What Blows Up First? Part 8: Leveraged Corporate Loans

by John Rubino

By now just about everyone understands what junk bonds are and why they matter. But there’s a non-publicly traded version of this kind of debt that’s also soaring and has recently caught the Fed’s eye.

Called leveraged loans, these are loans made by banks to companies with weak balance sheets – defined as debt exceeding six times EBITDA, the broadest measure of cash flow.

The dynamic with leveraged loans is the same as with junk bonds (and margin debt, mortgages and car loans), which is to say the longer an economic expansion lasts, the more willing the markets are to fund the sketchier borrows in a given category. Which creates an unstable sector, which leads to a crisis as soon as the economy turns down, and so on.

In the Fed’s most recent report on potential sources of instability, leveraged loans earned a place of honor by clocking a 20% increase in the past year, combined with “rapid growth of less-regulated private credit and a weakening of underwriting standards.”

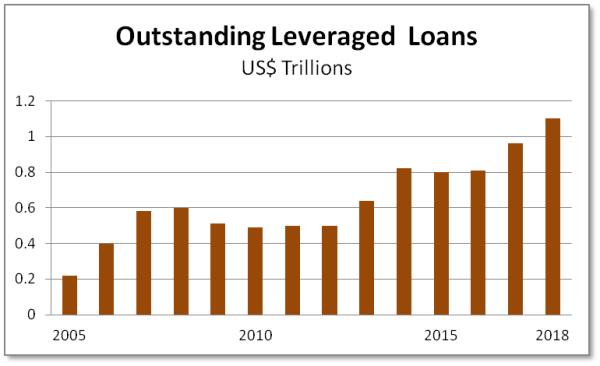

As the following chart illustrates, outstanding leveraged loans have blown past their 2008 record highs and are now approaching twice that level.

“Borrowing by businesses is historically high … with the most rapid increases in debt concentrated among the riskiest firms amid signs of deteriorating credit standards,” noted the Fed.

Soaring debt raises the vulnerability of corporations as a whole, especially when they’re running up against trade wars, disorderly Brexit negotiations, political turmoil in the US and slowing growth in Europe.

This is the kind of problem that festers under the surface for a time before “surprising” everyone by blowing up and causing/contributing to a crisis. The reason it can fester is that in good times when credit is freely available, low-quality borrowers don’t fail. There’s always someone willing to refinance whatever loans come due, so default rates are extremely low.

Experts without a sense of history (or, more frequently, with a desire to keep the profitable deals flowing) are quoted in the media touting this combination of high yields and low risk (a 2% default rate!) as an opportunity for pension funds and other yield-hungry buyers to generate outsized returns. The marks take the bait and the game continues.

Until a slowing economy or sector-specific problem bursts the bubble.

This perfectly describes junk bonds in the late 1980s and subprime mortgages in the 2000s, with one difference: Today’s leveraged loans occupy just one of maybe a dozen pockets of extreme and growing risk that’s mostly hidden from even professional investors. Sub-prime auto loans and the bonds in which they reside, student loans, emerging market dollar-denominated debt, peripheral eurozone country (read Italy and Spain) sovereign debt, tech stocks; the list just keeps going. When one of these goes several if not all of the rest will follow, in what promises to resemble a fire in a munitions factory.

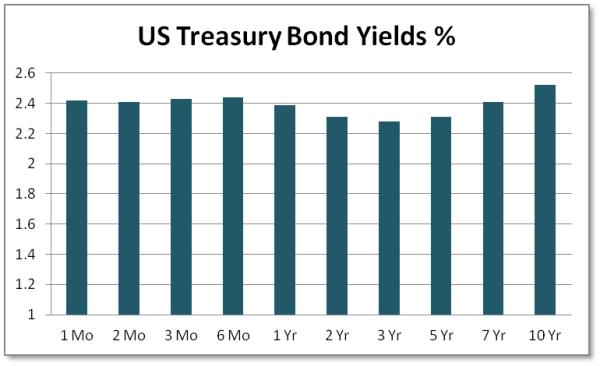

As for what might start the fire, an equities bear market and/or an inverted yield curve would do nicely. And it just so happens that the Dow is down 500+ points as this is being written, while the Treasury bond yield curve is flattening big-time. From 1 month out to 7 years, it’s already slightly inverted.

The other posts in this series are here.

0 comments:

Publicar un comentario