Greenback blues

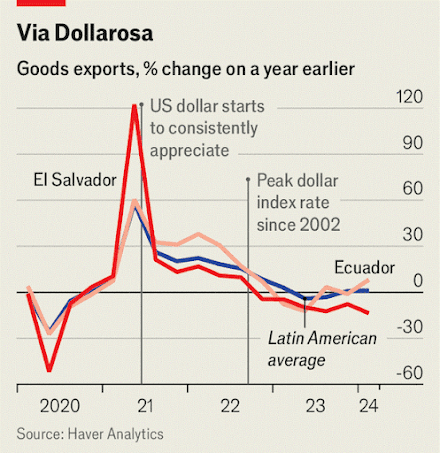

The strong dollar is hurting exports from Latin America

For three small dollarised economies it has exposed a lack of competitiveness

Conditions in ecuador’s Andean highlands are ideal for growing roses.

The country is one of the world’s biggest exporters of them.

But having suffered with the pandemic slump and social unrest in 2022, the rose growers now have another problem.

After its currency collapsed, in 2000 Ecuador adopted the American dollar instead.

With the dollar now strong, Ecuador’s roses are losing out in world markets to rivals from Colombia, Ethiopia and Kenya.

Thanks to a weakening of Colombia’s peso, in 2023 its flower exports were more than 40% higher than before the pandemic, while those from Ecuador had grown by just 12% over the same period.

Like Ecuador, Panama and El Salvador also use the dollar.

Exports from all three have been hit recently by the strength of the greenback (see chart), but selectively so.

Economic growth in all three countries is projected to fall below the (admittedly modest) Latin American average.

There are some other factors, too.

Ecuador has suffered a destabilising wave of gang violence.

Following protests, Panama’s government closed a big copper mine, which has shaved perhaps 1% off its gdp.

And unpredictable policymaking in El Salvador under its authoritarian president, Nayib Bukele, has shaken investment.

The strong dollar adds to all these difficulties.

Adopting the dollar means renouncing an independent monetary policy and forgoing the option of responding to external shocks by devaluing the currency.

Central banks still exist in Ecuador and El Salvador, but they do not control the money supply or set interest rates.

Instead, economies have to find other ways in which to be flexible and competitive.

But in Latin America that is rarely the case.

Dollarisation encourages greater economic integration with the rest of the world because it cuts the transaction costs involved in trade.

But if goods and services are uncompetitive, it is tougher to make the most of potential opportunities.

A recent study published in Applied Economics, a peer-reviewed journal, found that adopting the dollar had failed to create any major positive trade effects for Latin America.

Strict fiscal policy becomes especially important, because countries cannot print money to cover their budget deficits.

But in all the dollarised three, deficits were sizeable last year and public debt looks worryingly high.

The imf is particularly alarmed about El Salvador’s fiscal expansion, which it deems “unsustainable”.

He might argue that by eliminating the fiscal deficit and tearing down controls, he is making Argentina’s economy sufficiently flexible to benefit from dollarisation.

And it is certainly true that Latin America has abused currency depreciation to cover up policy flaws.

But experience shows that far from being a panacea, to dollarise can create a rod for one’s own back.

0 comments:

Publicar un comentario