Beijing Throws China’s Housing Market a Bone

Policy paralysis of the past half year has given way to stronger signals that Beijing wants to support the market

By Jacky Wong

China’s housing market will likely begin to stabilize in the coming months, but at a level far below its late 2020 and early 2021 peak. PHOTO: /BLOOMBERG NEWS

China’s housing market will likely begin to stabilize in the coming months, but at a level far below its late 2020 and early 2021 peak. PHOTO: /BLOOMBERG NEWSThe deep malaise in China’s critical housing sector has finally pushed Beijing to make some forceful moves.

The real-estate market may get a meaningful boost in late 2023—but it will remain in a state of structural decline over the long run.

In the past couple of weeks, China has unveiled a smorgasbord of measures to support the flagging property market.

It isn’t yet rolling out a large-scale 2015- or 2009-style stimulus, or the kitchen sink, but the range and breadth has been notable—especially in contrast with the muted policy response over the summer as the economy ground to a near-halt.

China’s biggest cities like Shanghai and Shenzhen have rolled back some longstanding restrictions on buying property.

In particular, buyers who previously had a mortgage can now become eligible for first-time homebuyer-like benefits—lower down-payment ratios and interest rates—as long as they don’t currently own an apartment.

That will make it easier for homeowners considering an upgrade to move back into the market without a huge cash outlay: quite important given how risk averse households have become.

Other regulators, including the central bank, will also lower minimum down-payment ratios for both first-time and second-time home buyers and nudge banks to cut interest rates for existing mortgages.

Nomura estimates that existing mortgage borrowers could save around 200 to 300 billion yuan, the equivalent of $27 to $41 billion, a year.

The dovish signals toward second-time home buyers are especially important, given how thoroughly the central leadership has emphasized the mantra “homes are for living in, not for speculating on” in recent years.

What ails China’s housing market includes fundamental factors like poor demographics and overbuilding in lower-tier cities—but also Beijing’s overly successful campaign to squeeze animal spirits out of the market.

Any concrete, rather than rhetorical, signs that Beijing is easing off even a little on its antispeculation stance are therefore notable.

“The signal is clear: officials are now willing to tolerate greater property-market speculation in order to stabilize sales,” wrote Rosealea Yao, an analyst at consulting firm Gavekal, in a recent note.

These new measures will attract some home buyers into the market, especially those in the largest cities who are open to switching to a bigger home.

It’s also likely that such cities will further relax some remaining restrictions on home purchases in the coming months.

Country Garden, once seen as one of China’s most stable property developers, is now struggling financially, leaving the future of unfinished megadevelopments like Malaysia’s Forest City in doubt.

Yet the impact on smaller and medium-size cities—which account for the lion’s share of the actual physical market—could be more muted.

For one, many of these cities either didn’t have as stringent restrictions to begin with, or already relaxed them earlier this year.

The housing oversupply situation is also worse.

It is therefore uncertain whether better home sales in major cities will lift sentiment in lower-tier cities, too.

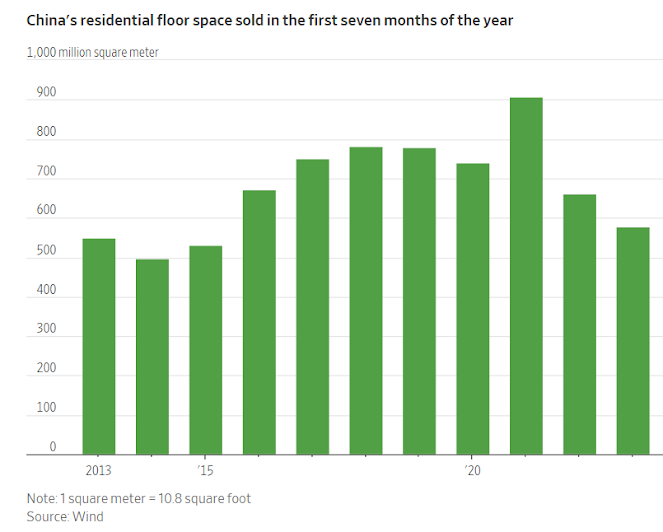

China’s housing market will likely begin to stabilize in the coming months, but at a level far below its late 2020 and early 2021 peak.

Morgan Stanley estimates that annual demand for new homes will fall to nine million units in this decade, around 35% lower than the 2021 level.

Beijing’s new measures will provide a reprieve for China’s unhappy homeowners—and builders.

But the good old days are long gone, and there are few signs that Beijing wants them back, even if that means much lower economic growth over the next few years.

0 comments:

Publicar un comentario