Bonds Are Saying Something - We Should Be Listening: Part IV

by: Eric Basmajian

Summary

- Long-term interest rates continue to move lower on fears of slower economic growth.

- The factors that consensus continues to cite for higher interest rates are not the driving factors behind Treasury bonds.

- Why is consensus consistently wrong on interest rates?

- Bonds are saying something - is it finally time to start listening?

A few months ago, I wrote part III to this series outlining why interest rates would continue to remain low and most likely continue to fall on the long-end of the curve, confounding consensus opinion as to why interest rates should rise.

The consensus opinion on long-term interest rates, unfortunately, continues to reference the factors that do not ultimately drive the direction of long duration Treasury rates including deficits, QE or QT, foreign hedging and other factors that have put you on the wrong side of the interest rate decline since 2010.

In February (and again in March) I wrote earlier parts to this series in which I forecast that 30-year interest rates would continue to decline for the true fundamental factors that drive the shape of the Treasury curve, monetary tightening expectations, growth expectations, and inflation expectations.

In that research note, which you can find by clicking here, I wrote:

If you think that growth expectations are going to come down over the next several months, as I believe based on the leading indicators, and monetary tightening expectations will be moving anywhere but up, the pressure on the 30-year yield will be lower and in the short-term, we will see 2.9% again on the 30-year, indicating upside for (TLT).

This forecast was made when the 30-year Treasury rate was well above 3.0%. Today, as of this writing, the 30-year Treasury rate sits at 2.88%, just 8 basis points above the most recent cyclical low.

Many equity investors will try and discredit the analysis on Treasury rates by claiming that stocks have risen which must mean that growth is "good." First, "good" or "bad" growth are subjective opinions while accelerating and decelerating are objectively measured facts.

Economic growth has been empirically decelerating which brings with it lower long-term interest rates, regardless of the moves in the equity market. Much to the dismay of perma-equity bulls, a long position on US Treasury bonds is not equivalent to a short position in US equities. In fact, the two are often not even related. In 2014, both Treasury bonds increased (TLT was up over 20%) and the US equity market increased.

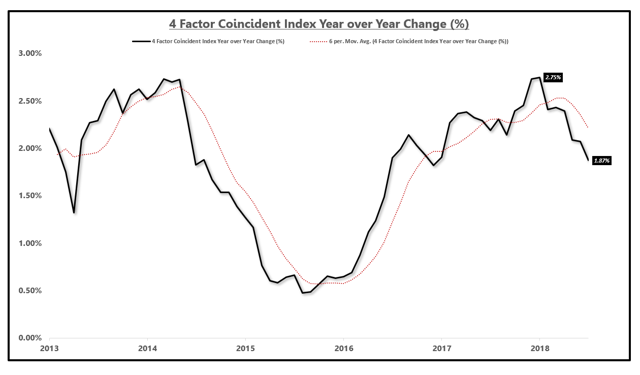

At EPB Macro Research, we use our 4-factor coincident index to measure the current direction of growth. This index is not a leading index and not used for forecasts, for that we use leading indexes.

This 4-factor coincident index takes the broadest measure of the largest components of the underlying economy including employment, production, income, and consumption.

Source: EPB Macro Research

What is the bond market telling us today?

The bond market continues to highlight the fact that economic growth remains in a period of deceleration. Interest rates can rise over the short-term for hundreds of factors but the longer-term trend will be determined by monetary tightening expectations, which will impact the short-end of the curve and growth/inflation expectations which will contribute to the shape of the curve.

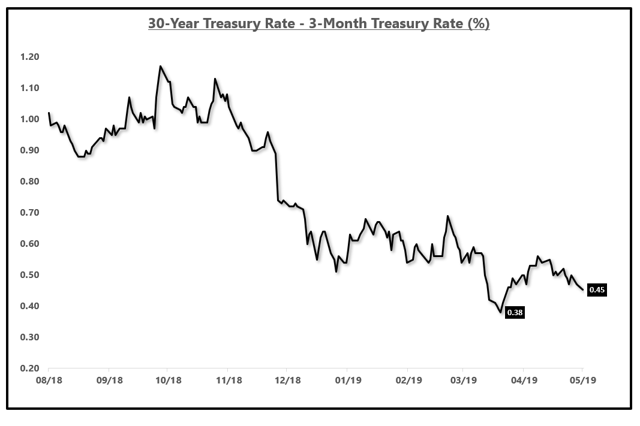

Recession risk is moderate based on signals from the bond market as the 30-year vs. 3-month Treasury spread nears the cycle low.

30-Year vs. 3-Month Treasury Spread:

Source: Bloomberg, EPB Macro Research

In my analysis, the growth rate of the economy has not slowed sufficiently to put the economy on recession watch. For that, I'd need to see the coincident index, cited above, to slow near 1.50%. If the coincident index presented above moves near the 1.50% range, this indicates that the largest four factors of the economy, as an aggregate, have slowed sufficiently to put the economy at the risk of a recession should a shock occur.

A shock is unknowable by definition and can knock a few points off of the economy's growth rate. If growth is accelerating, shocks tend to get absorbed. If growth is decelerating, and the momentum is lower, shocks are more impactful.

If you couple a shock with a growth rate that is low enough, growth in the four-critical sectors of the economy can move negative which therefore is a recession.

If the coincident index is showing a growth rate of 2.50%, a recession is almost impossible unless a shock can knock a full 250 basis points off growth. The lower the coincident index moves in growth rate terms, the less significant of a shock is required to pull the economy into a recession.

It should be noted that if economic growth decelerates below 1.50% as it did in late 2015, a recession is not guaranteed. The commonly discussed "soft-landing" can still occur if a material shock does not materialize before the economy starts to reaccelerate. For a recession to occur, typically we'd need to see growth decelerate to a sufficiently low level and couple a shock to push aggregate growth below the zero bound.

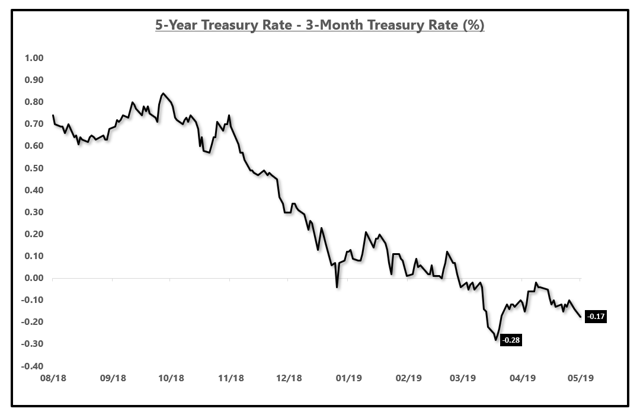

The short-end of the Treasury curve sees literally zero chance of an interest rate hike. The only question is about when the next interest rate cut occurs. Out to January 2020, the Treasury market is implying a 0% chance of a rate hike and a 60% chance of a rate cut. This is why the short-end of the curve remains inverted.

Below is the spread of the 5-year Treasury rate and the 3-month Treasury rate which remains in negative territory.

The bond market is consistent with the current economic outlook. Recession risk is not "low" because growth is decelerating and the economy is moving closer to the 1.50% range on the coincident index which makes the economy vulnerable to a shock.

While recession risk is not immediate yet, the economy has cooled enough and the monetary restraint, measured by monetary aggregates such as the money supply growth, have contracted enough in which the bond market feels a rate cut is needed.

In short, the bond market wants a rate cut but recession risk remains on the back burner still. Should the coincident index move below the 1.50% range, you'd likely start to see the 30-year vs. 3-month spread corroborate that move and flatten more considerably, especially if the Fed does not cut rates by that time.

It should also be noted that the Treasury curve out to 7-year paper is below the effective Federal Funds rate and the 10-year Treasury rate is just 2 basis points above the EFFR as of this writing. This is not something that immediately impacts the economy or the stock market but rather works with long and variable lags. Having a deeply inverted Treasury curve out to nearly 10-years is something that works to greatly impact shadow banking and direct lenders and most non-depository institutions.

To get the direction of interest rates correct, you need to follow the factors that actually drive the bond market.

Recession calls come frequently from those in the permanently bearish camp and never from those in the reliably bullish camp.

Using an objective measure of economic growth through various coincident and leading economic aggregate indexes, we can properly prepare for periods in which recession risk is low, high, rising or falling.

As of right now, recession risk is rising but not at an alarming level. Should growth continue to slow and the economy becomes vulnerable to a shock, a warning flag will be raised.

0 comments:

Publicar un comentario