The Downside Potential For The S&P 500 Is Starting To Look Very Appealing

by: Bang For The Buck

Summary

- The bond market has started to price in rate cuts and earnings estimates are revised downward, but the equity market remains elevated.

- 2019 economic growth seem far weaker than what we have seen historically, which has yet to be priced in by the market.

- The housing and auto sectors are unlikely to contribute to further growth and looks to remain flat in the best of scenarios.

Investment Thesis

- 2019 economic growth seem far weaker than what we have seen historically, which has yet to be priced in by the market.

- The housing and auto sectors are unlikely to contribute to further growth and looks to remain flat in the best of scenarios.

Investment Thesis

The global economy is slowing which I have discussed in several articles before, but now we are also starting to see more and more signs that point towards a slowing U.S. economy. There are now enough factors that I think will force the S&P 500 (SPY) and the overall U.S. stock market to face reality. I have consequently put a short position on the S&P 500 and will discuss the factors behind that decision below.

Bond & Equity Markets

We have seen longer U.S. treasury rates decrease significantly over the last 6 months. The initial reason was the equity market sell-off and more recently the Fed reversal due to lower inflation data and concern over the global economy.

Data by YCharts

Data by YCharts

Figure 1 - Source: YCharts

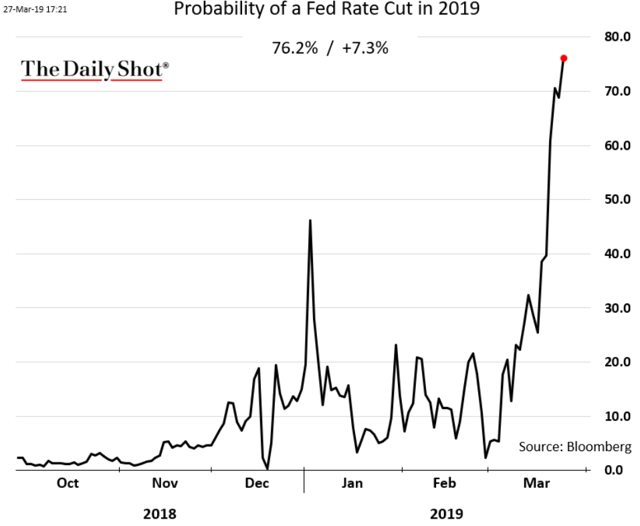

This is also reflected in the in the probability of a rate cut during 2019 as displayed in the below graph.

Figure 2 - Source: The Daily Shot

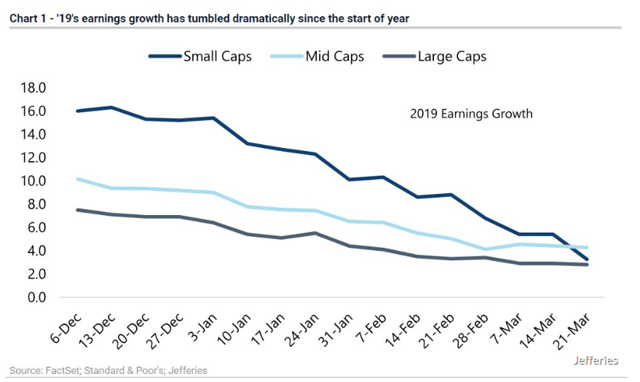

Over the same period, we have also seen analysts lowering 2019 earnings estimates for large, mid, and small caps significantly. Despite this, the S&P 500 has continued to climb since the end of December.

Data by YCharts

Data by YCharts

Figure 3 & 4 - Source: MarketWatch & YCharts

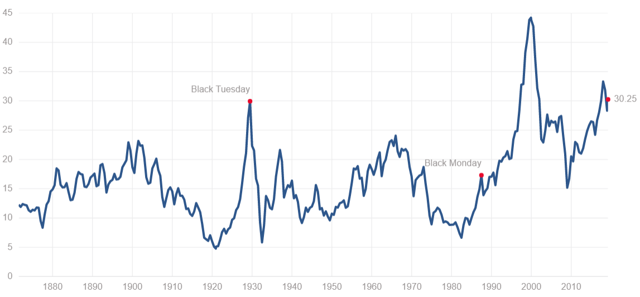

We are consequently left with high valuations at a time when both the bond market and analysts are expecting the economy and growth to slow. While valuations might not be as indicative over the short term, it does mean there is plenty of downside potential should the market turn.

Figure 5 - Source: Shiller PE

Economy

On the 28th of March, the Q4 2018 GDP Growth was revised down to 2.2% from the prior 2.6%. While Q1 GDP Growth is normally not the strongest quarter, the Atlanta Fed is now estimating Q1 GDP Growth to come in at 1.5% which is weak in a historical comparison.

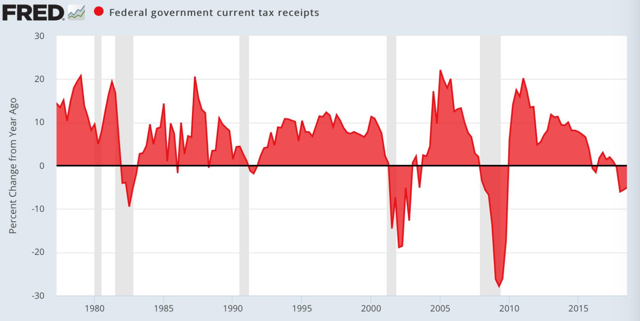

Another interesting data point which indicates slowing growth, is government tax receipts.

Naturally, the recent tax cuts have had an impact here. But they don't explain the downward growth trajectory for several years as the below chart indicates.

Figure 6 - Source: Sven Henrich - Twitter

Housing Market

We have recently seen some of the more extreme regions suffering declining house prices. It remains to be seen if lower mortgage rates can revive these markets. Many other regions have also seen stagnated prices, which might not detract from the economy, but will no longer contribute to further economic growth.

Data by YCharts

Data by YCharts

Figure 7 - Source: YCharts

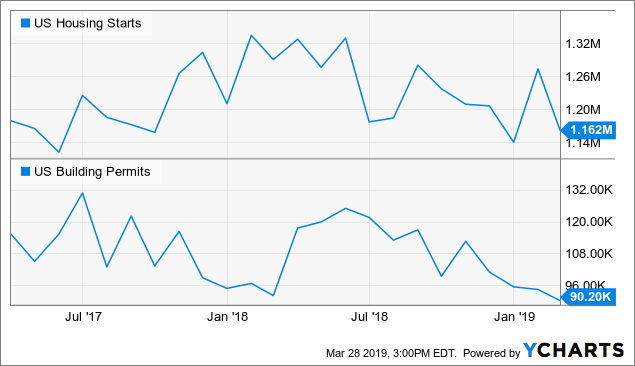

More forward-looking indicators like housing starts and building permits do not suggest a booming housing market either. Over the last few months, they have been at the lower end of a two-year range.

Data by YCharts

Data by YCharts

Figure 8 - Source: YCharts

Consumer

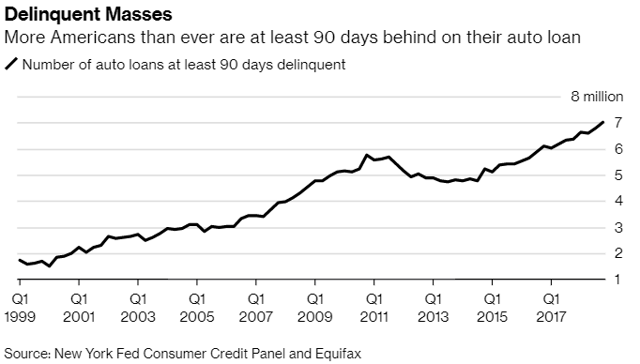

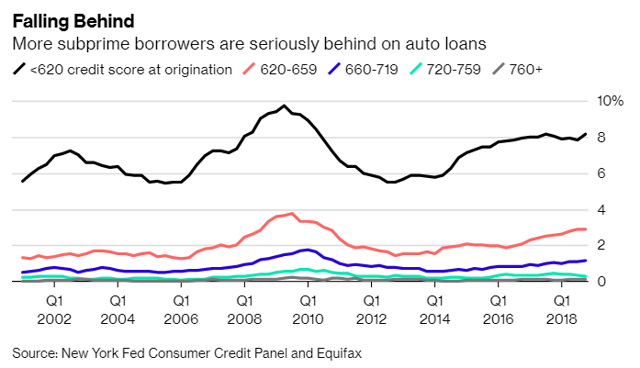

The U.S. consumer has also started to show signs off stress. We have seen more weak retail sales numbers coming though during the last few months. We see higher level of credit card delinquency rates for smaller banks further out on the risk curve and more Americans than any other time are delinquent on auto loans. While the auto loan delinquency rate is more extreme for lower income households, it is coming through in the aggregated statistics as well.

Figure 9 & 10 - Source: Bloomberg

Conclusión

We are seeing slow global economic growth in many regions. The bond market is starting to price in rate cuts, earnings estimates are being revised downward, and I think it is unlikely that the U.S. consumer will be able to pick up the slack given the statistics seen in housing and other credit data.

I expect we will start to see the macro factors come through in 2019 reported earnings. Given the fact that valuations are still elevated, the risk reward on the downside looks far more attractive than on the upside. I have consequently started to short the S&P 500 where the global data points can surprise even more to the downside.

It is certainly possible that the Fed can cut rates or return to quantitative easing with force, to boost the market. But I think we are unlikely to see that until the equity market has had a more significant correction.

0 comments:

Publicar un comentario