Hi Ho, Silver!

Gold’s monetary sibling is not to be ignored. Silver’s technical and supply/demand factors strongly suggest silver will outperform gold. But what will China do?

ALASDAIR MACLEOD

The technical chart below is about as positive as it can get.

It has broken out decisively above the post-covid four-year consolidation (the pecked line).

Furthermore, rising moving averages in sequence not only confirm the silver bull market, but they are accelerating higher lending additional support to the price.

Other statistics are equally supportive.

It’s just that gold is hogging the limelight, with central banks buying it furiously to get out of fiat dollars.

But even if you dismiss silver as an industrial metal, what’s happening to gold is also happening to silver.

Furthermore, those who have missed the gold story are likely to pile into silver as the metal that’s been left behind.

Before moving on to more technical factors, let’s remind ourselves about the fundamentals, and work out who or what is controlling the price.

Supply deficits and Chinese suppression

The following table is extracted from the Silver Institute’s latest annual report.

Over the last six years, total supply has barely grown while demand has particularly for photovoltaics.

Other than net selling of ETPs (ETFs) in 2022—2023, the supply shortfall is unexplained.

In the last six years, taking ETFs out of the equation this gaping hole in the numbers amounts to 1,093.4 million ounces, more than one year’s total mine and scrap supply.

This shortfall is unexplained in these figures.

But I have long suspected China of controlling the price, presumably to subsidise its electronic and PV industries.

And it turns out that in 2023 alone, China exported $4.69bn of silver and imported $1.14bn leaving net exports of about 140 million ounces, which ties in neatly with the Silver Institutes’ bottom line.[i]

China’s largest silver exports in 2023 were to Hong Kong, UK, India, and Switzerland.

Other than India, which is ramping up its PV production, the others are financial centres strongly suggesting that the export objective was to suppress prices.

What stands out is that if net investment in ETFs increases, it will trigger a supply crisis driving prices higher, unless China steps up its intervention.

That seems unlikely since they have permitted or even encouraged gold demand to increase and the sheer scale of silver price suppression is rising, putting strains on China’s own silver position.

Copper, which in bulk is more important than silver is also rising in price, up even more than gold at 23% this year so far.

And for the Chinese public, silver is still regarded as a monetary metal.

Clearly, silver is now badly out of line with gold and copper, putting pressure on China to rethink its silver suppression policy

The silver paper crisis

The trigger for current price turmoil has been Trump’s tariff scare which drove Comex futures to significant premiums over London spot, causing an arbitrage into Comex warehouses where stocks are now at record levels.

It has led to physical liquidity in other financial centres being badly depleted.

But it is essentially a paper squeeze crisis in a contract which is illiquid relative to gold.

Stand-for-deliveries since 1 January, whereby longs choose to take delivery on futures’ expiry total 106.625 million ounces to date, which is also significant in the context of Chinese price suppression.

Comex Swaps, who take the short side of the contract are uncomfortably short:

At net short 43,111 contracts on the last Commitment of Traders Report, it is not as much as the 2016 record at 49,609, when silver was under $14.

But the market value is an all-time record at $7.328bn and the gross short position is $11.303bn split between 25 parties.

If the silver price rises in the manner suggested by the technical chart at the beginning of this article, some of these Swaps could face financial difficulties.

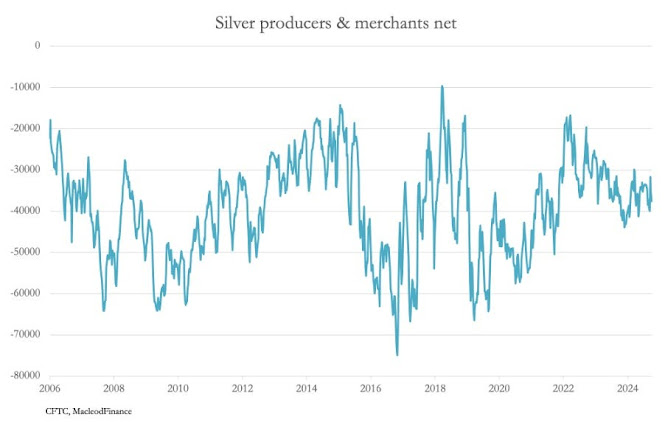

The other category taking the short side is Producers and Merchants.

For the last four years, they have generally reduced their net shorts and seem unlikely to rescue the Swaps, given their understanding of bullion supply constraints:

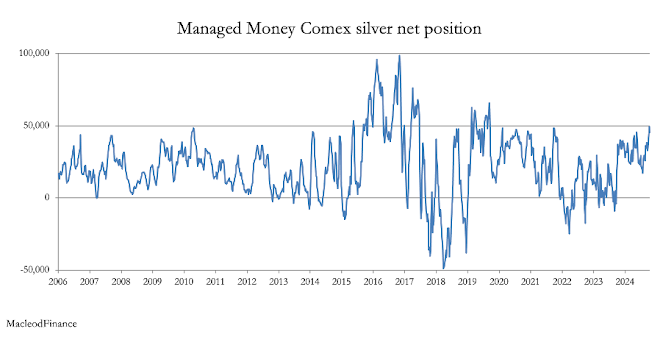

The long side of Comex is by no means extreme, as the Managed Money category (hedge funds) illustrates.

Furthermore, the sum of Others and Non-Reportables is not extreme either:

Therefore, Comex longs have plenty of room to buy before the silver contract becomes technically overbought.

Conclusion

Silver’s technical setup looks excellent, and the squeeze initiated on Comex futures has drained physical supplies away from other centres.

Unlike gold, there is no leasing supply from central banks to suppress the price.

Instead, the supply has come from China in an apparent attempt to suppress the price.

That suppression policy is failing, and it is probably not in China’s interest to continue to sell silver into the market cheaply.

If, as seems increasingly likely, China withdraws from supplying western financial markets with bullion, the price could rise rapidly, catching up with gold’s recent outperformance.

0 comments:

Publicar un comentario