U.S. Stocks Fall Further After China Retaliates Against Trump Tariffs

An escalating trade war sends the market to its worst week since March 2020

By Vicky Ge Huang

China retaliated against U.S. tariffs, escalating the biggest trade war in a century and sending global stocks to a second washout day in a row.

Friday’s declines in all the major U.S. indexes sent the market to its worst week since the Covid crisis was in full bloom, and raised anxiety among traders that next week might bring more of the same.

This week’s selloff was triggered not by a virus circling the globe, but by tariffs.

The president’s across-the-board levies on goods imported from virtually every one of its trading partners left investors shaken and fearful for a recession.

Stocks tumbled Thursday after Trump revealed the details of his plans.

They fell further on Friday after China’s retaliation dashed hopes for a speedy resolution to the trade war.

“We are in a period of self-induced vomiting—that is the best way I can encapsulate what happened this week,” said Callie Cox, chief market strategist at Ritholtz Wealth Management.

“Investors are really just trying to find the center of gravity right now given the dramatic nature of this new round of tariffs.”

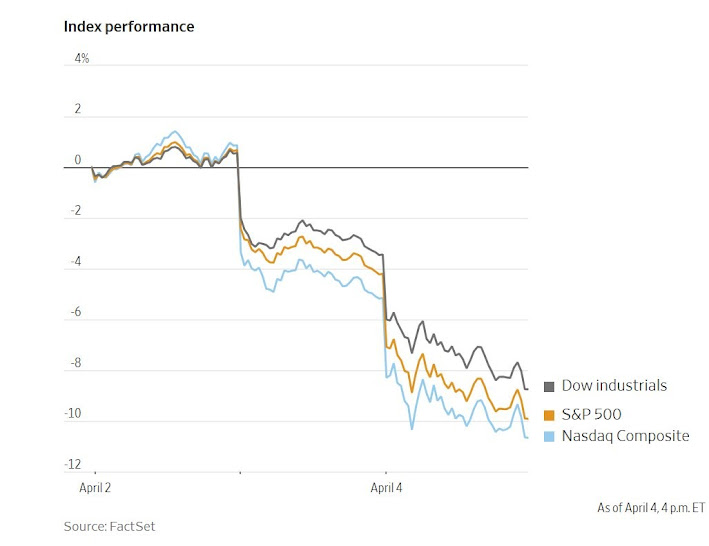

The Dow Jones Industrial Average lost more than 3,000 points this week, or 7.8%, sending the blue-chip index into a correction.

The tech-focused Nasdaq plunged 10% and into a bear market, meaning the index had fallen 20% from its previous highs.

The S&P 500 lost 9%. In the last two days alone, the Magnificent Seven group of large tech stocks erased $1.5 trillion of market value, according to Dow Jones Market Data.

Investors continued to seek safety in government bonds and gold amid the market turmoil. Photo: Liu Yanan/Zuma Press

Investors continued to seek safety in government bonds and gold amid the market turmoil. Photo: Liu Yanan/Zuma PressThe benchmarks fell further on Friday even after the Labor Department delivered a surprisingly good jobs report for March.

The U.S. added 228,000 jobs last month, well above the Wall Street consensus estimate of 140,000, suggesting the economy entered the latest salvo of the trade war on solid footing.

Nevertheless, all eyes were on China, which in response to Trump’s tariff hike said it would impose an additional 34% levy on all imported U.S. goods.

The extra tariff is set to take effect on April 10. “China played it wrong, they panicked,” Trump said in a Friday social-media post.

“Obviously the markets are just simply not taking Ps and Qs today from the labor data whatsoever,” said David Bahnsen, chief investment officer of the Bahnsen Group in Newport Beach, Calif.

“This is entirely around the China reciprocal tariffs.”

Investors continued to search for safety in government bonds amid the market turmoil.

The yield on the 10-year Treasury, a leading barometer of economic conditions, fell below 4% for the first time since October, suggesting heightened fears of a recession.

Friday’s declines were broad-based.

Gold futures slid 2.7% to $3,012 per troy ounce after climbing to record levels earlier in the week.

Meanwhile, oil prices slid to their lowest level in nearly four years.

On Thursday, U.S. markets suffered their steepest one-day declines since 2020, with investors fearing that President Trump’s new tariff plans will trigger a global trade war and drag the U.S. economy into recession.

Economists at global banks are taking a gloomier outlook on the economy, with many upping their recession forecasts.

A team of JPMorgan Chase economists raised the odds of a recession in a global economy to 60% from 40%.

Traders have increased their bets on interest-rate cuts this year, wagering that the Federal Reserve will take action at the first signs of a faltering economy.

In a Friday speech, Fed Chair Jerome Powell said the central bank would be able to address any fallout from President Trump’s tariff hikes to ensure one-time price increases don’t lead to persistently higher inflation.

Wall Street’s fear gauge flashed warning signs.

The Cboe Volatility Index, or VIX, surged to 43.21 on Friday, on pace for its highest closing level since April 2020, according to Dow Jones Market Data.

The stock-market swoon slammed the door on companies waiting in the wings to go public, with ticketing marketplace StubHub and buy-now-pay-later fintech company Klarna both postponing their initial public offering roadshows.

Overseas, Japan’s Nikkei 225 Index fell 9% for the week, while the Stoxx Europe 600 Index tumbled 8%.

Both indexes logged their largest one-week percentage declines since March 2020.

0 comments:

Publicar un comentario