The Uncertainty World

By John Mauldin

It is a cliché, but for a very good reason.

It is more than a truism.

In fact, businesses don’t like uncertainty.

You and I don’t like uncertainty in our personal lives.

When we go to the store, we want to be certain that what we are looking for is there, and at a reasonable price.

We want our food orders to be certain.

We want our relationships to be certain.

In fact, the relationships we value most are the

ones in which we feel certain whether it’s personal, business, or investing.

Today we are going to look at some of the uncertainties in our

world and then explore some ways to gain a little certainty.

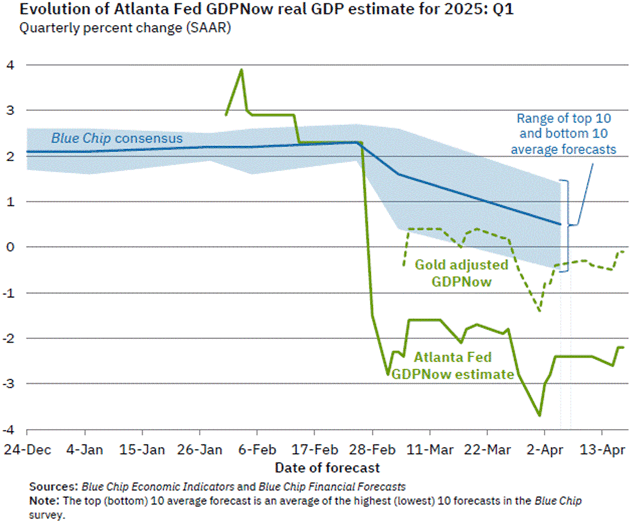

We talked about The Uncertainty Recession recently, and that certainly seems to be the case for the first quarter.

We looked at the Atlanta Fed’s GDPNow estimate a few weeks ago and it was indicating a first-quarter recession.

The latest update for their projection is worth

quickly revisiting.

Source: Federal Reserve Bank of Atlanta

Several comments are in order.

First, the Atlanta Fed acknowledges the impact of gold imports on their GDP forecasts.

This week I learned (and now you will) about how the Atlanta Fed tracks gold.

Turns out it is not straightforward.

And that it makes a difference going forward.

I should note that my “edge” in writing this letter is I have fabulous sources of information (and conversations!) that I have developed over the years.

Plus, I am part of several group chats and texts with seasoned market experts who regularly comment on data and a wide variety of topics.

What

I have in addition is my readers who graciously send me information and ideas.

Reader Robert Merrill actually wrote the caretaker of the Atlanta Fed GDPNow model, Pat Higgins, who wrote him back.

It turns out there are two sources for importing gold data: the Census Bureau and the Bureau of Economic Analysis.

According to Mr. Higgins, the Census Bureau’s numbers can be quite different because many gold import bars are classified as finished metal shapes.

The BEA classifies them as nonmonetary (for trade purposes) gold.

Higgins said that going forward they will likely make the switch to the BEA

numbers as they are more accurate for their purpose.

Why does this matter?

Right now, you can see that if you use the Census Bureau numbers for gold they would say that the actual projections would only show a slight recession.

Presumably, the BEA numbers would show a much

deeper downturn.

While the GDPNow can vary widely in the early months, this late in April with no more data to come in it is highly likely Q1 will show negative GDP growth.

The data could move either way from their projection.

If the final data shows more imports than are currently counted, the downturn will be deeper.

BEA will issue three Q1 GDP estimates over the next three months, an initial “advance” number later this month, then two updates.

These can change

significantly as new data comes in.

I think this recession, if this is the beginning of one, will be different than the typical business cycle recessions we have experienced in the past.

Policy uncertainty is causing some businesses to pause expansion plans,

unsure of what tariff and other tax policies will prevail 6–12–24 months from

now.

Not all the data is negative, though.

Consumer spending remains solid.

Households and businesses are not overleveraged and still have spending capacity.

However, consumer sentiment is down significantly.

Normally sentiment is reflected in consumer spending.

Why the disconnect?

Because consumers and businesses may be spending more to get ahead of the potential tariffs.

Just as high inflation makes consumers spend today to avoid high prices in the future, potential 25% tariffs (and much higher for Chinese goods) have the same effect.

In essence, if you know you will need a

particular product soon, why not just buy it now?

This is not just speculation on my part.

My good friend Lyric

Hughes Hale of Econvue sent me this note:

“As a tidal wave of tariffs rolls in around the world, weak consumer confidence numbers have sparked fears of a coming recession, driven by fears of falling consumption.

At least in the US however, this is not historically true.

Americans are born and bred to consume, and paradoxically, anxiety only seems to increase their propensity to spend.

The interplay between financial conditions and consumer behavior is complex.

This is a feature of a psychological phenomenon called catastrophic thinking.

In February of 2025, a survey by Creditcards.com

found the following:

·

1 in 5 Americans are buying more than usual, most driven by

Trump’s tariffs

·

3 in 10 Americans are purchasing items in preparation for another

pandemic

·

42% of Americans are or will start stockpiling items, mainly food

and toilet paper

·

1 in 4 Americans have made large purchases since November in fear

of Trump’s tariffs

·

1 in 5 Americans say they are “doom spending”—purchasing items

excessively or impulsively in response to fears or anxiety about future events

·

23% of Americans expect to worsen or go into credit card debt this

year

“…after 9/11, confidence fell by 25%, but spending only fell by 1.3% and rebounded within a month.

This pattern repeated during Covid, when direct fiscal stimulus added fuel to the fire, driving retail spending to all-time highs.

While culturally, Chinese consumers

react to stress by saving more, US consumers spend more in times of uncertainty

as a form of emotional reassurance, a pattern reflected in post-crisis retail

surges.”

This becomes even more tricky in terms of forecasting recession.

If consumers and businesses are mainly buying imports, it’s negative for GDP.

Businesses delaying expansion plans is clearly negative for GDP.

But of course,

we still see large businesses double down on anything related to artificial

intelligence.

Further, Lacy Hunt tells us in his latest essay that: “Five pivotal US economic considerations, including tariffs, monetary policy, fiscal policy, debt overhang, and demographics, are aligning to depress economic growth for the balance of this year and into 2026.”

I talked with him about

this view, and he will elaborate on it at the SIC.

Slower economic growth means lower tax revenue and higher unemployment and other safety net spending, the opposite of what the Trump administration needs if it wants to reduce the deficit.

An actual recession will aggravate the deficit even more.

Where Do We Go from Here?

The Trump administration certainly knows that uncertainty is creating negative pressure on the economy.

They are clearly trying to reshape the global trading order, but it is, well, uncertain what it will look like when they are finished.

Will it be a world of more open and balanced trade?

Or

a world of trade within silos because tariffs force businesses all over the

world to adjust supply chains?

The most important negotiations are the ones that are occurring between China and the US.

And yes, those negotiations are happening.

It is not clear how they will unfold.

Trump is evidently willing to build a wall around

China if he does not get what he feels is fair and equitable.

While some think that Beijing has a strong hand, I am more skeptical.

Certainly China is a powerhouse, but their system is not market-driven and has misallocated an enormous amount of capital.

China relies on the world, and to a great extent the US, to be its consumption driver, as the Chinese save 30 to 40% of their earnings.

Yes, many Chinese leaders are very upset, but they have constraints.

It is not the best climate for

negotiations, but both sides really need to come to the table.

We will have three sessions focused on China at this year’s Strategic Investment Conference and several more where China will be a significant topic.

I expect our speakers will know a great deal more in 30 days.

(We will have one speaker deeply embedded in China who will present anonymously.)

These figures include people who are old China hands, fluent in the

language and culture, many with deep connections in the business and government

worlds there.

The Trump administration seemingly believes it can resolve the tariff issues in 3 to 6 months, removing the uncertainty currently plaguing the system.

They are clearly willing to suffer a recession if need be in order to restructure the global trading system.

The removal of uncertainty will certainly spur a great deal of economic activity and growth.

If you combine that with scaling back the regulatory deep state, it could produce an environment where manufacturing grows significantly.

That seems to be their

bet.

My friend Mark Mills will be presenting at the SIC on energy, but he is also an expert on all sorts of government activity.

In a recent paper at the Manhattan Institute he noted that “…complying with federal regulations now costs $29,100 for large companies and $50,100 for small firms—per employee, per year.

Tomorrow’s large firms start as small ones, and over 90 percent of manufacturers are small firms that account

for 40 percent of manufacturing employment.”

Since 2017, there have been 550 major rules costing over $100 million imposed on manufacturing businesses.

The total cost of regulations is $80 billion a year.

Mark argues with real data that regulations are far more destructive to jobs than technology.

Technology in fact creates jobs.

Now think about how much regulation costs Chinese or other foreign manufacturers.

And we wonder why US manufacturers have trouble competing!

Some regulations are obviously needed, but bureaucrats are incentivized to increase regulations, as it increases their budgets and importance.

Or creates opportunities when they go into the private sector.

The exact opposite of what is needed.

We will see what Trump can do.

The US is still the entrepreneurial center of the world.

But China is clearly catching up.

We need to remove the impediments that hamper US activity at the same time we are negotiating for fair trade.

DC, Dallas, and Everywhere

I will be in DC Saturday night and for the next four nights attending a longevity conference and meeting with friends and readers.

It will be a busy time.

The next week I will be at a private conference for a few days, then the SIC will have me in Puerto Rico for 12 days and I will likely be in Dallas where our new longevity clinic will have been opened, then shortly in West Palm Beach, back in the DC area and of course here in Dorado Beach where we are opening clinics.

And we are in negotiations for more.

It is a busy time.

I am doing a deep dive into AI and finding that most of my friends already are there. I am picking up tips and amazed at what I can do.

I found out that I can take a folder in my inbox that I have been filling with emails for 15 years, click on all the messages and their attachments and it will show up in one PDF document I can then use to train my own personal AI.

I am a bit of a pack rat on information.

I now kind of regret deleting documents I knew I would never get back to, because they would be useful to have in my “database of everything in my inbox.”

And the research I can get?

Oh, dear gods.

I’ll stop there.

For those of you who asked, Abbi is recovering nicely from her open-heart surgery.

And with that, I will hit the send button and wish you a great week!

Your ready for SIC to start analyst,

|

|

John

Mauldin |

0 comments:

Publicar un comentario