The Countries Driving America’s $1.2 Trillion Trade Deficit in Goods

Growing gaps with Mexico and Vietnam add to the biggest imbalance the U.S. faces—with China

By Anthony DeBarros and Peter Santilli

The U.S. imported $1.2 trillion more in goods in 2024 than it exported, a record annual deficit and a major economic irritant for President Trump.

On Feb. 13, the president announced that his administration would evaluate tariffs and other trade barriers imposed on U.S. exports by other nations and match them with “reciprocal” tariffs.

The president said last week that 25% tariffs on Canada and Mexico would go into effect Tuesday.

Part of the president’s goal is to shrink that trillion-dollar gulf between imports and exports by getting other countries to buy more goods from the U.S. and by spurring domestic manufacturing.

The nation’s biggest trading partners—Mexico, Canada and China—contribute a sizable share of the gap.

But the U.S. last year ran a trade deficit with more than 100 countries, according to Census Bureau data.

Gaps with some of those nations, including Vietnam and India, have grown as businesses shifted supply chains away from China.

The monthly goods deficit has been on a tear—to the downside.

Preliminary census numbers for January show that, after hitting a record $123 billion in December, it rocketed to $153 billion as businesses raced to import goods ahead of tariffs.

The U.S. runs a steady trade surplus in services, which in 2024 left the overall goods and services deficit at about $918 billion.

Here’s a look at the top nations whose trade balances with the U.S. added to or reduced the goods trade deficit in 2024.

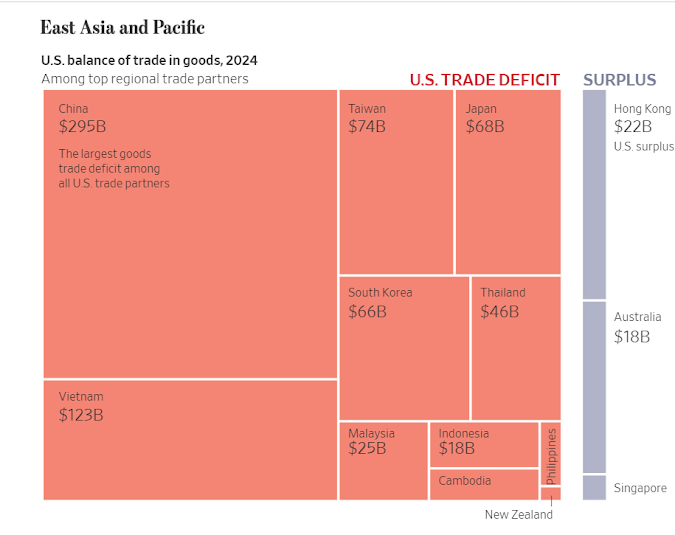

The U.S. recorded a combined deficit of more than $620 billion with its five largest Asian trading partners in 2024 by total trade: China, Japan, South Korea, Taiwan and Vietnam.

Its $295 billion gap with China was down from a peak of $418 billion in 2018 but still the widest of any U.S. trading partner.

Vietnam recorded the next-largest deficit among Asian nations, $123.5 billion—a gap that has ballooned following the pandemic and the first round of U.S. tariffs on China in 2018-19.

Those deficits were mitigated only slightly by surpluses the U.S. had in 2024 with Hong Kong, Australia and Singapore.

Last week, the president announced a 10% hike in tariffs on Chinese goods, which fall on top of a 10% levy announced earlier in February and tariffs placed during the first Trump administration.

After the first announcement, China retaliated with targeted new tariffs of its own, including a 15% levy on imports of U.S. coal and liquefied natural gas.

But China added no new tariffs on soybeans, the largest U.S. export to the nation in 2024 at $12.8 billion. Whole soybeans from the U.S. already incur a 3% tariff from China, according to Virginia Houston, director of government affairs for the American Soybean Association.

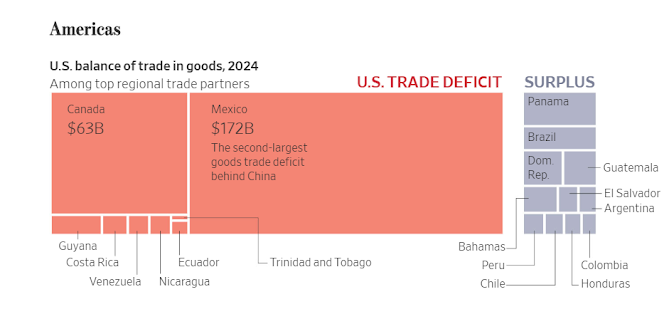

Mexico overtook China in 2023 to become America’s largest supplier of imports, and as commerce between the nations has increased, so too has the U.S. trade deficit with its southern neighbor.

The U.S. recorded a $172 billion goods deficit with Mexico last year, nearly 2½ times as much as in the first year of Trump’s first term.

The U.S. ships billions of dollars worth of oils, auto parts, integrated circuits, corn and other commodities to Mexico, but it receives more in Mexican imports, which include cars, trucks, computers, appliances, fruits, vegetables and beer.

Canada exported $63 billion more in goods to the U.S. than it imported in 2024, with shipments of $98 billion in crude oil and $35 billion of cars and trucks helping to fuel the deficit.

Much of the trade among the U.S., Canada and Mexico is duty-free, as specified in the 2020 U.S.-Mexico-Canada Agreement, or USMCA.

Trump nevertheless announced 25% tariffs on Canada and Mexico last month—albeit with a lower 10% levy on Canadian oil—then put them on hold after both nations’ leaders agreed to step up drug and immigration enforcement efforts at their borders.

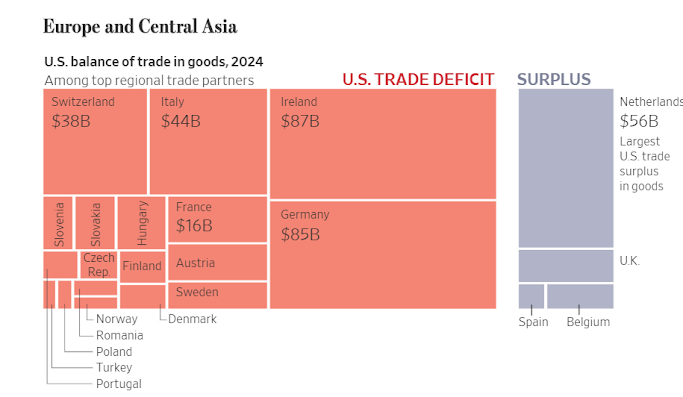

The U.S. runs trade deficits with most European countries, with exceptions.

Exports of oil and natural gas helped the U.S. achieve a $56 billion trade surplus last year with the Netherlands, a hub for oil and gas distribution; it is the largest surplus among U.S. trading partners.

Exports of gold and aircraft to the U.K. helped build a nearly $12 billion surplus.

But deficits with Ireland, Germany and other European nations tilt America’s overall trade balance with the continent into the red.

The U.S. imported more than $50 billion in pharmaceutical goods from Ireland last year, contributing to an $87 billion deficit. Imports of $68 billion in vehicles and machinery from Germany helped create an $85 billion deficit.

Peter Navarro, the president’s trade adviser, has recently highlighted the tariffs that European Union members impose on imports of U.S. automobiles as an example of uneven trade barriers the administration seeks to correct via reciprocal tariffs.

Autos that Germany exports to the U.S., for example, are subject to a 2.5% tariff, while the tariff on exports of U.S. autos to Germany is 10%, according to Dan Anthony, president of research firm Trade Partnership Worldwide.

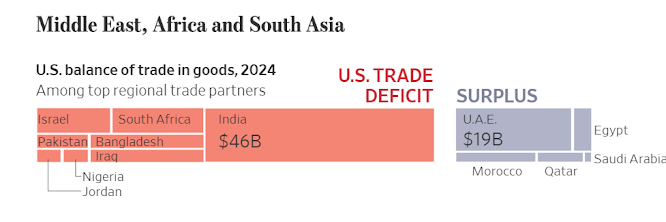

Middle Eastern, South Asian and African countries comprise a smaller share of U.S. trade, although the deficit with India has roughly doubled since the first year of Trump’s first term.

In 2024, the U.S. purchased about $21 billion in machinery and electronics from the country, reflecting rising imports as businesses have sought to reduce their reliance on China.

Apple notably has aimed to increase production of its iPhone there.

It is likely the Trump administration will take a look at India’s import tariffs, which averaged 14.3% in 2022, according to the latest data from the World Bank.

The U.S. average for that year was 2.7%.

India recently cut tariffs on imports including motorcycles and smartphone components, among other products.

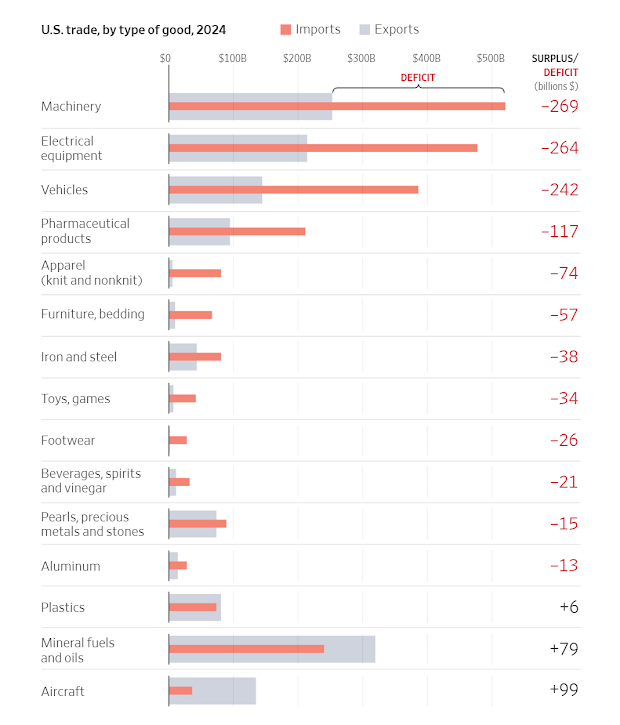

Across all nations, at a product level, the U.S. runs varying levels of trade deficits or surpluses.

The largest deficits in 2024 were in machinery, electrical equipment and electronics, vehicles and pharmaceuticals, according to census data.

Primary surpluses included aircraft and mineral fuels and oils.

Note: Regional breakdowns exclude trade partners that had less than $5 billion in combined U.S. imports and exports in 2024.

Regional groupings are based on World Bank classifications, with some groups combined for display purposes.

Goods category names are simplified from the two-digit level of the Harmonized Tariff Schedule; aircraft and vehicles includes parts; electrical equipment includes electrical machinery, electronics and parts; furniture and bedding includes light fixtures; toys and games includes sports equipment.

This explanatory article may be periodically updated.

0 comments:

Publicar un comentario