This Is How The U.S. Market Might Crash

by: Raphael Rottgen

- We could see a non-linear break in the market.

- This would be caused by a number of potential vicious circles of selling.

- Some of these potential vicious circles are the result of recent changes in market participant structure and activity.

- This would be caused by a number of potential vicious circles of selling.

- Some of these potential vicious circles are the result of recent changes in market participant structure and activity.

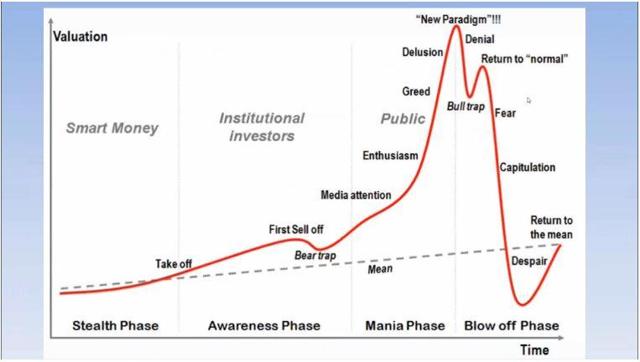

Source: financeandcareer.com

Source: financeandcareer.com

I have developed the conviction that we will have a non-linear break in the market in the near future, say the next 3-12 months. "Non-linear" in the sense that it will not be along the lines of losing a few percent or so every week to enter a bear market over the period of a few months, but an exponentially accelerating sell-off, similar to 1987, for example, whereby we could lose 20%+ in one trading day. This is less based on arguments along the lines that certain valuation metrics for the (U.S.) market are high (an argument that could have been made years ago) and more on arguments that a number of mechanistic pieces are now in place that could cause this type of sell-off.

So, what would we need to see such a scenario?

1. We need a trigger

We need something that tips us into selling territory far enough. Far enough to overcome the vested interest of market participants to keep the party going (this, by the way, was one of the typical pre-crash characteristics that John Kenneth Galbraith identified in his book The Great Crash, 1929. Far enough to overcome the price thresholds above which armies of automated algorithms (and also human traders) simply buy on the dip. Like in a chemical reaction, there is an activation energy threshold to overcome to get it going, and, again like in a chemical reaction, you need a catalyst.

What could be that catalyst?

First, we could have a cataclysmic event. For sure, it would have to be something very traumatic - 9/11 was on obvious example (the Dow was down approx. 14% for the week after the market reopened). If it happens, it may well be something that we did not expect at all - if we had expected it, we would have been prepared for it psychologically, practically (hedging), etc. I recently got reminded of this when the Qatar crisis started to unfold, and I contemplated the remote possibility of a war involving Saudi Arabia (I am not saying this is likely).

Second, and I think more likely (we should of course hope this will be the trigger rather than the first option), we could see a stark sell-off in some remote-seeming corner of the world of financial assets. A remote corner, but one that is sufficiently connected to the overall network of financial assets that it has the potential to spread its "sell virus" via contagion. This, of course, was the example of the crisis of 2008, which started with seemingly localized blow-ups like that of two internal Bear Stearns MBS hedge funds in June 2007. As Galbraith put it, in an eerily prescient article in January 1987: "For the loss will come. The market at this stage is inherently unstable. At some point, something - no one can ever know when or quite what - will trigger a decision by some to get out."

Or, do we need such a hard, human-rationalize-able trigger after all? Remember the flash crash of May-10 (Dow down 9% at its worst)? Remember the weird price action in tech stocks that Friday a few weeks ago? I tend to think that kind of "catalyst" would not be enough, though, as it would not push us down far enough and/or fulfill the other two conditions for the crash to which we shall now turn our attention.

2. We need perpetuation of the selling

Ideally in a self-reinforcing "vicious circle" way, where selling triggers further selling. This, too, may happen in various ways.

First, with humans as investment decision-makers in the middle. As Edwin Levèfre already said in Reminiscences of a Stock Operator, "the greatest publicity agent in the wide world is the ticker tape" and "never argue with it [the tape]." People who see prices dropping like a stone may just sell themselves, too, and ask questions later - especially if they have reasonable justifications for doing so (see next point "We need absence of significant supportive buying" below). This is also true as selling right now can be easily rationalized: we are almost eight years into a bull market (one of the longest ever in the U.S.), market valuations are high (again, in the U.S.) on most traditional metrics, QE seems to be ending, growth in many sectors is unexciting, etc. Note that against many of these points, one could elaborate counterarguments - e.g., who cares how long the bull market has gone on for? Or, regarding market valuations: high multiples are justifiable, given the ultra-low interest rates.

I, for one, will place my bet that, once a sell-off starts, few investors will stop to argue that the equity risk premium is actually correct; more likely, the majority will simply remember that the CAPE of U.S. stocks is near 30 and that we might just go back to something in the teens (the long-run mean and median) and that this will not happen via earnings catching up with prices. Lastly, with human decision-makers in the middle, most of which also tend to be employed rather than self-employed, Keynes's famous quote applies: "it is better for reputation to fail conventionally than to succeed unconventionally." Selling will be the conventional thing to do (just like continuing to buy is the conventional thing to do for now).

Second, via good old-fashioned contagion and forced selling. Once the crash starts, even if it is in some remote corner of the asset network, it will often force investors who commingle some of the affected assets with "good" assets to sell the latter ones, too, and soon, the selling may reverberate through the entire financial asset network. The exact extent and speed of contagion will depend on where the contagion starts and on the network topography, which is virtually impossible to know, but I would bet that the markets are more interlinked now than they were during the last crisis.

The more leverage, obviously, the worse, as assets pledged as collateral (including and in particular margined stocks) lose value, which then generates margin calls and, if those calls are unmet, forced sales of the collateral, leading to another vicious circle.

Third, in some perverse hard-wired, machine-driven way - which is really the same forced selling as above, but on steroids, as there are no humans in the middle and things may unfold extremely quickly. Remember the role of portfolio insurance in the 1987 crash? (Now, I am dating myself). In brief, in case of price falls, portfolios were programmed to sell a portion of the portfolio value short, via futures. That sounded like a great idea at the time until it entered a vicious circle, whereby a fall in cash equities caused the future to fall (via the portfolio insurance programmed actions) which in turn caused cash equities to fall further which in turn caused the future to fall further, which - you get the point. Here, we note that a "financial innovation" was another typical pre-crash characteristic that John Kenneth Galbraith identified in this book. The 1929 and 2008 innovations were investment trusts and MBS/CDO/etc. What could be current financial innovation that may become a culprit?

How about a class of instrument that grew at 20%+ CAGR over the last 12 years (and keeps going) and of which there are now more types (almost 6,000) than U.S. stocks of at least some reasonable size (using the Wilshire 5000 as a proxy)? I am talking about ETFs, of course (and ETPs).

Unless I am missing something, I can see how ETFs and their underlying assets could develop the same unhealthy, vicious interplay (i.e., another vicious circle) as happened between futures and underlying shares in the 1987 crash. Selling pressure may start in either place, ETF or underlying assets, but then the other instrument(s) will get dragged down via hedging activity which in turn will drag down the initial instrument(s), and so on - yet another vicious circle. Arguably, this same effect may have just happened on the way up, albeit in a slower and more controlled way as is likely on the way down.

An ETF, of course, is also often an excellent way to promote contagion, as they nearly always rather indiscriminately mix "good" with "bad" assets, interlinking them in a rigid, mechanical way, allowing the good to be dragged down with the bad (or the bad to rise jointly with the good). Although I cannot prove it, I sensed this happening recently, when in May 2017 the Brazilian market was shocked by the release of wiretaps implicating the Brazilian president in potentially criminal activities. The prominent Brazil-tracking ETF EWZ was down more than 15%, and pretty much all of its component stocks were also down roughly this percentage, albeit they represent a wide variety of companies that even cursory fundamental analysis would show to be of rather diverse quality and valuation.

The growth of ETFs has been a major, major change in market structure and may well be the cause for many a hedge fund manager's frustrated proclamations about how the market is not rational anymore. Of course, it really probably just means the market is not rational anymore on the previous time frames, now that many ETFs reinforce the prevailing trend and hence extend the trend's lifetime. But, considering how many hedge fund investors have tended to become more short-term oriented, you can see how this dichotomy between increasing periods of market irrationality (read: drawdowns/losses) and decreasing investor patience can drive hedge fund managers into returning outside money.

Galbraith mentions the emergence of investment trusts as a sign of the pre-1929 froth. I read about the first ETF of ETFs earlier this year.

Another potential source of forced selling may come to us thanks to the same folks that have brought volatility to its knees over the last few years. While again I cannot prove it with hard data, I have by now heard ample anecdotes of large institutions reaching for yield (understandable in our ZIRP world) by shorting vol. This includes, for example, me having had to listen to a senior investment management professional of an insurance company gloating about how he makes lots of yield by basically coming to the office every day writing puts. Let's see - reaching for yield via massively shorting an asset class already trading at historical lows - might we have seen this before? AIG Financial Products Group London writing CDS pre-2008? I listened to that person and thought I was looking at the guy that Steve Eisman had dinner with in Las Vegas in the movie The Big Short.

In any event, that game works fine until the day it does not work anymore. If a market drop is big enough, those institutions that are short puts will want to, and need to, cover their positions - i.e., they will either buy back the puts, which will then cause the counterparty to hedge itself by selling the underlying in the market, or more likely (as in a severe fall there may not be any people around writing puts), the institutions will just sell the underlying assets themselves. In any event, this activity will depress prices and probably set off yet another vicious circle.

3. We need absence of significant supportive buying

If things go down rapidly, where could the bid come from?

Machines?

Some of them may reinforce the downward trend, by following simplistic trend-following rules. Eventually (but likely not quickly enough), many machines will probably be taken offline - which is arguably correct anyway, even, or, perhaps especially, if the machines are sophisticated machine learning-based ones - as these rely on patterns observed in past data and are plainly unreliable when faced with data points that have never been seen before or only seen very few times.

"Regular human" investors?

Given the speed with which things will unfold, they will probably fall back on time-proven heuristics rather than any sort of deep analysis. I would bet that "don't catch the falling knife" will be a widely remembered and applied heuristic. Note also that investors will be able to rationalize not buying in the same manner they rationalized selling, as elaborated above.

Risk-loving prop desks who can enter a trade early and ride out a draw-down?

Well, thanks to the Volcker rule (not debating its merit here), there are fewer of those around these days.

Central Banks?

Their balance sheets are already full of stocks - just look at the JCB's ownership of the Japanese equity market (it was a top 10 holder in 90% of Japanese shares already as of mid-2016; by the way, they also buy loads of ETFs) or even the staid, quaint Swiss National Bank, who held over $63bn of U.S. shares as of year-end 2016. However, now the trend seems to be to shrink balance sheets.

Private equity?

Yes, they are full of cash but cannot, and do not need to, act quickly enough - but they will come out having a heyday (payday?).

Failed attempt at an upbeat note

The only fact that in theory could counterbalance my pessimist view so far is that there is actually an increasing number of voices that warn about the potential of a sharp downturn in markets - e.g., Jim Rogers or Mark Yusko. If these are just the visible exponents of a much larger, silent group that shares this belief, then maybe in the end, the market is already reflecting actions reflecting that belief, and it is not vulnerable as it actually is not overbought and overvalued? Maybe without these cautious beliefs and the resulting positioning, the CAPE would be in the 30s?

I do not buy it. The difficulty is that for many investors, even if they do share the belief that the market will come down, it is in practice very difficult to act on that belief, especially if they are employed (same Keynes argument as above) and/or managing other people's money - other people who typically do not look kindly on relative underperformance (even in hedge funds!) or things like holding cash reserves (which they have to pay fees on). That is why "as long as the music is playing, you've got to get up and dance," as Citigroup's Chuck Prince famously said in 2007. And, then you are magically supposed to know exactly when to stop dancing and quit the party before drunk people trash the furniture and start a fight.

It is like a multi-player game of chicken, made worse by the high payoffs/incentives to stay in the game. As somebody more eloquent than myself, John Hussmann, has said: "The problem with bubbles is that they force one to decide whether to look like an idiot before the peak, or an idiot after the peak." Many a smart person has looked like an idiot before the peak, at least temporarily - e.g., Warren Buffett during the internet bubble and Crispin Odey more recently.

Most people do not have Warren's or Crispin's financial or psychological stamina, though.

I could go on, but I'll stop here. We have not even talked about the links to the real economy yet (the whole reflexivity thing), but that might have to be another article.

So, do you agree? If so, how are you preparing/positioning yourself?

0 comments:

Publicar un comentario