Nvidia Is Now Competing Mostly With Itself—and AI Fatigue

New superchips will help the company keep its competitive lead, though worries about AI’s traction will linger

By Dan Gallagher

Nvidia has a very big crowd to please these days.

It managed to pull it off this time.

The chip maker that is now the world’s third most valuable company unveiled its latest artificial intelligence systems during the kickoff of its annual developers conference on Monday.

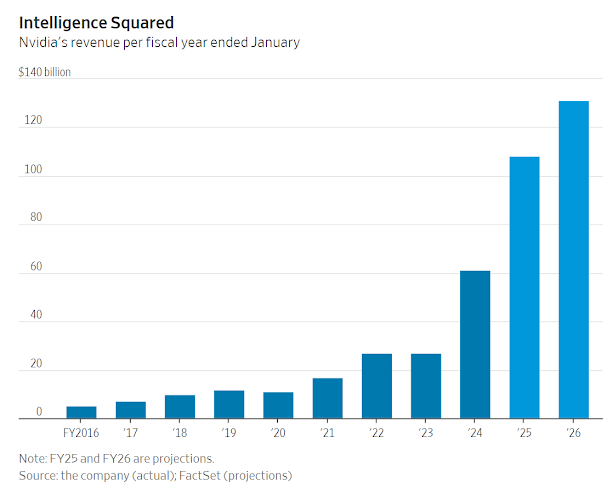

The event, known as GTC, had been held virtually since 2020, when Nvidia was generating about $11 billion in annual revenue mostly from the sale of graphics processors for videogaming PCs.

Nvidia’s business has mushroomed nearly sixfold since then, thanks to booming demand for the company’s data-center chips used to power generative AI services such as ChatGPT.

That rapid ascent has given the company and Chief Executive Officer Jensen Huang rock star status, with more than 11,000 people filling a Silicon Valley sports arena Monday to catch Huang’s keynote address.

It included the first official details of the company’s Blackwell B100 systems, which will succeed its popular H100 systems that have become the workhorse of generative AI workloads.

Even those chips are still catching up with demand.

The B100 chips offer a significant performance boost over the H100 family, especially for inferencing, which is when AI models use the data they are trained on to start generating answers.

This has been an area where Nvidia has some perceived vulnerability to competition.

But the strong performance specs of the B100 were in line with some early hints from the company, and Nvidia had already surprised investors last month when it disclosed during its fiscal fourth-quarter earnings call that about 40% of its AI revenue was coming from chips used in inferencing work.

At a conference earlier this month, Morgan Stanley analyst Joseph Moore described his reaction to that disclosure thusly: “I just about fell out of my chair.”

That left little room for Nvidia to spring any big surprises this week.

Nvidia’s stock picked up about 1% by Tuesday’s close, reversing an earlier decline following an analyst meeting that included no new financial updates.

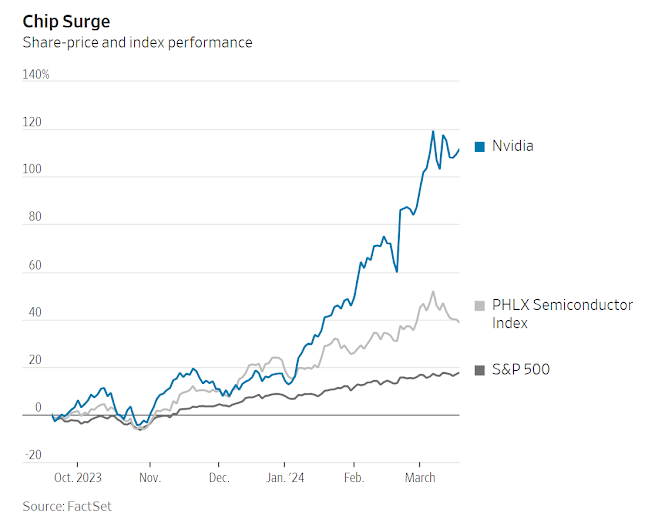

The stock has been caught up in a recent selloff that has taken the entire chip sector down a peg following a major AI-driven run.

Nvidia’s shares have slipped nearly 4% since reaching a record on March 7.

The PHLX Semiconductor Index has fallen nearly 9% over the same period.

Investors needn’t worry about Nvidia’s competitive position.

Analysts agree that the B100 systems will maintain the company’s strong lead in AI computing, even with rivals such as Advanced Micro Devices poised to pick up some sales.

Tim Arcuri of UBS said Nvidia’s new chips “will reassert its undisputed technical lead in performance,” while Vivek Arya of BofA Securities said the B100—and other new developments announced at the conference—“continues to fundamentally widen Nvidia’s competitive moat” in a note to clients.

The bigger risk for Nvidia—or at least to the incredible sales momentum it has been enjoying of late—is if the generative AI services being propagated by companies such as Microsoft, Google, Amazon, Meta Platforms and Adobe see tepid demand from consumers and business customers.

Adobe’s first-quarter report last week fell flat with investors as the results and accompanying forecast showed little uplift from the company’s new Firefly service.

The Wall Street Journal reported last month that early corporate testers of Microsoft’s Copilot are mixed on whether the new AI tools are worth their premium price.

Such a trend could ultimately cool the billions that those companies are currently dropping on Nvidia’s chips.

But even that doesn’t seem in the cards this year based on the capital-spending forecasts in the latest round of earnings reports.

It is also out of Nvidia’s hands.

What Nvidia can do is keep its strong technical edge that also allows it to maintain the pricing power that has driven its operating-profit margins to record high rates.

That in turn has made its stock’s valuation cheaper than many of its chip peers that aren’t seeing the same sort of AI sales boom.

Nvidia’s shares closed Tuesday around 38 times forward earnings—a 26% discount to memory-chip maker Micron, which is just emerging from a major sales slump and is expected to report its sixth consecutive quarter of net losses on Wednesday afternoon.

With its latest chips likely to drive another strong year ahead, even a $2 trillion Nvidia isn’t such a stretch.

0 comments:

Publicar un comentario