Tesla Gears Up for Battle With Gasoline Cars

Tesla is using price cuts to expand aggressively while old-school autos remain profitable. The two can’t stay in separate bubbles forever.

By Stephen Wilmot

For regular gasoline cars, prices remain high despite a recovery in production. PHOTO: BRANDON BELL/GETTY IMAGES

For regular gasoline cars, prices remain high despite a recovery in production. PHOTO: BRANDON BELL/GETTY IMAGESHead-to-head competition with Tesla TSLA 7.68% is a bullet that old-school automakers are still largely dodging in the U.S., but it is only a matter of time before they get hit.

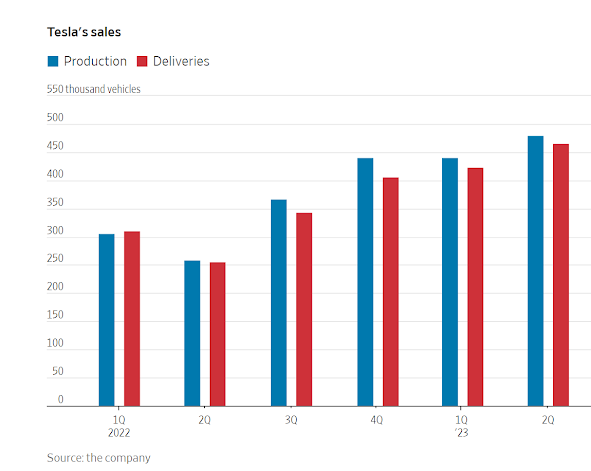

The electric-vehicle pioneer said Sunday that it delivered 466,140 Teslas in the second quarter, a record and around 24,000 more than analysts polled by FactSet forecast.

The stock was up about 5% premarket as investors saw a sign that Chief Executive Elon Musk’s price cuts earlier this year are bearing fruit.

Peel the fruit and it appears a bit less sweet: Production outpaced deliveries for the fifth consecutive quarter, meaning that Tesla’s inventories are still increasing despite better sales.

This gives the company a reason to continue finding ways to stimulate additional demand, such as a June offer that any Model 3 ordered before the end of the quarter would come with three months of free charging.

The result is that Tesla’s margins, which it will report later this month for the second quarter, could continue to decline in the second half of the year.

Tesla became highly profitable during the pandemic, but this year Musk has pivoted back to the company’s original mission of growing as fast as possible, even if it means earnings fall this year.

That isn’t the kind of thing investors usually celebrate, but Tesla’s stock has more than doubled year to date.

The company’s shareholders have a record of paying less attention to near-term profit than most, and this year’s performance also reflects a rebound after a dismal run, as well as a wider stock-market preference for big growth stocks.

Whatever the drivers, Tesla’s recent rally gives Musk a green light to carry on pricing and expanding aggressively.

At Adam Lee’s Jeep dealership, customers are seeing something they haven’t in years: lots of new cars.

That is a problem for competitors in the nascent U.S. EV market, which Tesla dominated with a market share of over 60% last year.

Peers can’t price their vehicles out of line with Teslas, never mind what they cost to make, which is invariably more than it costs the market leader.

The most visible victim has been Ford’s Mustang Mach-E: The division that makes the EV lost $0.7 billion in the first quarter alone.

Yet the wider industry hasn’t been much affected.

For regular gasoline cars, prices remain high despite a recovery in production.

Data provider J.D. Power late last month estimated the average June transaction price for all new vehicles sold in the U.S. was almost $46,000, flat from the same month of last year, when availability was more constrained.

That bodes well for overall profits from Detroit, particularly given the stronger-than-expected recovery in sales this year.

Cox Automotive, another data provider, last week raised its forecast for 2023 U.S. sales to 15 million, which would be an 8% increase from 13.9 million in 2022.

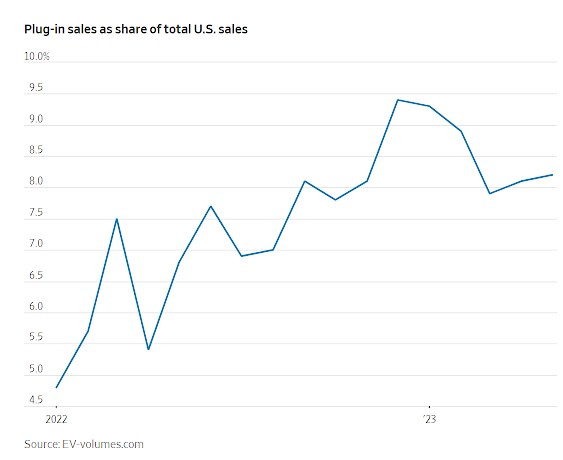

Tesla’s price war hasn’t spread because EVs remain a niche product in the U.S., accounting for just 7% of sales last year.

Detroit enjoys an additional level of protection because it makes the kind of larger vehicles that are harder to electrify.

Ford has pointed out that it increased prices of its F-150 Lightning electric pickup truck even as it cut them for the Mustang Mach-E, which competes directly with Tesla’s Model Y.

China, where plug-in cars accounted for 27% of sales in 2022, shows what happens in a more mature EV market.

There, Tesla’s price cuts last year started a battle to retain market share that has become even fiercer among gas-engine brands.

While it will take time for the U.S. to get to that point, the stars are aligning for EVs to merge into the industry mainstream.

Price gaps with comparable conventional models are narrowing, while the charging network, which has long put many consumers off, is unifying behind Tesla’s plug.

More new EVs are coming out, including from Detroit.

So far, the damage Tesla has inflicted on the wider auto industry is mainly to capital budgets: Incumbents have invested tens of billions of dollars in new products and production.

The point where EVs start to eat directly into the profitability of gasoline car sales isn’t here yet, but it is coming.

0 comments:

Publicar un comentario