Foreign Exchange

Dollar Watchers Look to IMF

Data on central banks’ holdings of greenbacks are expected to fuel the rally

By Ira Iosebashvili And Min Zeng

March 29, 2015 5:06 p.m. ET

.

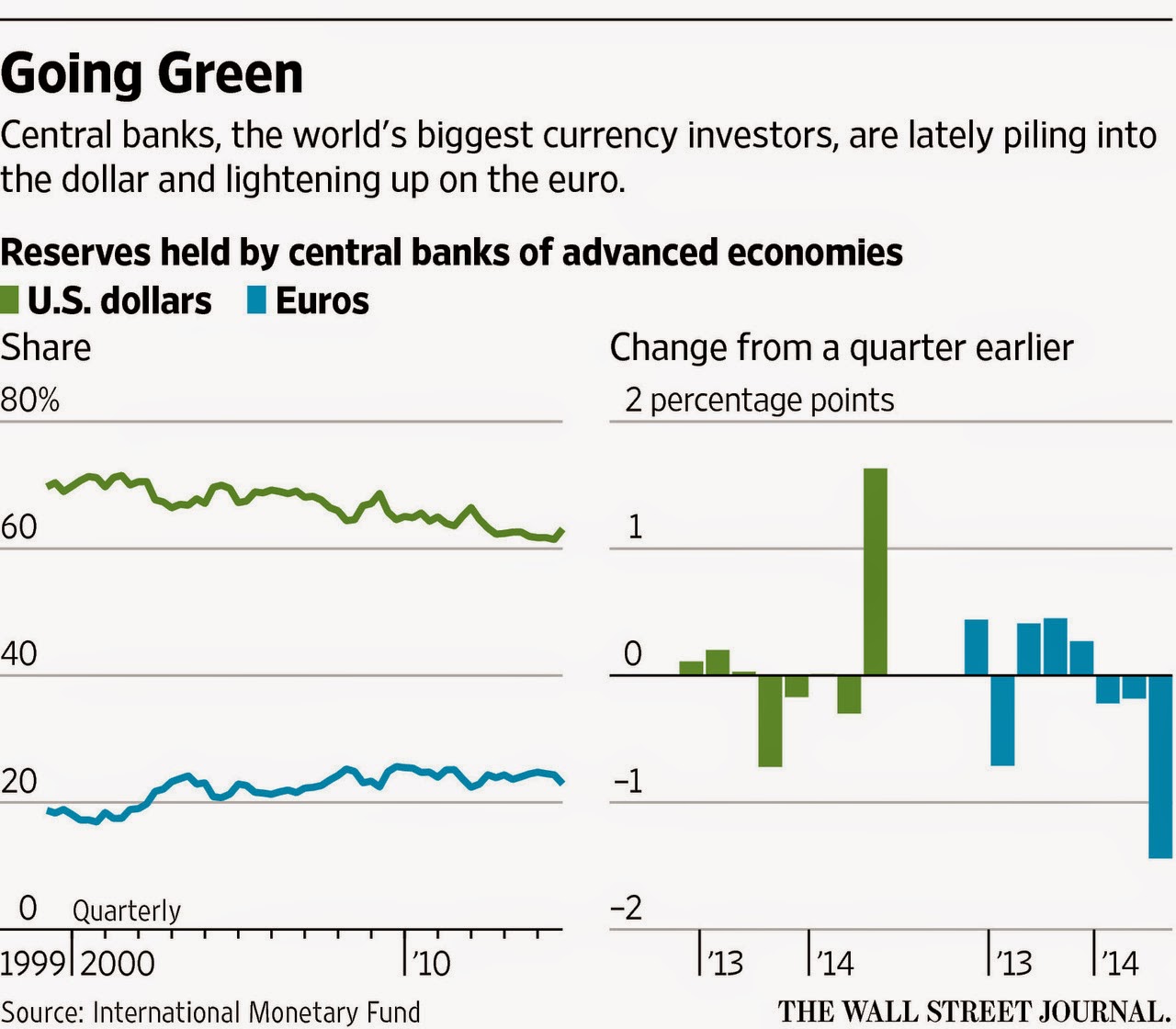

The IMF’s latest data release, for the third quarter of 2014, showed euros accounted for 22.6% of central banks’ reserves, a decline of 1.5 percentage points and the largest fall since 2004. It also showed a 1.6 percentage-point increase in allocations to the dollar, also the largest in more than a decade. The data is released on the last business day of every quarter and shows central-bank holdings going two quarters back.

The shift out of the euro came after the European Central Bank lowered the interest rate on deposits held with it to below zero last June for the first time in history, as it tried to head off a recession. The ECB’s move sparked an exodus of cash out of the euro, as central banks were now forced to pay for the privilege of owning euros.

Much of that cash found its way into assets denominated in dollars, attracted by an expected rate increase that would make the currency more attractive for investors seeking yield. Most investors anticipate the Fed will raise rates this year for the first time in almost a decade.

Some analysts and money managers said they believe interest in holding euros among central banks continued to weaken during the fourth quarter of last year and during the first quarter of 2015, a shift they believe accentuated the euro’s plunge. On March 9, the ECB began large-scale purchases of bonds, a tactic known as quantitative easing.

By printing money to pay banks selling the bonds, the central bank drives down the currency’s value in hopes of fostering lending and spurring economic activity.

Mr. Jen, a former economist at the IMF and the Fed, said that while safety and liquidity trump returns for central banks when they allocate their foreign-exchange reserves, it doesn’t make sense for reserve managers to hold negative-yield assets because it is punitive.

Negative-yield bonds have been the fastest-growing asset in the region over the past six months.

Now, more than a quarter of eurozone government bonds trade with negative yields, according to some analysts.

A buyer of negative-yield bonds pays a higher price than the bond’s par value.

Mr. Jen says he expects the euro to fall to $1 as soon as May or June. Others, however, are alarmed by the dollar’s sharp rally. In a note issued this month by HSBC Holdings PLC, analysts said that the dollar’s bull run “is nearing its end,” given how much the currency has already rallied. While most banks predict the euro will decline against the dollar next year, HSBC sees the currency rising to $1.10, versus $1.0890 Friday.

“The drama offered by policy divergence has already run its course,” analysts at the bank said in a note to investors. “Valuations show the dollar is nearly the world’s most overvalued currency.”

0 comments:

Publicar un comentario