An equity bear market begins

Last week’s action, particularly in Japan where the Nikkei 225 Index fell 15% in less than a month and 9% of that in just two days suggests the bull is over and the bear is now in charge.

ALASDAIR MACLEOD

Bear markets surprise the vast majority of investors, who are instilled with a mixture of peer pressure, complacency, and speculation.

These conditions can continue for some time, lulling everyone into an increasingly false sense of security.

But there is lots to go wrong.

There are government debt traps that require higher not lower bond yields to fund.

Being the consequence of government budget deficits, inflation is not going away but will persist, putting a floor under central bank attempts to suppress interest rates.

And commercial bank balance sheets are highly leveraged while lending risk is increasing, typical at the top of the bank credit cycle.

Credit is the lifeblood of markets, and any restriction of bank credit is bearish.

But the most important factor is the stretched valuation of equities compared with bonds.

Typically, equities continue to rise in the early stages of a rise in bond yields.

And then a point arrives when the valuation disparity is too great to be sustained.

This disparity is now probably greater than it has ever been in history, and certainly more than twice as great as anything seen since the mid-eighties when global commercial and investment banking activities were merged, and credit activities were refocused towards purely financial activities.

I shall demonstrate this overvaluation in two stages, so that this vital point is fully understood.

The first chart shows the S&P 500 Index in red based at 100 in January 1985 (left-hand scale), and the yield on US Treasuries similarly based, but in blue (right-hand scale).

Putting both axis on a log scale facilitates the display of large data disparities.

It will be observed that the S&P Index generally rose while the yield on the 10-year Treasury fell.

And as inferred above, when bond yields began to rise in 2020 equities continued on their bullish course — initially as expected before the valuation differential tips equities into a bear market.

But the chartabove gives us little clue about how stretched equity valuations have become relative to bonds.

In order to assess the current situation, we need to invert one of the series to compare them.

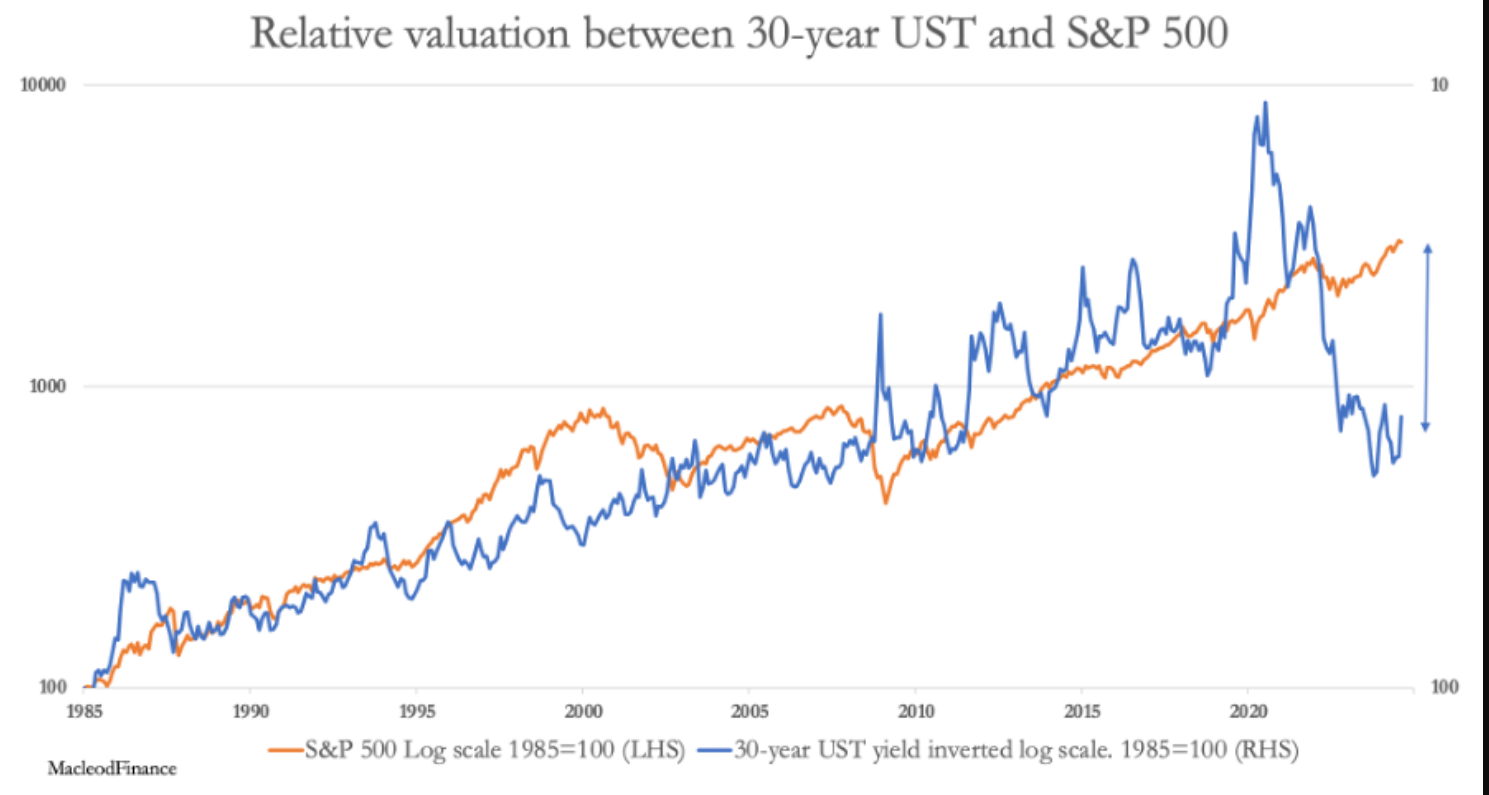

The next chart shows the bond yield inverted, and the disparity immediately becomes apparent.

It is now clear how overvalued equities have become relative to bonds, indicated by the double-arrowed line in the right-hand margin.

It is a significantly greater disparity than in early-2000, when the dot-com bubble burst.

For the two years after 2000 the valuation disparity corrected as bond yields rose and equities halved, with equities finally bottoming in February 2009.

It strongly suggests that equity markets face an even greater pull-back, particularly as inflationary conditions driven by government budget deficits continue, foreign bond holders continue to sell, and the US Government’s debt trap intensifies.

These conditions put the potential scale of the bear market into Wall Street Crash category, when the Dow fell 89% from September 1929 to mid-1932.

It consisted of three basic moves with an initial 37% decline in less than two months.

The market then recovered, retracing about half the fall, before embarking on a debilitating decline from May 1930 to the low in 1932.

In the chart below, these three moves are marked A, B, and C.

The conditions for a repeat of this pattern today can easily be envisaged.

An initial sharp fall which has just started threatens to develop into a financial crisis as collateral values leave lending banks exposed to losses, threatening to wipe out their capital.

Speculators will be forced to liquidate other assets to cover their losses, spreading the crash into other credit instruments, and other jurisdictions.

Undoubtedly, the existence of the entire financial system would be threatened both directly and from the knock-on consequences of a collapse in economic confidence.

The Fed would be forced to intervene, reducing its funds rate, resuming aggressive QE, and standing ready to rescue failing financial institutions.

Confidence would be bound to be temporarily stabilised by official actions, with a rally in equities as the investment community heaves a collective sigh of relief, and bear positions are closed leading into a technical rally.

Based on the 1929 crash model, that could steady markets into early next year, before the reality of dollars and dollar credit being continually liquidated by foreign holders for geopolitical reasons and also with an eye on a USG debt situation being made considerably worse by American authorities response to an equity market crash.

We should also bear in mind the exceptional level of foreign holdings of dollars and dollar denominated investments.

Over $14 trillion are invested in stocks alone, according to the US Treasury.

Unlike domestic US investing institutions, foreigners are not required to hold US equities if they fear losses.

Indeed, selling of US stocks is likely to be regarded as a source of funds to cover losses in their own markets

At roughly half US GDP, the overhang of $14 trillion of foreign portfolio investments in US stocks could turn out to be a crushing burden.

The current situation of gold, and therefore silver, ensures that they will be reasonably protected from a general liquidation, because their prices are increasingly set outside the western financial system.

We saw evidence of this in Friday’s trading, when a sudden decline in equities occurred at a time when bond yields fell.

In volatile trading, gold and silver rose before the fall (though Tokyo’s Nikkei had already fallen over 8%) and when the US payroll numbers were released, gold and silver were marked down heavily along with equities.

But by the close, both had recovered to be unchanged on the day, while equities closed about 2% down.

That is the background: equities are wildly overvalued relative to bond yields, more so than at any time in financial history.

If, in the coming week or two they continue to fall it could become a self-feeding crash, forcing the Fed to intervene by making as much cheap credit available as it takes to steady the ship.

But then we will be witnessing the final decline of the dollar and the dollar-based financial system.

While equities tank, gold and silver’s ascendancies will only be just starting.

0 comments:

Publicar un comentario