How will falling equities affect gold?

Macleod Finance

A rise in bond yields tends to support the dollar and if there is a market shock, US Treasuries are the accepted safe haven of choice for international markets.

This was clearly illustrated during the great financial crisis of 2007—2009, when gold was marked down from $1000 to under $700 before rising strongly to all-time highs over the next two years.

And there can be little doubt that a crisis today might be expected by investors to follow a similar pattern.

But there are important differences.

First, the dollar is weakening and is likely to require higher interest rates to stabilise it.

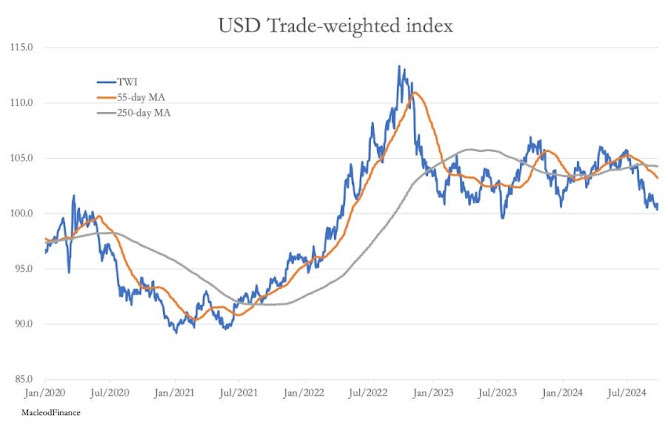

The problem is illustrated by the trade-weighted index:

There has not been such a clear death cross signal since mid-2020 when the Fed had cut interest rates to zero and the government’s deficit soared over covid.

That a more violent death cross has anticipated the Fed’s cut in rates to 4 ¾%—5% suggests a more substantial fall in the dollar than that of 2020—2021 is in prospect.

It is against this background that foreign holders of dollars and US financial assets will be considering their position.

Unlike the time of the 2008—2009 financial crisis, foreign attitudes to the dollar have altered fundamentally.

This is bound to colour its safe-haven credentials — instead of flying on autopilot into dollars and US Treasuries, it is more likely that a crisis today would, directly or indirectly, draw attention to a funding crisis for the US Government.

In short, the US Treasury and the Fed would be unable to simply blag their way out of a crisis as they have done in the past.

If that crisis is to be a market crash in equities, we would expect hedge funds and other players in Comex’s Managed Money category to cannibalise profits to cover their losses.

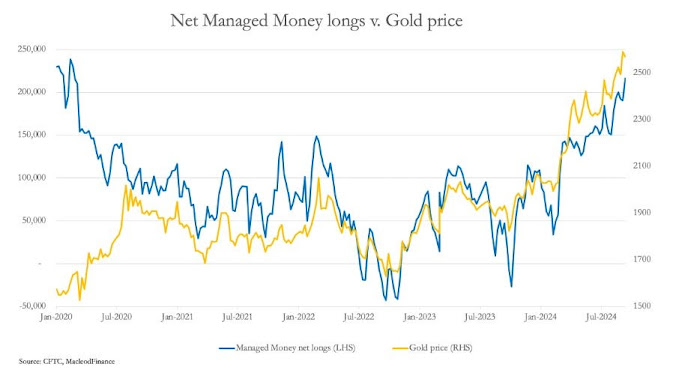

In this context, they are very long of gold futures, as my next chart shows (the blue line):

In the past, when the Managed Money category has been net long of 150,000—250,000 contracts the gold price is vulnerable to a bear raid by the perennially short establishment bullion banks and market-makers.

Indeed, to the dismay of gold bugs it has been an extremely profitable exercise for them.

But Managed Money overwhelmingly consists of hedge funds who pair-trade between dollars and gold.

The question arises as to whether they would readily liquidate their gold futures for dollars to cover losses elsewhere in a new financial crisis.

Flight out of the dollar into other currencies is signalled by the death cross on the trade-weighted index chart.

But that has limitations because the dollar’s troubles are bound to be shared by the other major currencies.

And in western capital markets, gold ownership by investors is low, with physically backed ETFs having been consistently sold down until only recently.

A resurgence of this interest, which is just beginning to be evident, will double the current physical squeeze on paper gold.

0 comments:

Publicar un comentario