Gold’s open interest on Comex declines

Preliminary open interest on Comex fell a further 11,497 contracts yesterday, yet the price has held up above $3000 ahead of tomorrow’s option expiry. What does this mean?

ALASDAIR MACLEOD

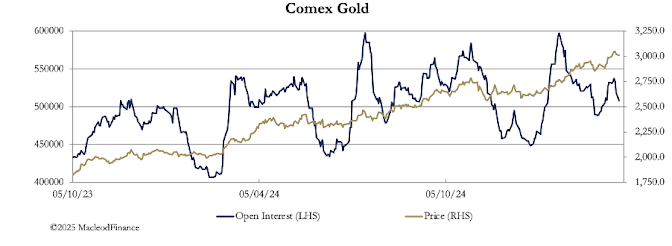

Despite gold remaining close to all-time highs, the chart above shows Open Interest falling when reasonably it should be somewhat higher to reflect current bull market conditions.

The next chart, which includes the price shows how the price tends to march on regardless of Open Interest on Comex:

The underlying point is that Comex speculators have yet to take a bullish stance. Yet the price is running away.

But normally, in the last week of contract expiry, acting in unison the shorts succeed in marking prices lower, triggering long stops, and making call options expire worthless.

We have seen this reflected in the modest price decline since last Thursday’s high.

But so far, that decline has been trifling considering the decline in Open Interest.

There may be a final attempt to get gold under $3000 before April options last day trading tomorrow.

There are 6,592 option contracts at that exercise price to be made worthless, and a further 3,200+ on exercise prices down to $2975.

Interestingly, the general disinterest in the futures is also reflected in low option turnover, as the next chart shows:

To summarise, despite the spectacular rise in the gold price in recent months, the undertone remains remarkably firm.

Therefore, any dip below $3000 represents an opportunity to buy the June contract before the rest of the investment universe wakes up to the consequences of a continuing bear squeeze in gold futures markets.

0 comments:

Publicar un comentario