Gold continues to rise…

Gold’s technical chart is fulfilling its bullish promise. In this update, I estimate the dynamics which are driving the price.

ALASDAIR MACLEOD

As I’ve been pointing out ever since gold finally broke above the $2075 level, gold’s technical position became extremely bullish.

After two challenges on the $2425 level, at $2435 this time gold appears to be on its way higher.

It found support at the 55-day moving average, which many thought would not be enough, preferring to see a dip towards longer-term support.

But such is the bullish momentum that in technical terms at least, gold can go considerably higher and more overbought before a more serious correction/consolidation should be considered.

If this was an equity stock, analysts would describe the move as a re-rating.

As a rough overbought/oversold indicator, gold is approaching overbought territory.

This chart is next.

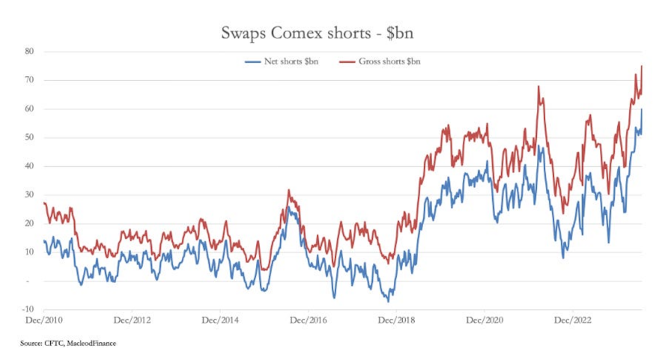

But Commitment of Traders figures show that some of this increase is not in outright bullishness but reflects an increase in spreads.

A spread is the purchase of one contract matched by the sale of another to take advantage of price disparities: in other words, neither bullish nor bearish.

Perhaps a fast-moving price is continuing to throw up spread opportunities.

Turning to the market itself, this morning’s rise in the gold price is consistent with overnight demand, presumably Chinese, being unwound in London ahead of this morning’s fix.

While the price may dip after the fix, this demand continues to leave London and Comex short of the physical upon which all paper contracts are based.

This underlying shortage is undoubtedly catching the attention of speculators.

The effect on the Swaps is making them extremely uncomfortable.

The next chart is my updated estimate of their current position, adjusted for the increase in price and open interest since the last COT figures (9 July).

Of course, some of this will be hedged into the London market through the exchange-for-physical channel, which has shown good turnover.

But that merely transfers the problem between common participants in different locations.

Given that notionally, at least, the Swaps who are mostly bullion bank trading desks are now record short in dollar-terms, an increase in speculative demand threatens to lead to a failure of one or more second-line bullion banks.

Alternatively, bank treasury departments might close down trading desks to prevent further losses, leading to short positions being bought back.

That would simply add paper fuel to the market fire.

Underlying all this is growing Chinese public demand, and doubtless increasing speculation on the Shanghai Futures Exchange, home to keen Chinese gamblers.

For now, it is a market phenomenon restricted to gold, because silver is underperforming it in recent trading sessions.

Perhaps we will look back on this move as the moment when price setting not only moved from London and New York to Shanghai, but from paper to physical.

And if the volume of paper declines relative to demand for physical, it will simply fuel extra physical demand.

0 comments:

Publicar un comentario