Inflation, Disinflation and Vibeflation

By Paul Krugman

A photo illustration in which a sunglasses-sporting man on a floating pool donut relaxes in a half-full glass of water. / Credit...Illustration by Sam Whitney/The New York Times; images by Klaus Vedfelt and Dragon Claws/Getty Images

A photo illustration in which a sunglasses-sporting man on a floating pool donut relaxes in a half-full glass of water. / Credit...Illustration by Sam Whitney/The New York Times; images by Klaus Vedfelt and Dragon Claws/Getty ImagesOver the past six months, the personal consumption expenditure deflator excluding food and energy — I know that’s a mouthful, but it’s the Federal Reserve’s preferred measure of underlying inflation — has risen at an annual rate of only 2.5 percent, down from 5.7 percent in March 2022.

The Fed’s inflation target is 2 percent, so we’re not quite there yet.

And you shouldn’t expect the Fed to declare victory any time soon.

As I can tell you from personal experience, anyone suggesting that inflation is more or less under control can expect an avalanche of hate mail and hostile commentary on social media.

In fact, I believe that the vehemence with which some Americans insist that inflation is still running wild distorts coverage in conventional media, too, because journalists are deterred from saying anything positive.

And the Fed has to be especially careful, because it would lose credibility if inflation went back up after sounding too optimistic.

The truth, however, is that inflation is looking very much like yesterday’s problem.

But wait — don’t real people have to buy food and energy?

Well, there are good reasons for policymakers to look at “core” measures excluding components that jump around a lot, but in case you’re interested, prices including food and energy have risen at an annual rate of … 2.5 percent, the same as core inflation.

The more familiar Consumer Price Index is rising a bit faster, by 3 percent, but that’s entirely because it puts a higher weight on housing, which at this point is very much a lagging indicator.

What’s remarkable isn’t just the fact that we’ve made so much progress against inflation, but also the fact that this progress has seemed to come without any visible cost.

So far, this has been “immaculate disinflation,” requiring neither a recession nor a large rise in unemployment.

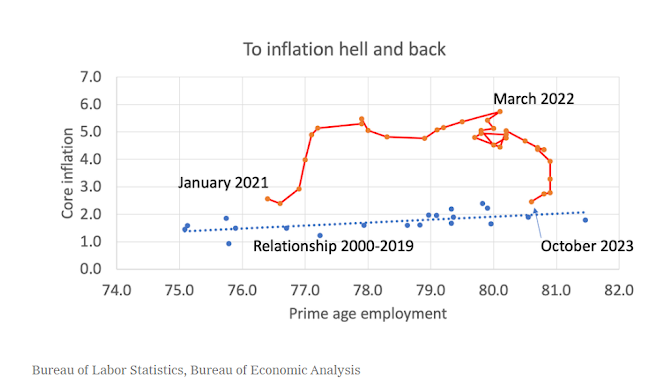

Here’s a chart I find helpful for telling the story of inflation in recent years.

The horizontal axis shows the fraction of adults between 25 and 54 who are employed, an indicator that is closely correlated with the unemployment rate but has seemed to be a bit better at measuring how “hot” the labor market is running.

The vertical axis shows core inflation:

The blue dots at the bottom are annual numbers from 2000 to 2019, while the red line above shows the path since January 2021.

Prepandemic, there was on average a modest positive relationship between employment and inflation, shown by the dotted line.

But inflation went far higher than this relationship would have led you to expect, then rapidly came down without any significant loss in jobs.

So what explains this history, and how does it compare with economists’ predictions?

There were some big disagreements among economists here. Almost everyone, I think, was surprised by how easily we reduced inflation. But some were more surprised than others.

Here’s a schematic picture with three arrows starting from the high inflation, fairly high employment position we were in midway through 2022:

The curve labeled “LS” shows the very pessimistic view held by economists who believed that we would need to go through a period of large job losses and very high unemployment to get inflation down, the way we did after the 1970s.

Yes, L.S. stands for Larry Summers, the most prominent advocate of that view, although he had plenty of company.

The arrow labeled “PK” shows the much more optimistic — but as it turned out, insufficiently optimistic — view held by economists who believed that getting inflation down would have some cost in terms of unemployment, but nothing like the stagflation of the 1970s and 1980s.

P.K. stands for the obvious: In August 2022 I put out a newsletter explaining why I thought the analogy with the aftermath of the 1970s was all wrong.

I was, in fact, baffled by the extreme pessimism I was hearing.

More on that later.

But I didn’t think disinflation would be painless.

I believed that the U.S. economy was overheated, with demand exceeding supply, and expected that correcting this imbalance would involve some pain.

“Getting inflation down,” I wrote, “requires cooling the economy down, but not putting it through an extended slump.”

And who’s R.W.?

That’s the real world, where getting inflation down didn’t require any job losses at all.

How was that possible?

Demand may have exceeded supply in 2022, but the gap appears to have been closed not by reducing demand but by increasing supply, as lingering disruptions from the pandemic were resolved.

I think those of us who weren’t quite optimistic enough can be forgiven for not seeing this coming, although I would say that, wouldn’t I?

And I did believe that the Fed was justified in raising interest rates given what we knew at the time, although I’m quite worried now that the Fed has overdone it and should start cutting soon.

But where did the extreme pessimism of some of my colleagues come from?

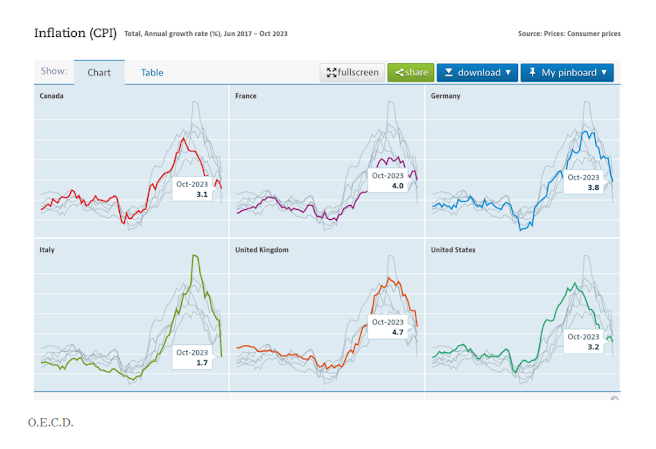

Several economists had warned that the American Rescue Plan, the large spending bill passed early in the Biden administration, would be inflationary, warnings that appeared to be vindicated by the inflation surge of 2021-22. In retrospect, these economists may have been right for the wrong reasons, since inflation eventually surged, not only in America but almost everywhere:

This suggests that inflation may have had less to do with overspending than it did with pandemic-related disruptions; see the article by Claudia Sahm in “Quick Hits” below.

But my big question is why so many economists predicted that the rapid initial rise in inflation would be followed by protracted stagflation.

The thing is, we have a standard story about why ’70s inflation was so hard to end, which relies on the way persistent inflation had become entrenched in expectations.

But this clearly wasn’t the case in 2022. So while predictions of inflation in 2021 more or less reflected textbook macroeconomics, predicting stagflation after 2022 meant throwing out the textbook in favor of novel arguments for pessimism.

Furthermore, what struck me in 2022 was that the arguments that leading pessimists were making for persistent high inflation had no logical connection to the arguments they had made for a surge in inflation back in 2021.

They were predicting the same thing but for completely different reasons.

There was nothing linking the inflationist views of 2022 to those of 2021 except a shared pessimistic vibe.

And vibes are a poor basis for economic analysis.

Indeed, vibe-based predictions of stagflation — vibeflation? — turn out to have been completely, you might say epically, wrong.

0 comments:

Publicar un comentario