Housing will keep the Fed honest

Expensive mortgages have not stopped a home price rebound

Ethan Wu

Good morning.

Here’s a question: are we late in the old economic cycle, or early in a new one?

There is a widening consensus that we are headed for, or are in the midst of, a soft landing.

But what comes after that?

House prices only go up

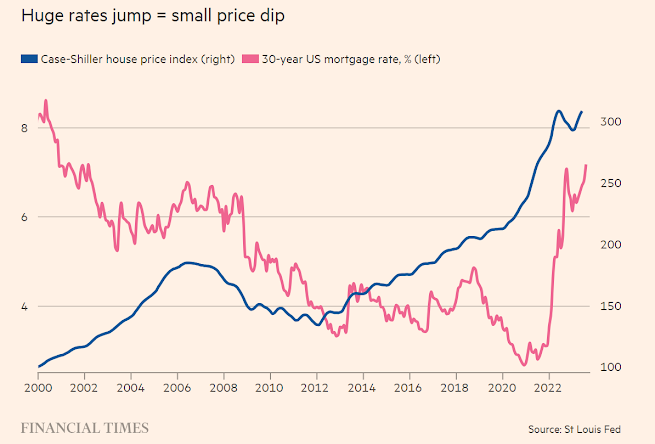

Thirty year fixed mortgage rates are now north of 7 per cent, and haven’t been this high since 2001.

And yet house prices are edging up again:

This is a remarkable and surprising chart.

The fastest mortgage rate increases in decades led to just seven months of declining house prices.

Since February, they have started rising. Last year’s decline has been erased.

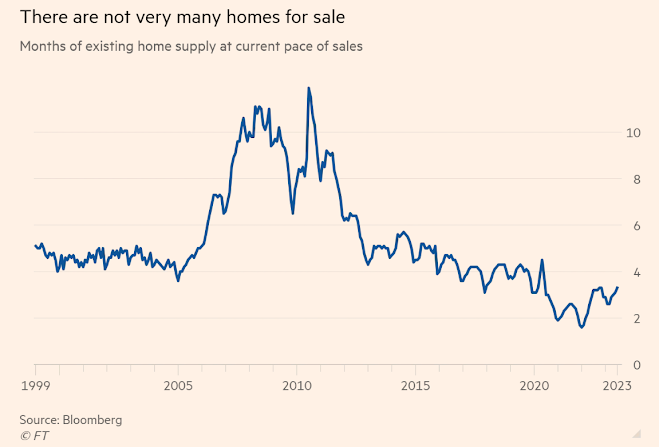

The reason is constrained supply.

More than a decade of too little construction left the US chronically undersupplied with homes.

High mortgage rates also create a lock-in effect where no one (not least Rob Armstrong) wants to part with their 3ish per cent fixed rate.

By some measures, supply is near a record low.

Put together, even the pressure expensive mortgages put on demand aren’t enough to push house prices down for long.

The chart below shows the scale.

Existing home inventory, which makes up the bulk of housing supply, is scarce:

These dynamics are relatively well known.

In a recent note, Larry Cofsky, Brandon Rowley and Crawford Crooks of Bridgewater go a step further.

They argue that the supply-demand imbalance in housing could force the Fed to maintain higher-for-longer rates.

A sketch of their argument:

- Rates have crushed housing demand.

In the first 15 months of this rate increase cycle, mortgage borrowing as a share of GDP has shrunk 3 per cent.

That is huge, and by far the largest decrease on record this early in a hiking cycle.

The previous biggest decrease was in 1999, when mortgage borrowing/GDP fell 0.5 per cent in the first 15 months of raising rates.

- But the huge drop in housing demand has barely dented house prices, because of tight supply, as the two charts above illustrate.

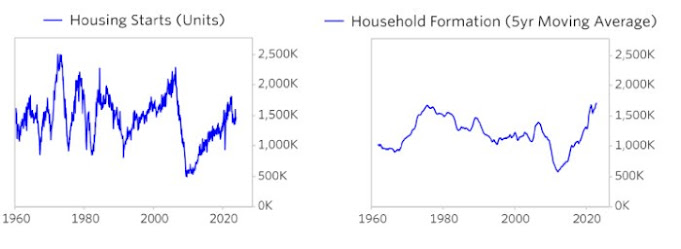

- Neither distressed sales nor housing construction look likely to boost supply anytime soon.

With the economy resilient and household balance sheets in good shape, few homeowners should be forced sellers.

And construction is happening too slowly.

Cofsky, Rowley and Crooks reckon that supply is running around 3-5mn housing units short of demand.

But new construction, at around 1.5mn units a year, is just keeping pace with new household formation, so it won’t fix the shortage.

Bridgewater’s charts:

- Much of the demand-squelching impact of high rates has already been felt.

The rapid increase in rates in effect “shut off the mortgage borrowing pipe”, resulting in last year’s small house-price dip.

Yet that has already happened.

Even if rates should rise further, the natural trickle of house demand from, say, growing families or divorces puts a floor under prices and activity.

- So cutting rates risks a resurgence of inflation through housing demand.

By reopening the mortgage borrowing pipe, lower rates would probably lift demand and prices.

Given housing’s importance to growth and inflation (remember that rents are one-third of the consumer price index), higher-for-longer rates “will need to be the mechanism to keep a lid on housing”.

This diagnosis of the housing market seems right to us.

But we’re a bit sceptical that the bind housing puts on lowering rates is quite so tight, for two reasons.

First, the rate lock-in effect, while powerful, is two-sided.

Homeowners’ locked-in rates are keeping supply off the market now, but rate cuts would lessen the trade-off for homeowners.

On the margin, that should bring more existing-home supply on to the market.

The question then becomes: what’s the net effect between a pop in demand from lower mortgage rates and a supply increase from a diminished lock-in effect?

It is hard to say before the fact.

Kiran Raichura, property economist at Capital Economics, thinks it would be slightly positive for housing prices and activity, but probably not the big uptick Bridgewater expects.

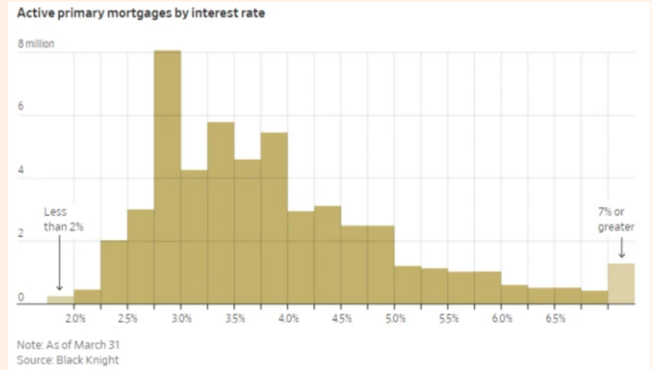

The chart below, published earlier this year in the Wall Street Journal, makes the point concrete.

It shows how many homeowners are locked in at different rate levels.

Overall mortgage rates falling from 7 per cent to 6 per cent probably wouldn’t matter for someone with a 2 per cent mortgage.

But it could well sway someone owning one of the 10mn mortgages between 4-5 per cent:

Second, the relationship between the housing market and measured inflation is indirect.

The CPI measures housing inflation through rents.

Over time, higher house prices pass into rents through the “asset price effect”: as house prices increase, homeowners renting out their property will eventually raise rents to keep rental yields steady.

But in the near term, there’s reason for optimism on the rental market, which is not only about housing.

Apartment construction is at a record high, vacancies have risen and rent growth is back at a pre-pandemic pace.

With all that said, the Bridgewater authors do make a strong macro point.

Housing, and all the assorted activity tied to it, has gone from sectoral downturn to modest recovery.

Unless the inflation-growth trade-off is much smaller than we think (possible!), that should lift growth and sustain price pressures.

We don’t think this rules out rate cuts.

But it probably keeps the Fed from rushing to pull that lever.

0 comments:

Publicar un comentario