Why Saudi Aramco Stock Is a Tough Sell on Wall Street

The world’s biggest oil producer is trying to tempt global investors with a $12 billion share sale, but the price looks expensive

By Carol Ryan

Aramco is the Saudi government’s key tool for keeping energy prices where it wants them. PHOTO: AMR NABIL/ASSOCIATED PRESS

Aramco is the Saudi government’s key tool for keeping energy prices where it wants them. PHOTO: AMR NABIL/ASSOCIATED PRESSSaudi Aramco’s generous dividends can only go so far in making up for an overpriced initial public offering.

The Saudi Arabian national oil company will sell shares worth up to $12 billion in an offering this week.

The Saudi government, which will still own more than 80% of Aramco at the end of the sale, will use the proceeds to fund the country’s cash-hungry Vision 2030 initiatives.

Projects designed to help diversify the Saudi economy away from oil, such as futuristic desert city Neom, haven’t attracted the flood of foreign capital Riyadh expected.

When Aramco went public in December 2019, investors in New York and London mostly stayed away.

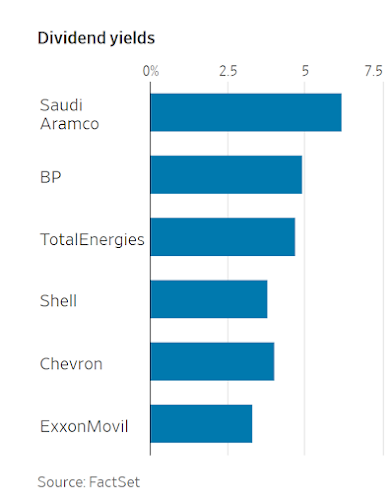

At $1.7 trillion, the price was high and they could find better value elsewhere. At the time, Shell and BP offered a 6%-plus dividend yield, compared with Aramco’s 3.85%.

Tepid demand meant plans for a dual listing on a major international exchange were abandoned.

Foreign investors ended up buying only 15% of the $29.4 billion IPO on Saudi’s domestic bourse.

A third of the offer went to local retail investors who received perks such as one bonus share for every 10 they held for at least 180 days.

Local retail shareholders will be allocated just a tenth of the latest offer.

Aramco is hoping a beefed-up dividend will be enough to lure international funds this time round.

After introducing a new performance-based payout last year, the company currently has a dividend yield of 6.2%, better than those of Chevron or Exxon Mobil.

However, Aramco still looks a lot more expensive than Western supermajors on other metrics, such as price-earnings multiples and free cash flow yields.

This valuation premium could hold back returns, just as it has since the IPO.

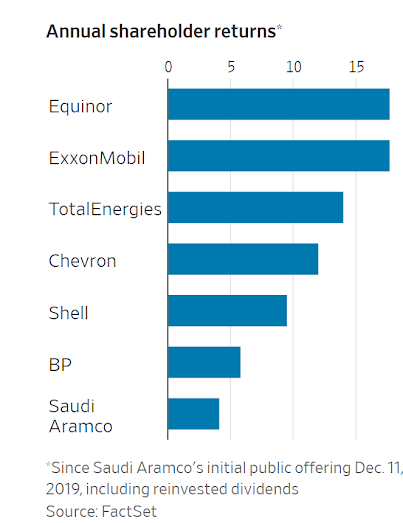

Including dividends, Aramco shares have generated annual gains of 4% since the end of 2019, compared with 18% at Exxon and 14% at TotalEnergies.

“It came to the market with a very rich valuation and is still growing into it,” says Bernstein analyst Neil Beveridge.

Aramco shareholders missed out on the share-price rallies and bumper payouts delivered by other major oil companies after Russia’s 2022 invasion of Ukraine.

Aramco’s total dividends remained flat that year at $75 billion, while Exxon Mobil doubled its distribution to shareholders, for example.

The Saudi government was still a big beneficiary of 2022’s high oil prices.

Royalties that Aramco pays to Riyadh more than doubled, as these fees increase in line with the oil price.

With a new policy in place, Aramco’s dividend should hit more than $120 billion this year.

For now, the interests of Aramco’s minority shareholders and the Saudi government seem aligned as both want more cash handed back to owners.

But Aramco’s free cash flow doesn’t cover its dividend.

While the company has net cash on its balance sheet for now, paying out more than it generates could eventually bring it up against a self-imposed debt-to-equity limit of 15%.

The increased payout may also be hard to maintain if oil prices soften.

Yesterday, the Organization of the Petroleum Exporting Countries and its allies, collectively known as OPEC+, agreed to extend its production cuts to 2025 to prevent that from happening.

With around three million barrels of oil a day of spare capacity, Aramco is the Saudi government’s key tool for keeping energy prices where it wants them.

According to the IMF, Riyadh needs oil prices to stay close to $100 a barrel to balance its budget.

The goal is proving elusive, and extending production cuts at Aramco gives market share to its rivals outside of OPEC.

This adds another layer of complexity to Aramco that investors don’t need to worry about at international oil companies such as Chevron or Shell.

The company “is basically an arm of the Saudi state and has an additional mission beyond just maximizing returns,” says Jim Krane, a fellow for energy studies at Rice University.

Aramco’s higher dividends may not attract as much foreign cash as the kingdom would like.

0 comments:

Publicar un comentario