Banks Can’t Shortchange Savers Forever

Lenders may feel more competitive pressure to pass on the benefit of higher interest rates than investors appear to think

By Jon Sindreu

A sign showing the interest rates at a First Republic Bank branch earlier this year. PHOTO: AFP VIA GETTY IMAGES

A sign showing the interest rates at a First Republic Bank branch earlier this year. PHOTO: AFP VIA GETTY IMAGESRight now, the only way to escape high interest rates is by opening a deposit account to try to benefit from them.

But investors shouldn’t assume banks can just keep on snubbing depositors.

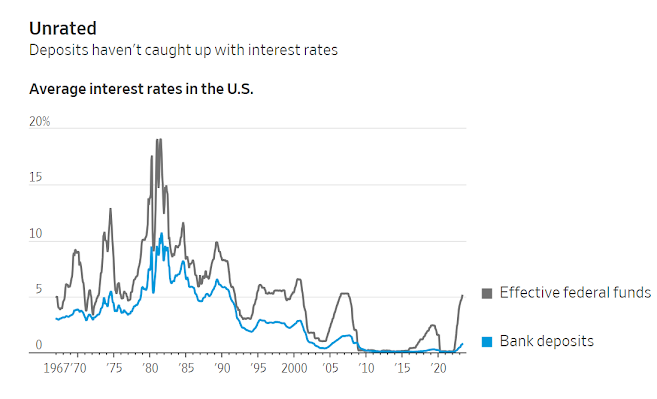

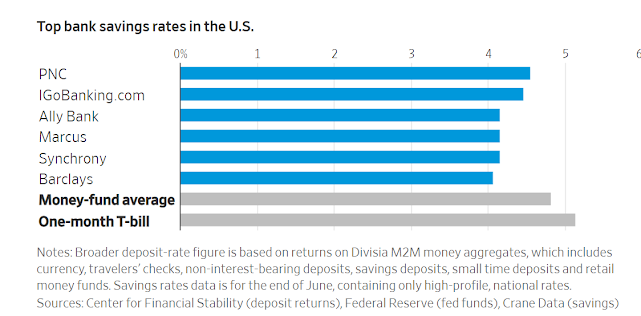

Though the Federal Reserve has pegged market rates of interest above 5%, getting more than 4% on a savings account is tough.

A handful of banks are there, such as Pittsburgh-based PNC and Goldman Sachs’ online arm Marcus, but the average rate paid in May was 0.73%, data from think tank Center for Financial Stability suggests.

Of course, where bank customers lose, investors gain.

With most Wall Street megabanks set to report second-quarter earnings next week and their European counterparts a week later, a correct assessment of “deposit betas”—the portion of rate changes that banks pass on to depositors—is crucial.

The CFS figure is very broad and underplays what banks offer new customers.

Financial filings suggest that deposits at big lenders such as JPMorgan and Bank of America return between 1.3% and 2%.

Moreover, it was normal before 2008 for deposits to yield less than central-bank rates.

Still, today’s gap between the two is unusually wide.

The trend in Europe is similar. In the U.K., instant-access deposits paid 1.83% in June even as rates rose to 5%, sparking accusations of profiteering from lawmakers.

In the eurozone, households and companies got a 2.4% and 3% return in May, respectively, while the European Central Bank rate reached 3.5%.

But investors who expect this situation to last may be too complacent.

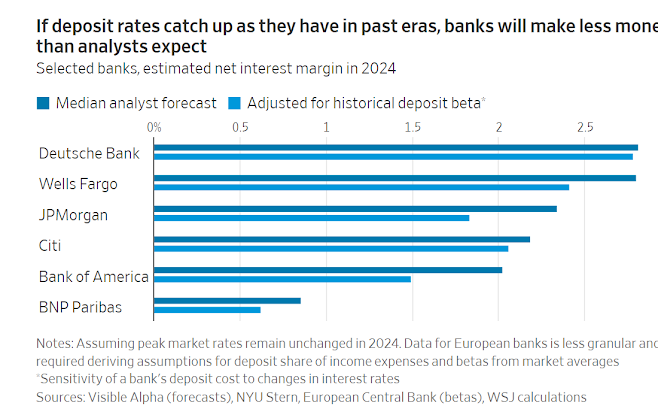

During the first quarter, even small increases in deposit costs forced analysts to trim their net interest margin forecasts for U.S. banks.

In Europe, Germany’s Commerzbank warned about a peak in interest margins. The same could happen in the coming earnings season.

Median sell-side forecasts collected by Visible Alpha see margins expanding powerfully this year, and then giving up some of those gains in 2024 as deposit expenses catch up.

However, even these 2024 margins would be about 0.3 percentage-point narrower at several major global banks if deposit betas rose to their historical averages, assuming constant interest rates, back-of-the-envelope calculations suggest.

It could be that central banks start lowering rates again next year, as derivatives markets seem to assume.

In that case, it is forecasts for returns on loans that could start to look overly optimistic.

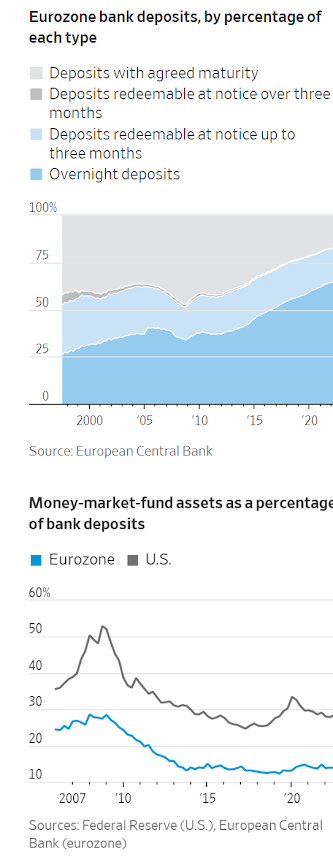

The ECB recently warned in its biannual financial-stability outlook that bank funding costs could jump as clients shift money from overnight to higher-yielding term deposits.

Because of the past decade of near-zero rates, the former makes up a whopping 61% of eurozone deposits, compared with 39% in 2013.

Similarly, negative-yielding short-term debt made people avoid money-market funds, which relative to deposits have stagnated on both sides of the Atlantic since 2010.

Now, they are paying 4.8% in the U.S., according to Crane Data.

This is stiff competition, especially for smaller lenders seen as risky after the March banking crisis.

Individual savers can often take a while to start seeking yield.

But they are on the case now: Money-market fund holdings in the U.S. have ballooned to record levels.

The Bank of England recently noted that U.K. households withdrew the highest volume of funds on record from banks in May, which was partially offset by an inflow into time deposits.

“Between higher returns and lower risk, the movement out of bank deposits is going to accelerate and we expect we are going to see a stampede out of bank deposits in the coming months,” said Octavio Marenzi, chief executive of consulting firm Opimas.

Many analysts appear to disagree, citing a number of reasons why deposit betas will stay lower for longer, particularly for big banks.

These institutions have become more concentrated, and user-friendly online-banking applications could make their deposit franchises stronger than in the past.

Then again, for banks as a whole, it is also possible to argue the opposite.

Digital platforms have made it easier for savers to shop around for higher-yielding products and shift their money accordingly, be it into money-market funds or the offerings of new online and fintech players, which have risen to dominate new checking accounts.

Europe may offer a natural experiment: Banks in France and the Netherlands, countries with more modern financial ecosystems that include more fintech options, have increased deposit rates far above those in Italy, Spain and Portugal, data by Jefferies analysts suggests.

A new era of high rates brings many uncertainties.

Taking for granted that depositors will remain the big losers is a dangerous assumption.

0 comments:

Publicar un comentario