The Dollar Shortage Is Back

Scarcity of greenbacks in the global financial system is a hidden risk for emerging markets

By Jon Sindreu

The world is short of dollars again. Emerging markets could be the chief victims this time round.

Signs of a global dollar shortage abated this year, only to resurface in mid-September. Investors and companies outside of the U.S. rely on the currency as the ultimate source of liquidity. Many were hurt by bouts of dollar scarcity after the 2008 financial crash, during the euro crisis, and even in 2016.

The shortage is usually most acute around quarter and year ends, because banks report their books to regulators and try to make their exposure look smaller relative to their capital. Banks now know they need to get their dollars well before the dreaded year-end deadline, so the potential for damage now is likely lower than in the past.

Still, the re-emergence of a shortage is a warning sign that the world’s dollar dependency is far from over. That is a bad omen for companies and countries that are especially reliant on international dollar liquidity—chiefly banks and emerging markets.

The re-emergence of a shortage of dollars is a warning sign that the world’s dependency on the currency is far from over. Photo: Elise Amendola/Associated Press

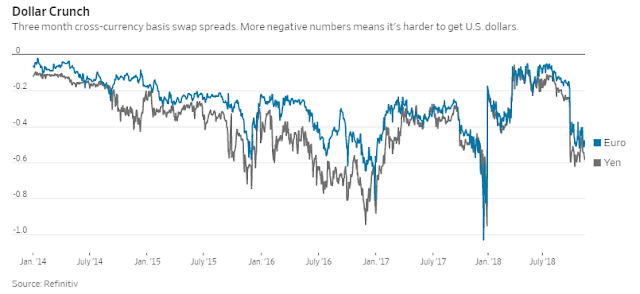

Greenback scarcity can be measured by looking at spreads on derivatives called cross-currency basis swaps, which are used by investors and companies to source dollars outside of the U.S. In theory, this spread should never stay wide for long, because arbitragers with access to U.S. borrowing can profit from it.

Since 2008, however, the gap has persisted because of the stress suffered by banks, which are now punished by regulations if they expand their balance sheets.

Against this backdrop it is surprising that spreads narrowed so much earlier this year, even as the Federal Reserve sold bonds back into the market—therefore sucking dollars out of the financial system.

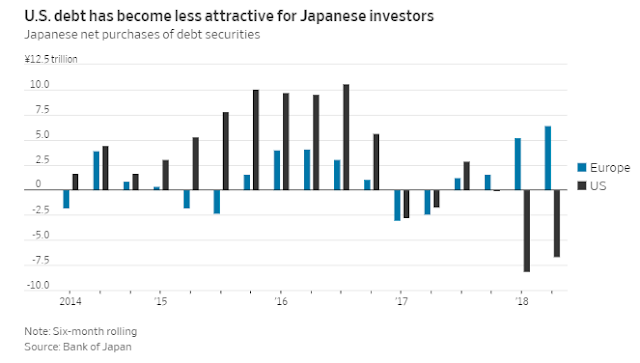

One explanation is that banks are using their balance sheets more efficiently, or attracting larger numbers of dollar depositors. Another is that Japanese investors are now moving out of U.S. debt and into Europe, removing a huge source of demand for dollars. This is probably a result of U.S. short-term interest rates rising relative to long-term ones, which makes it more expensive to hedge dollar currency risk.

Yet this effect may not last, as U.S. short-term rates lead others higher. Lower demand from Japan could even have obscured the dollar crunch in emerging markets. These are highly dependent on issuing dollar debt to international investors and banks, and a shortage of greenbacks tends to hamper their economic growth, research by the Bank for International Settlements has found.

In a famous speech in 1896, back when the U.S. pegged its currency to gold, former House representative William Jennings Bryan lamented that the economy was crucified “upon a cross of gold.” Even if the nails are now less visible, the world economy is still bound to its own dollar cross.

0 comments:

Publicar un comentario