The Jackson Hole Jolly For Central Bankers, And The Ramifications For Gold

by: Bob Kirtley

Summary

- The Jackson hole Meeting of Central Bankers has concluded and the volatility follows.

- The S&P 500 fell on the lack of financial stimuli.

- The US Dollar fell on the possibility of more interest rate cuts.

- Gold and the precious metals stocks jumped to higher ground as the Gold Bull gains traction.

Preamble

- The S&P 500 fell on the lack of financial stimuli.

- The US Dollar fell on the possibility of more interest rate cuts.

- Gold and the precious metals stocks jumped to higher ground as the Gold Bull gains traction.

Preamble

Investors and speculators alike awaited with bated breath for the latest meeting of the central bankers to be concluded. Given a less than positive economic future the bankers are looking to more financial stimuli in an attempt to cushion the upcoming recession.

Some news outlets have reported that there is now $16 trillion worth of global negative interest rate debt. Who in their right minds invests their hard-earned cash in a dead certainty of a loser? A pension fund that is paying out at a rate of 5%-6% is reliant on an investment that has a negative return, how long can that go on, frankly its beyond me.

For the Danes there is a benefit in that there are now negative interest rate mortgages in Denmark. A Danish bank has launched the world’s first negative interest rate mortgage giving out loans to homeowners where the charge is minus 0.5% a year. Jyske Bank has begun offering borrowers a 10-year deal at -0.5%. Jyske said; “We don’t give you money directly in your hand, but every month your debt is reduced by more than the amount you pay,” said Jyske’s housing economist, Mikkel Høegh.

This is a ‘first’ in my lifetime and it is a far cry from the 1979 period when the base rate in the UK was around 18% with mortgages a few percentage points higher and we all struggled like crazy to maintain a roof over our heads.

These are truly unchartered waters and treacherous to navigate as we are all on this journey into the unknown.

A Brief Look At Some Of The Current Issues

In the US The Chairman of Federal Reserve has outlined his view of the economy and it wasn’t well received by the markets. The Fed tends to be ‘data driven’ and the likelihood is that they will consider rate cuts on a month by month basis, whereas the markets are looking for an aggressive implementation of rate cuts in order to keep the markets at record levels. The Federal Reserve also has pressure from the US President who is demanding a 100-basis point rate cut and “perhaps some quantitative easing as well” in a recent tweet.

The German government is also preparing fiscal stimulus measures to prop-up Europe’s largest economy. Germany’s economy is heading into recession and the country’s central bank has warned that a slump in exports during the summer had every chance of continuing. The bank noted a fall in exports and blamed Brexit and the trade war between China and the US as among the factors responsible for a 0.1% drop in GDP.

In Italy the Prime Minister Giuseppe Conte has resigned as tensions between the far-right League party and the leftist Five Star Movement have gotten out of hand. It is now up to Italy's president, Sergio Mattarella, to decide if there can be a newly formed government or, if not, its fresh elections. Another election means more uncertainty for the European Union as they will probably be held at the same time that Brexit is coming to a head.

Talking of Brexit, the UK is now under a deluge of ‘fear’ politics as the remainers try to halt the exit process. This is a real headache for Mark Carney, the Head of the Bank of England, as UK interest rates are already at record lows so there isn’t much wiggle room left in terms of fiscal stimulus.

In India, their automobile manufacturer Mahindra and Mahindra, recorded a 15% decline in its domestic sales for the month of July 2019 as new car sales dwindle worldwide. No doubt they would appreciate some relief regarding borrowing costs.

The central bank of China announced last Saturday that interest rate reforms were in the pipeline which should make borrowing costs more affordable.

The overall theme that we are seeing is that we are in for a period of even cheaper money and possibly more Quantitative Easing.

Conclusión

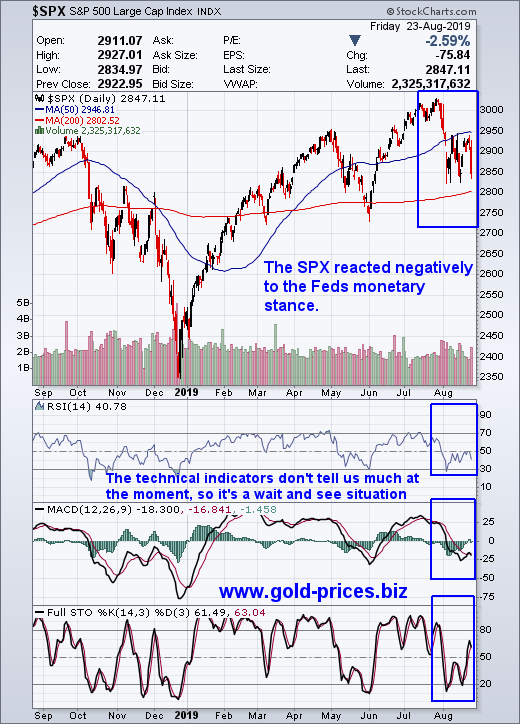

Jackson Hole has concluded with a vague statement of intent leaving the door open for the bankers to move at their own pace. However, the markets expected more and didn’t get it, so they fell around 2.5% as the chart of the S&P 500 shows.

It is clear that the central banks will ease monetary policy via interest rates and some form of financial stimuli, although the timing of such moves remains vague.

Quantitative Easing is another name for printing money which dilutes the buying power of the any currency making it less desirable to hold.

Interest rate cuts means that savers are taking it on the chin and making next to nothing by having money in the bank.

Banks carry risk and in most countries your savings are their assets in time of distress so your funds may not always be readily available to you.

It is rollover time for the S&P 500 as this long recovery period draws to a close.

Gold and silver were once derided as the precious metals because they do not pay interest, but they are now neck and neck with most currencies as they don’t pay interest either.

And when it starts costing us to deposit funds with a bank, we will get creative and do something else with our cash, hence this Bull Market begins.

I am not a perma-bull on anything, but as a speculator I am firmly of the belief that the gold is now in a bull market to be followed by silver. This bull will be spectacular with the metals outperforming all other sectors and the stocks delivering handsome profits.

We acquired physical gold and silver some time ago and have now placed 80% of our allocated funds for stocks and we continue to search for new opportunities in this field.

The options on some of these stocks will go ballistic when the time comes. This is a highly speculative process however we will be involved from time to time as and when our selection criteria is reached.

Go gently but rotate out of some of your assets and into this sector right now and hold on tight as it will be a roller coaster of a ride.

0 comments:

Publicar un comentario