American Borrowers Are Getting Closer to Maxing Out

Credit-card utilization and delinquency rates are on the rise

By Telis Demos

Some people are starting to consume more of their available credit from month to month. PHOTO: ANGUS MORDANT/BLOOMBERG NEWS

Some people are starting to consume more of their available credit from month to month. PHOTO: ANGUS MORDANT/BLOOMBERG NEWSA happy holiday shopping season might not end up being an especially cheery time for lenders.

Card loans are still growing, on average rising 1.6% in October over September across five big U.S. card lenders, versus a seasonally typical 0.7% increase, according to tracking of the latest monthly data by analysts at Goldman Sachs.

The trend suggests that consumers still are willing and able to use their cards, portending well for retailers.

U.S. retail sales slowed in October, but by less than feared, and were still at an overall solid level.

Some retail stocks have jumped recently on hopes for holiday shopping.

But as far as people paying back those loans, the data so far is less compelling.

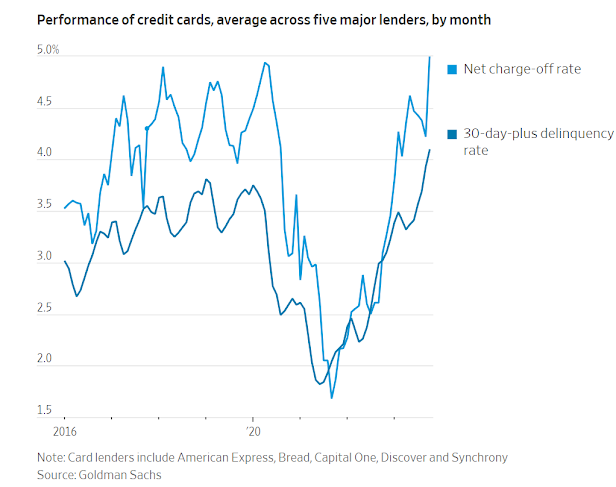

The average rate of 30-day-plus delinquency across the five big lenders jumped 0.16 percentage point from September to October, above the typical seasonal jump of 0.06 point, according to Goldman’s tracking.

Net charge-offs jumped 0.77 point on average, compared with a 0.18-point typical rise.

What all of this highlights is that some Americans’ spending habits might not be sustainable, at least when it comes to their cards.

Some people might be starting to consume more of their available credit from month to month—and could hit the wall once those lines are exhausted.

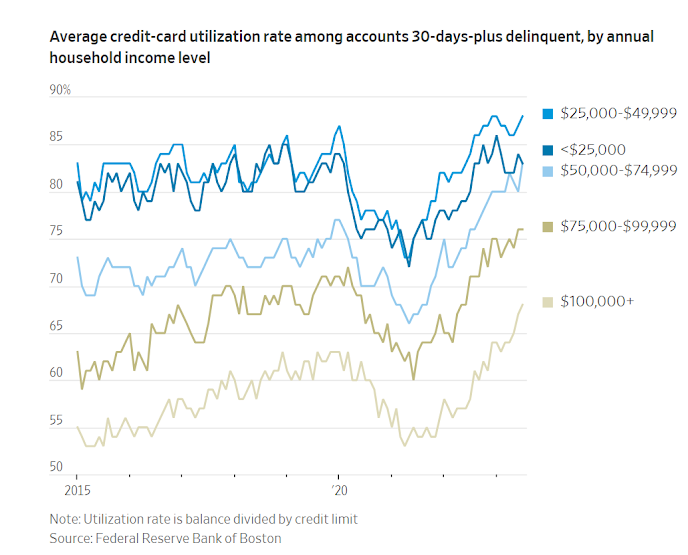

A recent note published by the Federal Reserve Bank of Boston found that as of July, consumers with annual household incomes of less than $50,000 whose accounts were delinquent were on average utilizing 80 to 90 percent of their available credit.

This leaves “those consumers with a very small amount of credit left on their accounts to cushion against a deterioration of their financial situation,” according to the paper.

Across all cardholder income groups as of July, average utilization rates—the ratio of outstanding card account balance to the account’s credit limit—were above February 2020 levels.

Keep in mind, too, that many banks are ratcheting back the credit they are willing to offer.

The Fed’s latest Senior Loan Officer Opinion Survey for the third quarter found “significant net shares of banks reported tightening lending standards for credit card and other consumer loans.”

The Boston Fed review noted that the average card credit limit, adjusted for inflation, was below its level in early 2020.

Of course, many consumers still retain savings cushions, which will help support spending.

But one factor threatening to eat away at that buffer could be eventual paydowns of lingering debts.

Notably, the rate at which card companies have collected on charged-off loans has recently been below historical norms.

Goldman’s tracking showed that as of the third quarter, five of the big card lenders on average had recovered about 18% of their gross charge-offs, versus a roughly 23% 10-year norm.

It isn’t that the lenders are being generous.

Rather, because delinquencies have accelerated sharply, card lenders are just starting to catch up.

So some consumers might be facing stepped-up collections just as their student-loan payments are resuming.

The silver lining from a macroeconomic perspective is that challenges could be fairly concentrated within certain subsets of consumers, such as those with lower incomes and student-loan debts.

American Express, which tends to have wealthier and more creditworthy borrowers, reported a 30-day-plus delinquency rate as of October of 1.3%, versus over 4% on average across the five lenders, according to Goldman’s tracking.

The strong job market also helps ease pressure—though any change there could expose some households.

Beyond sorting loans by borrower income, the timing of loans could also be important.

In particular loans made over the prior couple of years could prove more dicey, as some consumers’ credit profiles were bolstered by the pandemic stimulus and recovery.

“We’re getting closer to the peak of this massive 2022 vintage of credit, which was a period when several underwriters apparently loosened standards,” says Goldman analyst Ryan Nash.

All of which implies that a bottom for consumer credit is potentially still ahead of us.

S&P 500 consumer-finance firms are trading at roughly 10 times forward earnings versus a 10-year average closer to 12, according to FactSet.

But investors should be wary about jumping into these stocks simply because consumers are acting all jolly.

0 comments:

Publicar un comentario