Mayday markdowns

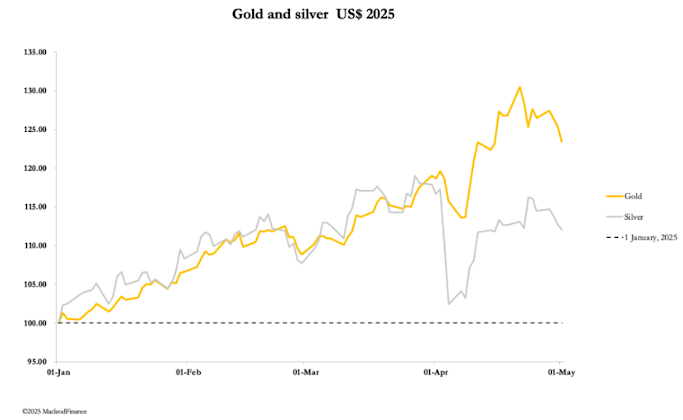

Gold is consolidating its rise from mid-December. The May Day holiday in China and with much of Europe shut as well, was an opportunity for the Comex shorts to punish the longs.

ALASDAIR MACLEOD

This morning marks the ninth trading session since gold briefly hit $3500.

And yesterday saw a dramatic markdown which commenced after the end of the previous afternoon session on the Shanghai Futures Exchange.

This morning, gold was trading in Europe at $3255, down $65 from last Friday’s close.

And silver traded at $32.55, down 52 cents on the same time-scale.

It was the end for May contracts on Comex.

The previous Thursday saw options expiry, which goes some way to explaining why gold was hit hard after rising to $3500 the day before.

So, first it was options expiry, pause, and then contract expiry.

These negative forces are now behind us.

Incidentally, current Shanghai futures run to the 15th May offering short-term leverage to Chinese speculators, should they wish to return as buyers next week.

They seemed to return modestly on the bull tack last night, with gold tiptoeing higher.

We will have to see how it pans out today, bearing in mind that at the time of writing, Shanghai futures have shut down for the weekend.

It would be a mistake to think that now that Comex is looking at new futures contracts that it will be plain-sailing for the bulls.

On the plus side, we can be sure that the real money is ignoring paper volatility and looking to benefit from any bullion being shaken out.

But there is so little of that, that genuine buyers are still turning to standing for delivery on Comex.

Since the Easter break, 34.5 tonnes of gold have been stood for delivery, and a whopping 1,993 tonnes of silver thanks to a record 11,692 contracts on Wednesday — an all-time one-day record.

The squeeze on Comex silver is very much in evidence, as our next chart shows:

The arrows clearly show how since early-April, the price has rallied while open interest has fallen.

In other words, instead of the usual situation where prices rise on increasing buying volumes, silver has risen on lower buying interest.

It can only be an uncomfortable squeeze on the shorts.

Pitiful and declining volume in the silver contract confirms.

For silver bulls, it might feel like Waiting for Godot, but the technical setup is very positive, shown next:

With respect to gold, we can only conclude that pricing is no longer driven by London and Comex.

Comex can only use opportunities such as China’s Mayday break to take charge.

But the reality is that gold is now predominantly a physical market dominated by Shanghai.

And recently, China’s authorities announced that for the first time ever the Shanghai Gold Exchange is going to open vaults outside China to allow trading for gold in yuan.

Obviously, this is a major step in the death for the dollar as the currency medium for international trade.

It could be the future basis for linking the offshore yuan to gold.

As to where these vaults will be located we are not told, but following Xi’s visit to ASEAN trading partners it would make sense to extend the yuan to the entire East Asian region to drive out the dollar for ASEAN trade.

Presumably, China has no current intention of fixing a gold/yuan exchange rate, but the option is there for the future.

Besides the volatility on the Shanghai Futures Exchange, there is increasing demand from Chinese households for gold bank accounts and gold accumulation plans.

With low interest rates and the threat of a weakening yuan, plus the absence of credible investment alternatives, there is as much as $2.5 trillion equivalent in annual Chinese household savings overhanging the gold market.

Chinese households are little different from savers in western capital markets, only just becoming aware that gold is in a bull market.

They will be looking for opportunities to buy, relected in increasing totals for ETFs:

For Chinese households, ETFs are not the favoured form of gold investment, gold saving products offered by banks being preferred. But the soaring increase over the last 18 months is an indication of investor sentiment.

Chinese households are definitely going for gold.

Meanwhile, gold has begun to flow out of Comex warehouses, as shown next:

Some of this has returned to London, where LBMA vaults recorded a slight increase (0.14%) in March over February — a trend likely to continue:

For now, wider sentiment in western capital markets is on pause.

The fall in the dollar has stopped, equities have recovered somewhat, and bond yields have drifted lower.

With increasing evidence of recession (US GDP growth was reported to have declined 0.3% in the last quarter), investors are uncertain.

What they miss is that the debt/credit bubble is becoming unstable.

And as that bursts, equities fall, bond yields rise, and the economy tanks.

As this realisation begins to take hold of markets, the dollar will begin its next decline, driving safe-haven demand for both gold and silver.

0 comments:

Publicar un comentario