Why the U.S. Remains Far From Recession

The pandemic’s aftereffects fuel economic resilience despite rising interest rates

By Sarah Chaney Cambon

Government policies in response to the pandemic left consumers and businesses with lots of money and cheap debt. PHOTO: JONATHAN ERNST/REUTERS

Government policies in response to the pandemic left consumers and businesses with lots of money and cheap debt. PHOTO: JONATHAN ERNST/REUTERSMore than a year after the Federal Reserve began rapidly raising interest rates to tame inflation, the hallmarks of a widely expected recession remain elusive.

Employers are hiring aggressively, consumers are spending freely, the stock market is rebounding and the housing market appears to be stabilizing—the most recent evidence that the Fed’s efforts have yet to significantly weaken the economy.

Instead, the lingering effects of the pandemic have left consumers and employers still playing catch-up.

That momentum could prove self-sustaining.

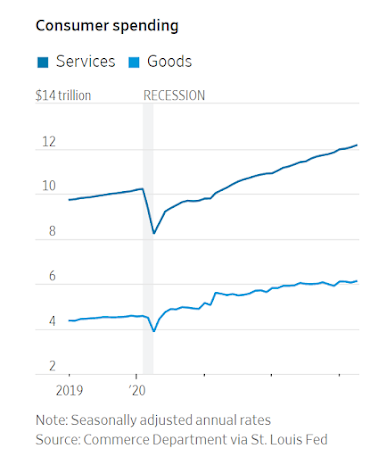

Americans are splurging on the activities they skipped during pandemic lockdowns, such as travel, concerts and dining out.

Businesses are staffing up to satisfy the pent-up demand.

Government policies in response to the pandemic—low interest rates and trillions of dollars in financial assistance—left consumers and businesses with lots of money and cheap debt.

The same inflation that so worries the Fed translates into higher wages and profits, fueling spending.

Many economists expect the Fed’s rate increases to cool the economy and price pressures over time, triggering a recession later this year.

So far, however, the data keep coming in hotter than forecast.

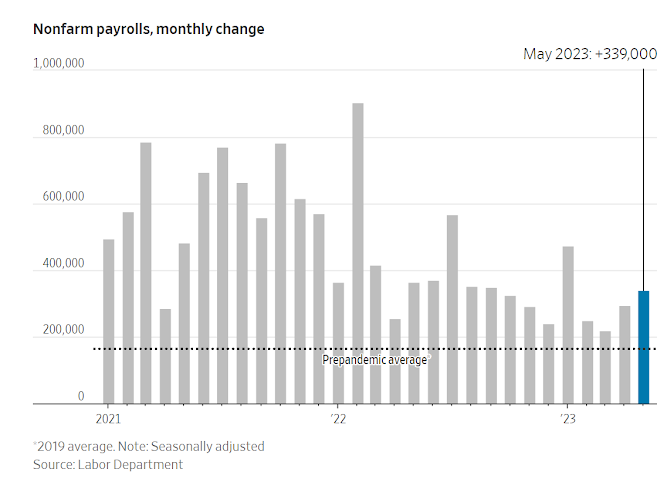

Job gains, in particular, remain robust, pumping more money into Americans’ wallets.

Payrolls grew by a surprisingly large 339,000 in May, and the increases for the preceding two months were higher than initially estimated, the Labor Department said Friday.

“I don’t think there’s any chance we’re in a recession,” said Justin Wolfers, professor of public policy and economics at the University of Michigan.

The National Bureau of Economic Research, an academic research group and the official arbiter of U.S. recessions, analyzes a slew of economic data to help determine whether the economy is in a recession. Most of those indicators look healthy, Wolfers said.

Postpandemic labor market still recovering

Employers hiring last month included those in sectors such as healthcare, leisure and hospitality and government, which saw sharp job losses at the pandemic’s onset in spring 2020.

State and local government—which includes public schools—and leisure and hospitality—a category that spans restaurants, hotels, entertainment and spectator sports—have yet to return to their prepandemic employment levels amid continuing labor shortages.

Across the economy, job openings increased to 10.1 million in April from 9.7 million in March, far exceeding the 5.7 million unemployed Americans that month.

The mismatch between job opportunities and job seekers continues to spur wage growth.

Average hourly earnings grew a solid 4.3% in May from a year earlier, similar to annual gains in March and April.

“I certainly did not think the labor market would remain this strong for this long,” said Carl Tannenbaum, chief economist for Northern Trust.

Courtney Wakefield-Smith is among those who have recently benefited from the strong labor market.

The 33-year-old said she was promoted last year to an office job at a New Jersey water utility company.

In her new role, she makes more than $25 an hour, well above her part-time jobs earlier in the pandemic that paid between $11 and $17 an hour.

Her higher wage and benefits including maternity leave are helping support her newborn son.

“This is my first child,” she said.

“I don’t think I would have been able to afford a child before now to be completely honest.”

The job market could stay tight, largely because millions of former workers near retirement age have dropped out of the labor force since the pandemic began.

The share of Americans age 16 and older working or seeking a job held steady last month at 62.6%.

Consumers have money to spend

Americans have about $500 billion in so-called excess savings—the amount above what would be expected had prepandemic trends persisted, according to a May report from the Federal Reserve Bank of San Francisco.

That allows them to shell out for summer travel, concert tickets and cruises despite rising prices—and enabling companies to keep raising them.

Southwest Airlines Chief Executive Bob Jordan said recently the carrier sees strong demand in the next two to three months, the window during which most people book flights.

American Airlines raised its projections for unit revenue in the second quarter, citing strong demand.

The number of people passing through U.S. airports during the Memorial Day weekend topped the prepandemic figure from 2019, according to the Transportation Security Administration.

Brett Keller, CEO of travel site Priceline, a unit of Booking Holdings, said he has been surprised at the strength of travel demand when many consumers are paying more to book an airline ticket or reserve a hotel room.

Keller has seen examples for this summer, with round-trip fares from the East Coast to Boise, Idaho, exceeding $1,000, roughly double $500 a few years ago.

Economy’s resilience complicates Fed rate outlook

Economic activity and inflation haven’t slowed as much as Fed officials anticipated.

Since March 2022, they have lifted the benchmark federal-funds rate from near zero to a range between 5% and 5.25%, a 16-year high.

Higher borrowing costs typically are felt first in rate-sensitive parts of the financial markets and economy, such as stocks and housing.

The S&P 500, for example, fell about 25% from late December 2021 to last October as the Fed raised rates sharply.

The broad index has since rallied about 20%, which wouldn’t typically happen if the economy were falling into recession.

Sales of existing and new homes fell sharply last year but have climbed since January.

A shortage of homes for sale has helped drive home prices higher recently.

Home builders are feeling more confident as a shortage of existing homes boosts demand for newly built residences.

Residential and industrial construction firms added 25,000 jobs last month, up from a monthly average of 17,000 over the prior 12 months.

These signs of resilience suggest the Fed might need to raise interest rates further to push inflation down from its current rate around 5% toward the central bank’s 2% target.

Americans have about $500 billion in excess savings, according to a report, allowing them to splurge despite rising prices. PHOTO: RICHARD B. LEVINE/ZUMA PRESS

Americans have about $500 billion in excess savings, according to a report, allowing them to splurge despite rising prices. PHOTO: RICHARD B. LEVINE/ZUMA PRESSFed officials last week signaled an inclination to hold rates steady at their meeting this month.

But Friday’s jobs report strengthened the likelihood that they would pair any such pause with a stronger preference to raise rates later this year.

“A decision to hold our policy rate constant at a coming meeting should not be interpreted to mean that we have reached the peak rate for this cycle,” Fed governor Philip Jefferson, said Wednesday.

“Indeed, skipping a rate hike at a coming meeting would allow the committee to see more data before making decisions about the extent of additional policy firming.”

There are some signs higher rates are having an effect.

Businesses slowed investment in the first quarter, cutting back on equipment spending particularly sharply.

The average workweek fell to 34.3 hours last month, the lowest since April 2020 and possibly reflecting that businesses are cutting hours instead of workers.

The unemployment rate rose to 3.7% in May from 3.4% in April.

The tech-heavy information sector cut 9,000 jobs in May.

Many economists and business executives say it is just a matter of time before interest-rate increases—which work with a lag—significantly sap the economy’s vigor.

Economists surveyed by The Wall Street Journal in April put the probability of a recession at some point in the next 12 months above 50%.

But they have said that since October, and the recession appears no closer.

Alison Sider and Chip Cutter contributed to this article.

0 comments:

Publicar un comentario