A matter of interest — the battle over monetary policy

Former Fed chair Ben Bernanke and historian Edward Chancellor offer conflicting perspectives on the crisis in central banking

Martin Wolf

Postwar inflation reveals itself in the changing prices at a vendor’s stall in France in the late 1940s © US Department of State/PhotoQuest/Getty Images

Postwar inflation reveals itself in the changing prices at a vendor’s stall in France in the late 1940s © US Department of State/PhotoQuest/Getty Images

Inflation is back.

Rising prices have placed a “cost of living crisis” at the top of the economic, political and social agenda.

Inevitably, this has brought central banks and monetary policy under the spotlight.

Yet controversies over both are not new.

On the contrary, while the issues change, debate over how monetary and financial stability can best be sustained abides.

Though completed before inflation returned, two new books set out sharply conflicting perspectives on underlying issues.

In the orthodox corner stands Ben Bernanke, a governor of the Federal Reserve from 2002 and chair from 2006 to 2014, a period that includes the global financial crisis of 2007-09.

Arguably, Bernanke is the most influential thinker and practitioner on central banking of our era.

His book, 21st Century Monetary Policy, offers a lucid account of the evolution of central banking and the US central bank from the “great inflation” of the late 1960s, 1970s and early 1980s to today and into the future.

In the opposite corner stands Edward Chancellor, historian, asset manager, journalist and author.

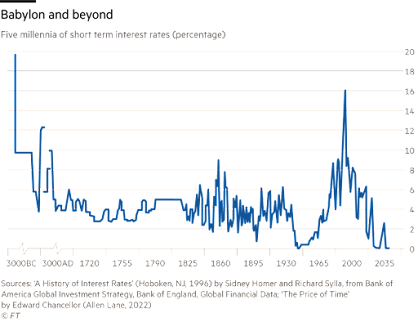

The Price of Time offers a history of interest back to the Babylonians as well as of the debate over the legitimacy of demanding it at all.

Mainly, however, it is a polemic against everything Bernanke stands for.

For Chancellor, the rate of interest is “the price of time” — the rate at which the money one expects to receive or pay in future should be adjusted into today’s.

Under the influence of people such as Bernanke, he asserts, interest rates have been far too low for far too long, with ruinous results.

Behind each of them stands a different guru.

For Bernanke, it is John Maynard Keynes, the pioneering British economist.

As he notes: “Keynesian economics, in a modernised form, remains the central paradigm at the Fed and other central banks.”

The main aim of monetary policy, then, is to achieve and sustain full employment.

If inflation tends to rise, demand must be too strong; and if it falls too low, demand must be too weak.

This, then, makes inflation the best intermediate target of policy.

Yet this target must also not be too close to zero: central banks would have too little room to cut rates in response to recession.

That is the “trap” into which Japan fell in the 1990s and from which it has had such difficulty escaping.

Bernanke’s book explores three fundamental realities of past decades.

The first is the surprisingly weak response of inflation to changes in unemployment in recent years.

In the past, low levels of unemployment tended to raise prices faster.

The second is “the long-term decline in the normal level of interest rates”, partly because of lower inflation but also because of the long-term decline in real rates of interest.

The third is the “increased risk of systemic financial instability” in our world of globalised and liberalised finance.

In terms of policy, explains Bernanke, short-term rates of interest came very close to, reached or, in some cases, even fell below zero in the aftermath of the global financial crisis and subsequent eurozone crisis.

This drove the Fed and other central banks towards a range of “unconventional” policies, including large-scale asset purchases (generally known as “quantitative easing”) and “forward guidance” on future monetary policy.

Overall, Bernanke insists, the Fed has been successful in preventing another Great Depression and returning the US economy to growth.

I agree with him.

[Chancellor] condemns the low interest rates adopted by central banks as the root of almost all economic evils

Chancellor emphatically does not.

His guru is Friedrich Hayek, a contemporary of Keynes, leading figure in the Austrian “free-market” school of economics and opponent of central banking.

Hayek was also an exponent of the “malinvestment” explanation of depressions, according to which the slump represented the necessary purgation of previous errors.

Hayek lost the debate on macroeconomics in the 1930s and moved on to political economy, especially with The Road to Serfdom, published in 1944, which found an acolyte in Margaret Thatcher.

Chancellor is a believer in the Hayek of the 1930s, however.

He condemns the low interest rates adopted by central banks as the root of almost all economic evils.

Ultra-low interest rates are to his mind the malign product of the false credo of inflation targeting.

As he complains: “Never mind that zero interest rates discouraged savings and investment, and impaired productivity growth.

Never mind that ultra-low interest rates, by keeping zombie companies on life-support, resulted in the survival of the least fit.

Never mind that central bank policies contributed to rising inequality, undermined financial stability, encouraged ‘hot money’ capital flows, and fostered numerous asset price bubbles from luxury apartments to cryptocurrencies.”

Does this charge sheet make sense?

Not much.

Low interest rates have substitution and income effects: the former make it attractive to save less, because of the lower returns; but the latter make it necessary to save more, to compensate for the lower returns.

Chancellor himself quotes Raghuram Rajan, former governor of the Reserve Bank of India, to the effect that “savers put more money aside as interest rates fall in order to meet the saving they think they will need when they retire”.

The outcome of low interest rates for overall saving rates is simply ambiguous.

Again, Chancellor insists that lower rates discourage investment, even though he stresses that they do motivate risk-taking.

Why, then, would they not encourage more risk-taking investment?

A low interest rate environment is, after all, one in which funding, including equity funding, will be cheap.

If good investment opportunities do indeed exist, as Chancellor insists, why would low interest rates be a prohibitive obstacle to funding them?

The survival of “zombies” might be a partial explanation.

But dynamic businesses should be able to outbid zombie firms for workers, suppliers and customers.

Moreover, businesses able to cover their variable costs should survive.

True, if one closed down most marginally productive businesses, the productivity of workers who remain employed would rise.

But the productivity of the overall workforce would fall, which would be a bad bargain.

Again, the argument that low interest rates increase inequality is grossly misleading.

Even a doubling of the wealth of billionaires has no real significance to people who own next to nothing.

Thus, according to the 2020 US Census, the median net worth of the bottom 20 per cent of US households was minus $6,029 and the median net worth of the next 20 per cent was just $7,263.

What matters to such people is not how immensely rich Elon Musk is, but whether they actually have a job.

Active responses to recessions by central banks help them achieve this.

If Chancellor really cares about inequality, what about campaigning for wealth taxes?

Chancellor also has many complaints about the effect of low interest rates on financial instability and fragility.

Yet it is unlikely that the modestly higher interest rates he recommends would have saved the world from financial crises.

The world of 19th-century America, without central banking, saw plenty of them.

That is why the Federal Reserve was created in the early 20th century.

What, above all, is the author’s alternative to the low interest rates he despises? A depression.

Indeed, he insists that “[t]he broad economy benefits from this dose of salts”.

He even goes so far as to cite Andrew Mellon, the treasury secretary of Herbert Hoover, who notoriously advised his boss to “liquidate labour, liquidate stocks, liquidate the farmers, liquidate real estate”.

Mellon might have added “liquidate democracy”.

In Germany, chancellor Heinrich Brüning managed to achieve just that as he prepared the ground for Hitler.

Bubbles are terrible, insists Chancellor. Mass unemployment? Fine.

In sum, Chancellor has written an overheated and unbalanced polemic.

Yet this does not altogether vindicate Bernanke’s managerialist perspective.

William White, a former chief economist of the Bank for International Settlements, and Claudio Borio, who still works there (both cited approvingly by Chancellor) have indeed given us sobering and sometimes prescient warnings about the financial risks that have built up.

The fundamental problem is that we have two objectives for policy: stabilising the real economy in the short to medium term and containing financial risks.

One cannot hit two goals with one instrument.

The choices are either to split the focus of monetary policy between the two goals in some way or to employ other instruments, such as regulation (for managing finance) or fiscal policy (for managing demand).

The efficacy of the first, sometimes called “leaning against the wind”, is unclear.

Moderate rises in interest rates might even have given us the worst of both worlds — both deflation and persistent financial froth.

Yet tighter regulation, though necessary, will create opportunities for arbitrage, as motivated players find ways around it.

At the same time, governments have not used active fiscal policy well, which suggests that monetary policy will still be needed to steer the economy.

More immediately, the question is whether today’s high inflation presages a fundamental shift in the monetary policy environment from one of low inflation to something more like the 1970s.

Already, the most recent Fed policy review, with its rear-view mirror focus on the average of past inflation rates, is hopelessly out of date.

Yet how far the shocks of the past two and a half years have durably altered the policy environment is unclear.

The perfect solution to monetary policy is the holy grail of central banking.

But, like the grail, it is unlikely ever to be found

Bernanke is right: quantitative easing in response to the “Great Recession” did not create the hyperinflation against which so many mistakenly warned.

The mistake over inflation was more recent, more understandable and more modest.

It consisted of not recognising soon enough the scale of the surge in the supply of broad money in 2020 in response to the Covid-19 crisis, the pervasiveness of supply disruptions and the strength of the recovery.

The perfect solution to monetary policy is the holy grail of central banking.

But, like the grail, it is unlikely ever to be found.

At the same time, the public is not going to accept a return to 19th-century US capitalism, without even central banks.

We will continue to manage money and finance, not return to the gold standard or embrace bitcoin and its rivals as the solutions.

Today, the inflation targeting supported by Bernanke looks the least bad approach.

But the question also remains how best to contain the financial risks emphasised by Chancellor.

The biggest concern, we know, is the tendency towards incontinent expansion of credit and so also of debt.

Regulation is a part of the solution.

But the most important structural source of excessive leverage is the tax deductibility of interest.

We should eliminate that now.

0 comments:

Publicar un comentario