How China’s slowdown is deepening Hong Kong’s ‘existential crisis’

The territory’s growing reliance on China has turned into a distinctly mixed blessing — with questions of how long hallmarks of its own system can endure

Chan Ho-him in Hong Kong

Rosanne Wong should be enjoying a year of recovery at her four cigar shops in Hong Kong, after three years of Covid restrictions were finally lifted at the start of the year and traditionally high spending mainland Chinese tourists returned.

Hand-rolled Cuban cigars have been in high demand — prices for some of the most-sought after types have more than doubled over the past three years.

Instead, in what should have been peak season during October, coinciding with China’s Golden Week national holiday, sales were down roughly 30 per cent compared with the beginning of the year.

Wong says big-spending patrons, many of whom are mainland Chinese working in Hong Kong’s finance industry, were “willing and able to afford high quality cigars” and used to spend up to HK$100,000 ($12,800) each month in the past.

“They are less willing to splash money today,” she says.

Her experience illustrates how the territory’s growing reliance on China has turned into a distinctly mixed blessing.

It now finds itself hitched to a slowing mainland economy.

Additionally, competition from Chinese capital markets and a political crackdown by Beijing have left Hong Kong facing “an existential crisis as a major international financial centre,” according to Eswar Prasad, an economist and professor of trade policy at Cornell University and senior fellow at the Brookings Institution.

For decades, the special administrative region benefited as the mainland’s growth raced ahead.

Its economy almost doubled between its return to China in 1997 and the onset of the pandemic in 2020.

But over the past three years it has been battered — by the stringent zero-Covid policy adopted by Chinese president Xi Jinping’s government, by a sweeping national security law imposed in the wake of protests, and then by a slowdown in China’s post-Covid economy that has dragged down consumption and investment in Hong Kong.

Expectations of an economic bounce after Covid have been confounded.

The recovery has instead been so anaemic that Hong Kong’s finance minister, Paul Chan, recently cut the city’s annual economic growth forecast to just over 3 per cent, down from up to 5.5 per cent projected in the beginning of the year.

Earlier in December, Moody’s downgraded the outlook on Hong Kong’s sovereign credit rating to negative, a day after a similar downgrade for China’s outlook.

Queues outside a Louis Vuitton store at Harbour City shopping mall in June. In the past three years, Hong Kong’s economy has been battered © Lam Yik/Bloomberg

Queues outside a Louis Vuitton store at Harbour City shopping mall in June. In the past three years, Hong Kong’s economy has been battered © Lam Yik/BloombergThe rating agency said the move reflected its “assessment of tight political, institutional, economic and financial linkages between Hong Kong and [mainland China]”, adding that the negative outlook on China’s rating “therefore implies a negative outlook on Hong Kong’s rating.”

The increasing extent of Beijing’s political interference in a city that is supposed to enjoy a degree of political autonomy is also raising concerns among the multinational corporations that view it as a gateway to China.

They question how long the hallmarks of Hong Kong’s system — low taxes, a transparent legal system, independent judiciary and dollar-pegged currency — can endure.

Some companies, wary of Beijing’s growing control and emphasis on security over economic growth, are already relocating to other financial centres such as Singapore.

More than 140,000 people out of a population of 7.5mn left the territory in the two years up to 2022.

Hong Kong is now “firmly under Beijing’s thumb”, says Prasad, warning that “[Beijing’s] imposition of its limited version of the rule of law that features judicial subservience to the government could erode investors’ trust.”

Hong Kong has long traded on its position as an entrepot for China.

Multinational banks, law firms and other businesses often selected the territory as the hub for their Asia regional operations.

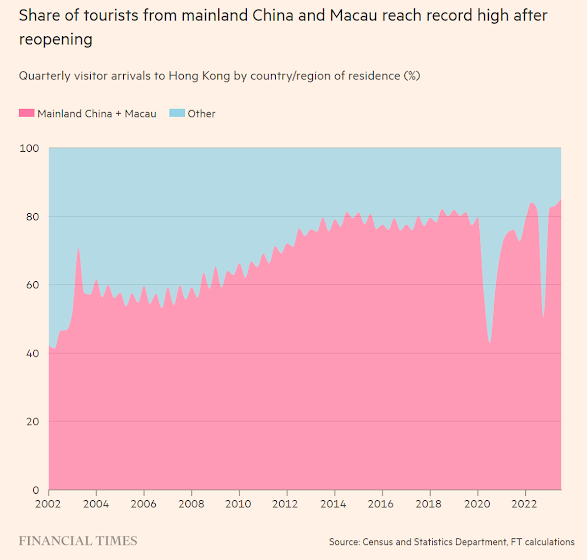

But since the handover, it has come to rely more and more on the mainland for its tourism, trade, stock market, property investment and financial sectors.

The new security law imposed by Beijing in 2020 — which silenced dissent, outlawed mass demonstrations, forced the shutdown of pro-democracy media outlets and sent opposition activists either to jail or into exile — caused real alarm in international business circles.

Journalists, businessmen and lawyers have been arrested under security charges.

The judges that preside over such cases are handpicked by Hong Kong’s top officials and there is a 100 per cent conviction rate.

Local authorities have increasingly adopted tactics similar to those of mainland China against dissidents and others, including televised “confessions” and forced “repentance” letters.

The appointment of John Lee, a former career policeman and security minister, as the city’s leader last year sent another clear signal: national security continues to trump economic and business interests.

John Lee enters the Legislative Council meeting room to deliver a policy address. Hong Kong’s leader told a global bankers’ conference last month that ‘Hong Kong means prosperity’ © Hong Kong Legislative Council/Pool/AP

John Lee enters the Legislative Council meeting room to deliver a policy address. Hong Kong’s leader told a global bankers’ conference last month that ‘Hong Kong means prosperity’ © Hong Kong Legislative Council/Pool/APEven as Hong Kong was stepping up efforts to woo back foreign investors, Lee in July denounced eight self-exiled activists as “street rats” and offered a total bounty of $1mn for information leading to their arrest.

Last week, national security authorities announced new bounties for five more activists overseas.

Faced with what a range of lawyers, bankers, professors and economists who spoke to the Financial Times describe as a “new reality”, foreign businesses and expats have continued to leave the city, their places taken by mainland firms and citizens.

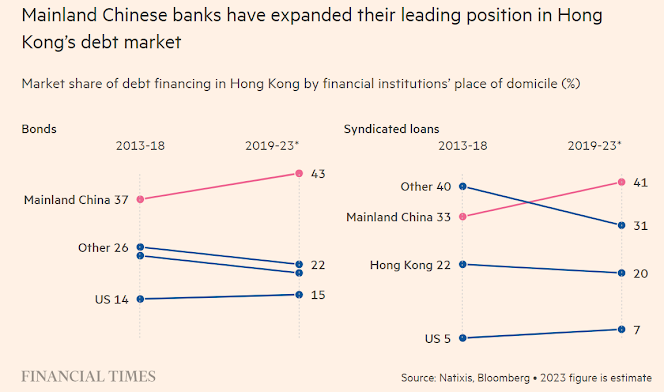

Take banking.

The total number of licensed banks in the city dropped to 155 last year from 164 in 2019, according to the Hong Kong Monetary Authority.

But within that total, the number of mainland Chinese-controlled banks rose while European-owned entities declined.

The share of customer deposits at mainland Chinese banks has risen over the past decade, while European banks’ share dipped.

Gary Ng, a senior economist at French bank Natixis, says that growing numbers of foreign investors find it more difficult to look at Hong Kong’s status separately from that of mainland China.

Another executive, the head of a global bank’s Hong Kong arm, says that “if you’re an American investment bank that had been hoping to expand in China . . . geopolitical uncertainties [have indeed been] making it more difficult” to do so.

The number of firms with regional headquarters in Hong Kong fell to 1,411 last year from 1,541 in 2019, while the total number of employees in these companies dropped more than 30 per cent during the period.

National Australia Bank in August said it would be shutting its Hong Kong office.

That followed the exit of Westpac, another Australian bank, in June.

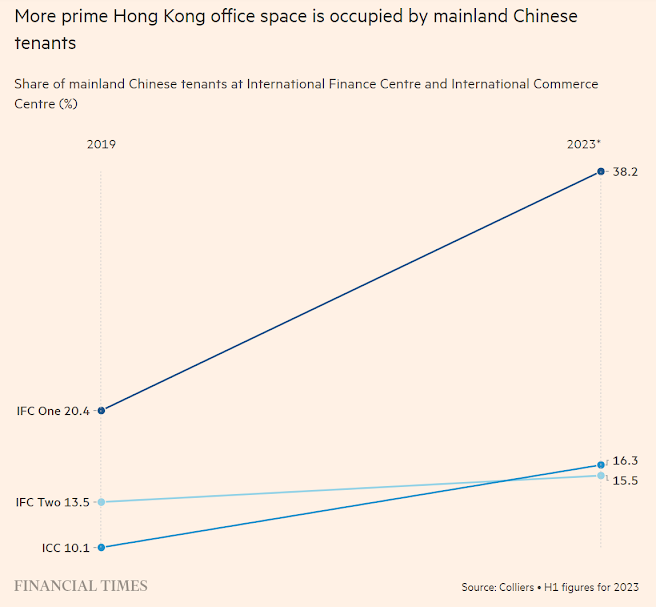

Meanwhile, the proportion of Chinese tenants at One International Finance Centre, one of the city’s most sought-after office buildings, has almost doubled to 38 per cent this year from 20 per cent in 2019, according to commercial real estate agency Colliers.

Another senior commercial real estate agent says she expects that in 10 years’ time, the proportion of mainland Chinese tenants at prime office buildings in central business districts “could reach as much as 40 or even 50 per cent”, up from the current average of around 20 per cent.

Singapore has been marketing itself as safe-haven alternative to Hong Kong.

The south-east Asian city state reopened following Covid-19 lockdowns months earlier and is perceived as being less exposed to strained US-China relations.

But several financiers told the FT that Hong Kong’s economic fundamentals remain compelling: at $4tn, its equities market is more than six times the size of Singapore’s.

It also has a far bigger wealth pool, with three times as many individuals with a net worth of at least $30mn.

Since borders reopened, Beijing’s liaison office, the central government’s official representation in Hong Kong, has been “more actively” approaching current and former senior executives from major mainland Chinese companies to encourage them to invest their wealth and expand their business footprint, according to people familiar with the matter.

As Hong Kong increasingly caters for the growing demand from mainland Chinese clients, the number of Mandarin-speaking bankers, lawyers and consultants has been on the rise.

“When our clients look for corporate lawyers . . . they rarely look for foreign talent because corporate is an area where Chinese is really required,” says one senior executive at one specialist recruitment firm.

Areas of the territory’s financial regulation are also edging closer to Beijing.

From August, following a similar move by China’s securities watchdog, China-incorporated companies listing on Hong Kong’s stock exchange no longer need to declare China-related risks in their applications.

One banker says trading floors in Hong Kong contain noticeably more locals and mainland Chinese today compared with 10 years ago, when there were far more Britons, Americans and Europeans.

As Hong Kong’s wider relevance to Beijing diminishes, and mainland cities such as Shenzhen grow faster, questions linger over how much leverage the territory can exert upon China’s policymakers © Dale De La Rey/AFP/Getty Images

As Hong Kong’s wider relevance to Beijing diminishes, and mainland cities such as Shenzhen grow faster, questions linger over how much leverage the territory can exert upon China’s policymakers © Dale De La Rey/AFP/Getty ImagesAhead of the handover, Beijing promised that Hong Kong’s capitalist system and style of governance as well as its independent judiciary would remain unchanged until at least 2047.

The “one country, two systems” pledge made by China’s former paramount leader Deng Xiaoping is spelt out in the city’s Basic Law, its mini-constitution.

But growing numbers question Beijing’s commitment to it, following a 2021 overhaul of the city’s political regime that included a “patriots ruling Hong Kong” edict banning virtually all political opposition.

Patriotic judges were installed to handle security-related cases with foreign lawyers barred from representing defendants.

“An area that people are starting to look at — and probably be worried about — is the legal system in the long run,” says one senior corporate lawyer from an international law firm.

The lawyer points out that a junior studying law now has less than 24 years until 2047. “At that stage [they] will be at the prime of their practice.

They may be partners in law firms — but what is Hong Kong law going to be in 2047? Are we still going to have the two systems?”

Bankers have started to question how much longer Hong Kong can justify keeping its low taxes — the top rate of income tax is just 17 per cent — when counterparts on the mainland are paying much more.

Uncertainties also surround the continuation of the currency peg established in 1983, under which the Hong Kong dollar fluctuates within a narrow band against its US counterpart.

Some have argued that Hong Kong should peg to the renminbi instead, though both the financial secretary and the head of the Hong Kong Monetary Authority, the territory’s de facto central bank, have over the past year defended the peg and declared it is here to stay.

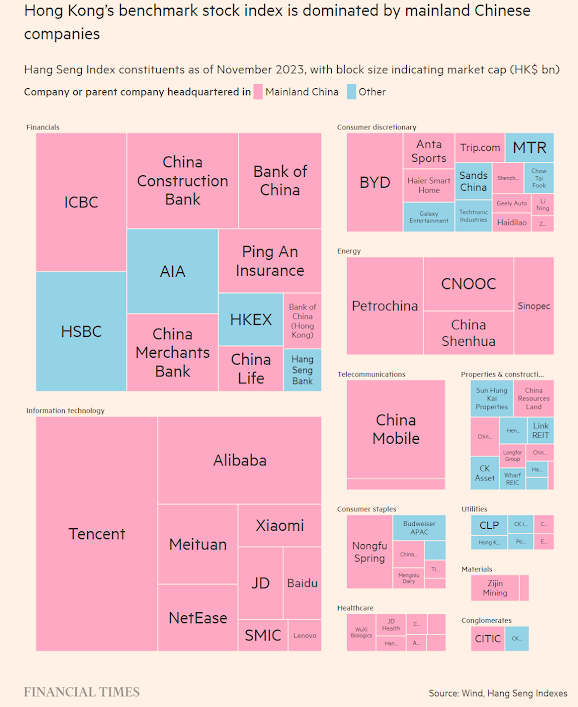

As China’s economy has slowed and tensions with the US have risen, Hong Kong’s benchmark stock index has fallen 13 per cent over the past year — by the end of November, India’s National Stock Exchange was bigger in terms of market capitalisation.

But top officials appear unworried; an enthusiastic John Lee told a global bankers’ conference last month that “Hong Kong means prosperity”.

Finance luminaries such as UBS chair Colm Kelleher and Apollo Global Management’s co-founder and chief executive Marc Rowan were also among the speakers.

In another upbeat speech at a summit organised by Saudi Arabia’s Future Investment Initiative Institute this month, Lee insisted the city was still very much “the world’s pre-eminent gateway . . . and a ‘super value-adder’ for economies, cultures and peoples, east and west”.

But as expats drift away, they are being replaced with mainland Chinese citizens.

In the first half of 2023, Hong Kong approved more than 25,000 applications under a new talent scheme with over 94 per cent of them originating from mainland China.

In contrast, approvals under an existing general employment scheme focusing on overseas talent fell 42 per cent when compared with the first half of 2019, to 11,432.

The influx of mainland Chinese to Hong Kong has relieved some of the pressure on the city’s economy from low birth rates, a falling student population and emigration.

But it has added to the sense that the territory is losing its unique identity.

Hong Kong will “converge to the Chinese system step by step,” says Yasheng Huang, a global economics and management professor of the Massachusetts Institute of Technology.

Large scale development projects in the city reflect this. Over the next two decades or so, the Northern Metropolis master plan envisages half a million new flats around a “technopole” aimed at integrating Hong Kong more closely with Shenzhen, the closest major Chinese city.

“This substitution effect would then create demands for Chinese rules, regulations, and business methods, and economic practices,” Huang adds.

“The subsequent changes could very well come from bottom-up demands of an increasingly Chinese business community in Hong Kong . . .

Once the general principle of ‘one country two systems’ is undermined, the two systems at multiple levels will start to converge.”

But some, including those from Hong Kong’s pro-Beijing political groups, disagree.

Gary Zhang, a first-term lawmaker elected under the “patriots” electoral regime, says that “if Hong Kong becomes just another mainland Chinese city it would become rather pointless”.

Zhang, who has worked as an engineer and manager in the city since the late 2000s after graduating from high school in Shenzhen, thinks that while China “could survive” without Hong Kong, the territory’s unique system “is definitely an advantage” to Beijing in the long run.

Protesters march through Hong Kong’s streets in protest against the extradition bill, in 2019. Many feared the erosion of the city’s legal system © Kin Cheung/AP

Protesters march through Hong Kong’s streets in protest against the extradition bill, in 2019. Many feared the erosion of the city’s legal system © Kin Cheung/APMany analysts share Zhang’s belief that Hong Kong will still prove useful to Beijing as a testing ground for pioneer projects, such as China’s push for greater offshore use of the renminbi, as a conduit for incoming foreign capital and for Chinese firms to secure overseas financing.

During a rare visit to Hong Kong to mark the anniversary of the 1997 handover, Xi himself declared that the territory should maintain its capitalist system “with a high level of autonomy”.

But as the city’s wider relevance to Beijing diminishes — it accounted for 18 per cent of China’s economy in 1997 but only around 2 per cent now — and as mainland cities such as Shenzhen grow faster, questions linger over how much leverage the territory can exert upon China’s policymakers.

While it has been exploring markets in the Middle East and south-east Asia, China will remain the economy upon which Hong Kong most depends for trade, investment and visitors.

Natixis’s Ng says the city currently relies on the mainland for roughly 40 per cent of its economy but expects that could grow to up to 50 or 60 per cent over the next decade.

For many, there is little doubt about where that leaves the former British colony.

“There is no way that China will converge to Hong Kong,” concludes Huang. “It will have to be the other way around.”

Additional reporting by Kaye Wiggins and William Langley in Hong Kong

0 comments:

Publicar un comentario