Covid-19 vaccine winners suffer reversal of fortune

Companies have yet to provide investors with convincing post-pandemic strategies

Hannah Kuchler in London

The Covid vaccine market is dogged by uncertainty owing to unpredictable demand © FT montage/Eyepix Group/Future Publishing/Getty Images

The Covid vaccine market is dogged by uncertainty owing to unpredictable demand © FT montage/Eyepix Group/Future Publishing/Getty ImagesAt the height of the pandemic, investors clamoured to buy vaccine makers, the closest thing to a sure bet.

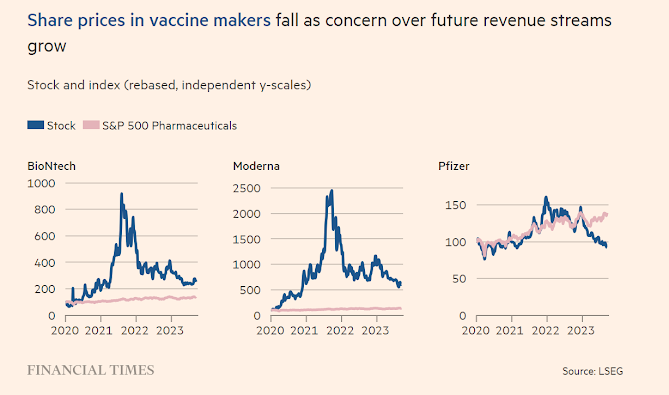

But the fall in coronavirus infections has meant a reversal in fortunes for these Covid-19 winners, with the shares sliding on sales uncertainty and questions surrounding their future growth.

Shares in Pfizer, which developed a vaccine and an antiviral drug, have plummeted 46 per cent from their peak in late 2021, while its German vaccine partner BioNTech is down 75 per cent and rival Moderna has plunged 79 per cent.

Less successful vaccine makers have fallen back even more significantly: shares in Novavax, whose Covid shot has sold far fewer than the messenger RNA jabs, have fallen 97 per cent since early 2021.

Evan Seigerman, an analyst at BMO Capital Markets, said investors who drove up these stocks in a “sugar-high rush” were now “mentally over the pandemic”.

“In 2020, interest rates were zero, everyone had extra cash because they weren’t spending it on going out and had the fiscal stimulus, so what are you going to do with your money?

Invest it in the stock market,” he said.

With the boom in their shares now over, companies have yet to provide a convincing vision of life after the pandemic.

The Covid vaccine market is dogged by uncertainty owing to unpredictable demand, while the companies are spending their windfalls on ambitious plans that will take years to come to fruition.

Pfizer, which has the bestselling Covid jab, is forecasting a 64 per cent drop in vaccine sales this year and a 58 per cent fall in sales of the antiviral Paxlovid compared with 2022.

Pfizer’s chief executive Albert Bourla said on the company’s most recent earnings call that it would have much more clarity and certainty about the future of its Covid products by the end of the year.

“We are acutely aware that all these uncertainties are making it difficult to project the future revenues of Pfizer — and are also affecting our stock price,” he said.

Michael Leuchten, an analyst at UBS, said that even during the pandemic, many experts had predicted that the vaccines would not present a secure annual revenue scheme.

“To anyone who ever looked at a pandemic it was very obvious that was not going to happen,” he said.

Future sales for Pfizer will depend on the wild card of new variants that evade previous protection.

Factors that need to be considered include the number of people suffering from vaccine fatigue and demand for Paxlovid beyond that of the US government when the drugmaker starts selling it commercially in the country.

Moderna and BioNTech are also hoping winter 2023 in the northern hemisphere would provide more certainty on what a “normal” Covid jab market would look like.

Moderna’s president Stephen Hoge said the company expected $6bn to $8bn in sales of its Covid vaccine this year and did not know if that would be repeated or be slightly lower in future years.

“It really depends upon what happens with vaccine uptake in the fall,” he said.

How investors assess the future of companies such as Moderna and BioNTech rests on their view of the potential of mRNA, which was first used in the pandemic to rapidly produce adaptable Covid vaccines but is also being trialled in cancer treatments.

Pfizer’s Covid pill Paxlovid is tested in Freiburg, Germany. The company forecasts a 58% drop in sales of the drug this year © Pfizer via Reuters

Pfizer’s Covid pill Paxlovid is tested in Freiburg, Germany. The company forecasts a 58% drop in sales of the drug this year © Pfizer via ReutersInitial high efficacy rates of the shots excited some investors and boosted hopes that mRNA would be successful in other big vaccine markets, from improving the efficacy of flu vaccines to tackling tough targets such as HIV.

After disappointing early results from Moderna’s flu programme, trials from a tweaked flu jab looked more positive.

However, shareholders are now more aware that mRNA is not a holy grail.

Gareth Powell, head of healthcare at specialist fund manager Polar Capital, said mRNA was following previous platforms such as antibodies, in which investors would get excited about developers initially using the technology, but the companies would be quickly followed by others.

The other big vaccine makers, including Sanofi and GSK, are now working on mRNA.

“They were deemed to have these unique technology platforms, but it becomes more about not the platforms itself but what they develop in their pipelines,” he said.

BioNTech may face an even larger challenge.

The company specialises in oncology, but its only approved product is in infectious diseases.

The German biotech group wants to create personalised cancer treatments using mRNA, along with other technologies, but the vast majority of its programmes are still in early-stage trials.

The windfall from Covid vaccines gives the company the money to back research for many jabs.

But investors have also been nervous about how much the company has been spending.

Last month the company cut its forecasts for full-year research and development expenses by €400mn to try to “increase cost consciousness”.

“I think that’s smart. If you have billions coming in, you don’t want to become a cash-burning biotech,” said Suzanne van Voorthuizen, an analyst at Van Lanschot Kempen.

She said if it controlled costs, the $27bn market capitalisation was quite attractive, given it had more than €17bn in cash and cash equivalents.

Ryan Richardson, chief strategy officer at BioNTech, said the company was focused on the mid-to-long term and that most of the shareholders were long-term investors.

“We don’t focus too much on the stock price,” he said.

“They certainly want to see more investment . . . to realise the full potential,” he said.

“But on the other hand . . . they also want us to manage our profit and loss statement and our spend in a prudent manner, which can sometimes involve making hard trade-offs between short term and long term.”

He said the company was heading into a “data-rich” 12 months or so, with the opportunity to show investors what it could do in oncology.

Investors will still have to wait until at least 2026 for an approved oncology product.

Future sales of Pfizer’s Covid vaccine will depend on the wild card of new variants that evade previous protection © Ezra Acayan/Getty Images

Future sales of Pfizer’s Covid vaccine will depend on the wild card of new variants that evade previous protection © Ezra Acayan/Getty ImagesPfizer has also been rapidly investing its Covid cash in filling its drug pipeline, aiming to launch 19 new products over 18 months, most of which were discovered in-house, and to add at least $25bn in 2030 risk-adjusted revenues from business development.

The New York-based pharma group has acquired four companies — Arena, ReViral, Biohaven and Global Blood Therapeutics — that it expects will contribute about $10bn in revenues in 2030.

And it plans to acquire oncology-focused biotech Seagen for $43bn, which it expects to contribute more than $10bn in 2030 sales.

Powell said investors worried that Pfizer had paid a lot for what it had bought.

“They are punishing them for the increase in investment in the short term and not giving them any reward at the back end,” he said.

Pfizer said its approach was to seek opportunities “where we have the ability to add substantial value to rapidly bring new breakthroughs to patients”.

Linden Thomson, lead manager of the AXA IM Framlington Biotech fund, compared the vaccine companies with others that have had a standout year because of a single drug, such as Gilead with its hepatitis C medicine and, to some extent, Vertex with its cystic fibrosis treatment.

She said a company such as Moderna, which the fund holds, had massively expanded its manufacturing capacity and gained a huge amount of experience in its new technology because it was so widely used.

While some investors are sceptical of companies without long-term growth plans, she said Moderna had met every challenge.

“My view is you should give them the benefit of the doubt because quite honestly, on everything that they’ve had thrown at them, they’ve checked the box,” she said.

Thomson said in future pandemics, vaccine makers were still likely to want to invest in creating a jab for a novel pathogen if they thought they had a chance of tackling it successfully.

“People have seen how much profit can be made from them,” she said.

However, companies might be more cautious about assuming how long the new reality of a pandemic will last, she added.

“Next pandemic, investors could look back and are probably going to assume the changes in how we need to live might last a few years, rather than assume upfront it will be the new normal on a long-term basis,” she said.

0 comments:

Publicar un comentario