sputtering and firm up. Profits, especially in tech, will prove to be as reliable as ever.

Merger activity will pick up and I could see a rally taking us to new highs late summer, early fall. Until then, speculation and trading will generate tremendous alpha if we remain nimble. So take strong profits this morning. Not 100% but 30%-50%, and if the rally goes another 24 hours, tail out those profits accordingly. Be brave, this is a speculator's paradise. An individual investor picking individual stocks is once again the winner. I will take this up on Sunday as well.

Happy Trading!

0 comments:

Publicar un comentario