The Fed Alone Can’t Make Gold Sparkle in 2024

Though potential interest-rate cuts are a positive for the precious metal, this year’s experience shows that many other factors are at play

By Jon Sindreu

On the fifth day of Christmas my true love sent to me: five gold rings, which turned out to be much more expensive than a year ago.

The key investment question is whether they will be worth even more by the time next Christmas comes around.

New York gold futures traded around $2077 an ounce Friday, meaning that the precious metal is up 14% year to date and is set to finish the year near the record close of $2081.90 reached Wednesday.

This snaps a two-year losing streak.

Many Wall Street analysts believe that, despite big gains in 2023, the stage is set for gold to keep glistening next year.

Central banks across the developed world are expected to start lowering borrowing costs in the first half of 2024, reversing part of their aggressive policy tightening since 2022.

Federal Reserve Chairman Jerome Powell seems particularly likely to pivot soon, given that inflation in the U.S. has cooled fast.

Derivatives markets price in a 79% chance of rates there being at least 1½ percentage points lower in a year’s time.

In theory, this should be a big boost for the price of gold and other precious metals such as silver and platinum.

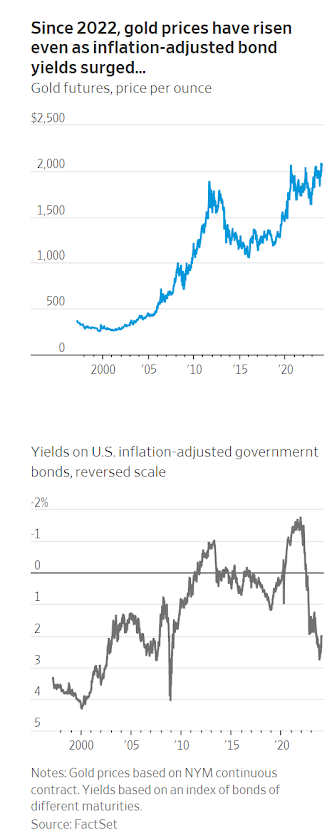

Interest rates are the main driver of the yield on government bonds, which in turn tend to be strongly correlated with gold—especially inflation-linked paper.

It makes sense: Both serve investors as a risk-free store of value and a hedge against inflation.

But gold offers no coupon, and so it becomes less attractive the higher bond yields rise, and vice versa.

However, the past couple of years offer a cautionary tale against overinterpreting these relationships.

Over this period, inflation-linked yields have jumped from minus 1.5% to roughly 1.6%.

The price of gold would have been expected to tank, not surge.

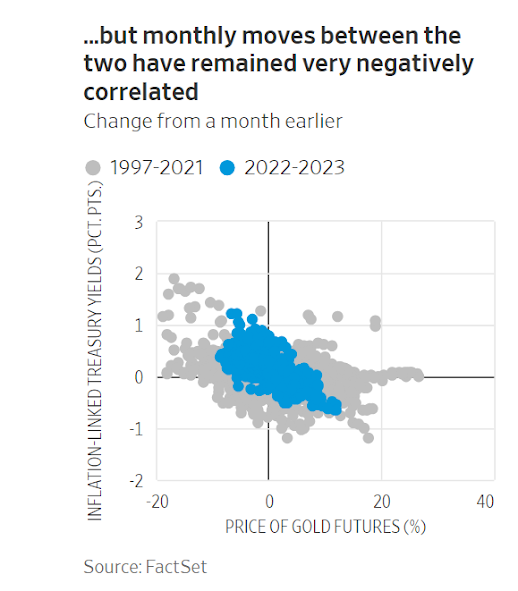

Investors may be tempted to conclude that the negative correlation between gold prices and bond yields has simply broken down.

Yet it is tighter than ever when looking at monthly moves.

How is this possible?

Because when yields have shot upward, gold prices have fallen by much less.

Conversely, drops in yields have translated into amplified gold rallies, especially around events that worried investors, such as the collapse of Silicon Valley Bank in March and the start of the Israel-Hamas war in October.

Something similar has happened to the traditional inverse relationship between moves in gold and the U.S. dollar.

Another issue is that, as the massive bond rally of the past two months suggests, much of the fall in rates in 2024 has already been priced in.

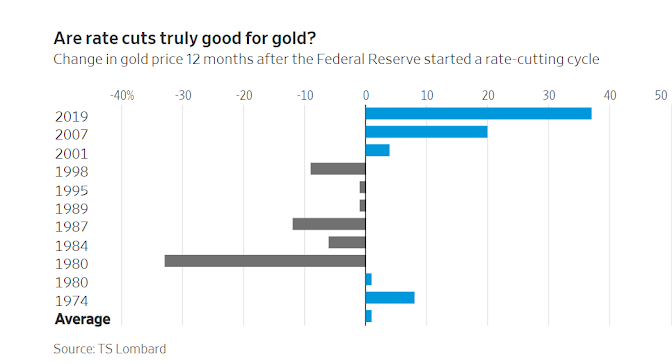

An analysis of the Fed’s loosening cycles since the 1970s done by Skylar Montgomery, macro-strategy director at TS Lombard, shows that gold prices have on average risen a bit in the 12 months after rates started coming down, but not always.

In fact, they tended to fall quite significantly in the 1980s.

There are clear parallels between then and recent times that suggest gold may be overbought, including high inflation and disrupted supply chains.

Rates were also about to come down from very elevated levels, while geopolitical tensions—in that case between the U.S. and the Soviet Union—ratcheted up.

This all pushed up the price of gold to a peak in January 1980. Ominously, a slow deflation followed.

To be sure, gold may have other strengths this time around.

Countries with a cultural affinity for the metal, such as India, are growing nicely.

Meanwhile, a slowdown in mining has constrained supply.

And central banks themselves have emerged as big buyers in their attempts to diversify reserves.

Ultimately, though, the valuation of a shiny metal with scant industrial demand is anyone’s guess.

Just as hawkish monetary policy wasn’t enough to spoil the party for gold bugs, there is no guarantee that reversing it will make their year.

0 comments:

Publicar un comentario