Thoughts For A Pivotal Weekend

by: The Heisenberg

Summary

- As a blockbuster first half comes to a close for markets, all eyes turn to the G20, where presidents Trump and Xi will try to find common ground.

- Three things have to happen (or not happen) for multi-asset investors to enjoy another outstanding six months.

- As for the trade talks, the Huawei issue is the key.

- Herein also find some uncomfortable math for a prospective next round of China tariffs and a margin reality check for protectionist proponents.

- Three things have to happen (or not happen) for multi-asset investors to enjoy another outstanding six months.

- As for the trade talks, the Huawei issue is the key.

- Herein also find some uncomfortable math for a prospective next round of China tariffs and a margin reality check for protectionist proponents.

As markets warily eye Saturday's all-important meeting between Donald Trump and Xi Jinping at the G20, I wanted to make a couple of quick points for readers headed into what, by all accounts, should be a pivotal weekend. As usual, this is designed to be a concise treatment, with an eye towards brevity and should be taken as such.

On Friday, former trade-turned Bloomberg columnist Richard Breslow wrote that "if you had to force an opinion it would be cautious optimism tempered by the notion that such an attitude remains very much a work-in-progress."

That assessment applied both to the market outlook for the second half of the year, and to prospects for something amicable to come out of the G20 in Osaka. "Things could turn out with a positive, risk-on cast but there are significant hurdles, fundamental and technical, to overcome," Breslow went on to write.

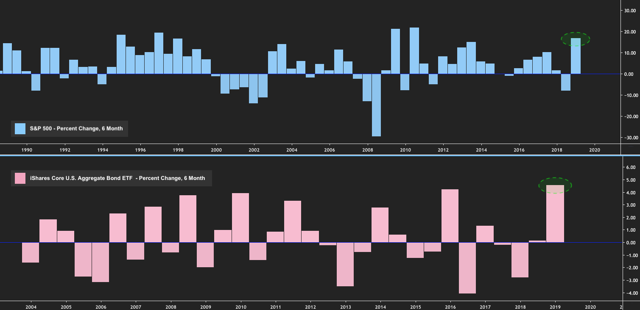

When it comes to markets, let me just pick up where I left off in a Thursday post for this platform. It's difficult to imagine that the second half of 2019 could be kinder to multi-asset investors than the first half. H1 was the best first half to a year for the S&P since 1997. At the same time, the iShares Core U.S. Aggregate Bond ETF (AGG) had what looks like its best half on record.

In a true testament to just how over-the-top the bond rally was, the German 30-year bond logged a total return of some 15%. That would be the second-best 6-month return in a quarter century and very nearly better than the S&P's first-half gain.

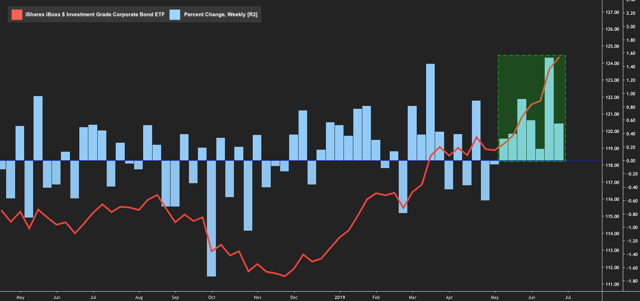

Recent gains in the IG credit ETF (LQD) are borderline comical.

Those interested in a full breakdown of cross-asset performance during the first half of the year can find it here, but for our purposes, suffice to say 2019 has been the opposite of 2018. Last year, USD "cash" outperformed nearly everything on the planet. This year, nearly everything on the planet has performed well.

In order for this to be any semblance of sustainable, I would argue that a trio of conditions have to be met. First, trade tensions have to simmer just enough to keep the Fed on track to cut rates, but cannot boil over to the point where the US moves ahead with 25% tariffs on the remaining $300 billion in Chinese goods and absolutely cannot escalate to auto tariffs on Europe and Japan.

Second, the Fed has to largely deliver on market expectations which means, at the least, cutting rates in July and again in September and maintaining a dovish bias (i.e., "ready to act to sustain the expansion") throughout.

Third, the economic data in the US cannot decelerate so much that recession fears outweigh the prospect of Fed cuts in the minds of equity and credit investors. With stocks perched near record highs and the US corporate sector dangerously over-leveraged (by some measures), definitive signs that the cycle is turning too quickly could spark a rout in stocks and a dramatic widening in spreads if the Fed isn't seen as adequately responsive. It's worth noting that Friday brought the first contractionary PMI reading in the US, as the MNI Chicago business barometer printed just 49.7 for June, missing consensus expectations by four handles.

On the G20, early reports indicated that Beijing was prepared to demand, as a precondition for resolving the trade dispute, that the Trump administration lift the ban on Huawei. Although Larry Kudlow subsequently called reports of preconditions on either side "fake news," everyone knows the Huawei ban was the last straw for China. The placing of the country's corporate crown jewel on the Commerce department's entity list made it clear that the US is after far more than reducing bilateral trade deficits. The Trump administration is aiming to curtail China's global tech ambitions, something that was underscored powerfully late last week when Wilbur Ross added four firms tied to the country's super-computing industry to the same blacklist, prompting alarm from the likes of SocGen, whose analysts wrote the following:

The addition of these five firms to the Entity List, coming right after Huawei… suggests that even intellectual property rights and spying concerns related to 5G deployment could be secondary issues. In fact, the prospect of China building a competitive semiconductor industry may well be the key worry.

The problem with lifting this ban in the interest of resolving the trade war is that the US is engaged in a global push to bring America's allies around to the idea that Huawei is a national security threat.

The administration has worked night and day (figuratively and, one imagines, literally) to make the case to other countries. Were Trump to simply lift the ban, it would raise questions about how serious the White House actually took the national security narrative in the first place. Meanwhile, Micron (NASDAQ:MU) made all manner of headlines earlier this week when the company said it had begun shipping some products to Huawei again (I wrote a detailed account of that here). That reportedly irritated some hardliners within the administration, which is likely to mean that opposition to a wholesale lifting of the ban has calcified.

If the Huawei ban isn't lifted, it seems unlikely that Beijing will be willing to work towards a deal. It wasn't clear from early reports whether Xi was willing to restart talks without a lifting of the ban, but even if he is, Huawei will cast a pall over the discussions and potentially deep-six the chances of a resolution.

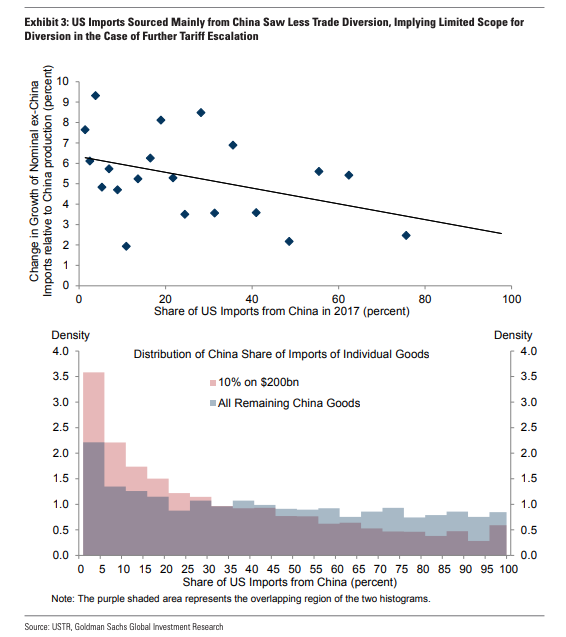

The next round of tariffs (assuming there is one) will hurt. Although it seems likely that Trump would start with a 10% levy on the remainder of Chinese goods before going "all-in" with 25% duties, import substitution will become increasingly challenging. Here, in brief, is the problem, as quantified by Goldman:

Goods in which China supplies a large share of total US imports are less likely to provide scope for import diversion if sufficiently developed production chains are not yet in place in other countries. To test this, for each category we construct a measure of import diversion as the change in nominal ex-China import growth relative to the nominal value of imports of the category from China, which roughly captures the share of US imports from China replaced by increases in imports from other countries. We find a sizable and statistically significant negative relationship between our measure of diversion and the share of US imports from China (Exhibit 3, top). Many of the imports from China not yet hit by tariffs have large China import shares, and our analysis therefore suggests significantly less scope for substitution of imports going forward (Exhibit 3, bottom).

It doesn't help that, during an interview with Fox earlier this week, President Trump suggested he might put tariffs on Vietnam, whose exports to the US exploded in Q1 thanks in large part to substitution effect from the China tariffs. Obviously, if you start slapping punitive tariffs on countries you rely on for trade diversion, you effectively remove one of the pressure valves that mitigated what would otherwise be the deleterious effect on American companies that source from abroad.

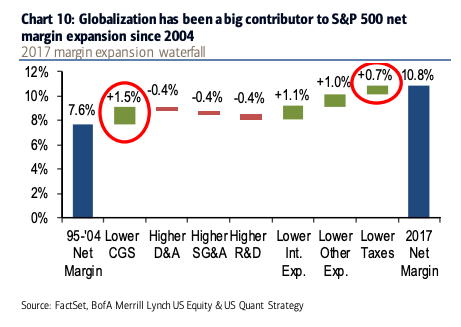

In an age of ascendant populism, there's no shortage of criticism when it comes to the purported ills of globalization. If you can manage to put your political leanings aside for a moment and look at things purely from the perspective of your portfolio, you might be interested to note that over the last 15 years, globalization has been the largest contributor to margin expansion for S&P 500 companies.

(BofA)

(BofA)

If the protectionist push continues, don't be surprised if you start to notice the bottom line deteriorating for any companies in your portfolio without sufficient pricing power to offset margin compression.

As far as the base case for the Trump-Xi pow wow, the most likely outcome is another handshake deal like what the market got in December. Further tariffs and non-tariff escalations would be postponed in that scenario as the two sides restart stalled talks.

For whatever this is worth (which is actually something, given that it isn't wholly subjective), BofA was out with the following take on Friday as part of a much longer G20 preview:

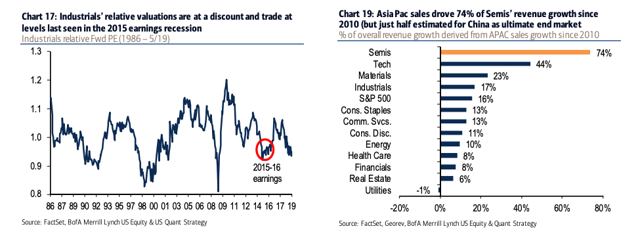

Base case (truce – no comprehensive deal, but no new tariffs). Buy high quality Industrials. Industrials are pricing in an earnings recession already. We continue to see higher volatility under a truce and prefer high quality stocks. Defense stocks could benefit from potential for heightened geopolitical tensions. Software over Semis. 74% of Semis’ revenue growth since 2010 has come from Asia Pacific. Within Tech we would prefer Software, which has less China exposure.

To be clear, there is no chance of a "real" trade deal over the weekend, where that means all of the issues are resolved and a date is set for a signing ceremony.

There is, however, a small chance that Trump and Xi do not agree to anything other than to stay in contact (i.e., no announcement that principal-level talks will ramp back up). If that happens and the news is accompanied by some kind of irritated tweet, don't expect risk assets to be in a good mood come the Sunday FX open.

0 comments:

Publicar un comentario