The U.S. Dollar Is Looking a Bit Stretched

Microsoft’s warning highlights the downsides of a mighty greenback, but the currency’s strength looks set to wane

By Aaron Back

A stronger U.S. dollar is mixed news for the American economy. / PHOTO: MOHAMED ABD EL GHANY/REUTERS

The U.S. dollar’s rally has paused.

Investors shouldn’t necessarily assume it will resume.

The greenback has been an unsurprising beneficiary of the Federal Reserve’s tightening campaign: Higher interest rates drive flows into U.S. bonds and other dollar assets and out of other currencies.

Stock-market weakness also has prompted safe-haven buying of dollars, as has Russia’s invasion of Ukraine.

The net result is that the dollar is up 7.1% so far this year, according to the widely followed ICE U.S. Dollar index, or 6.6% as measured by the WSJ Dollar Index, which tracks the U.S. unit against a broader group of currencies.

Over the past year, the ICE Dollar index is up 14.2%.

A stronger U.S. dollar is mixed news for the American economy.

It makes imports cheaper, which can be a useful offset for inflation.

But it also makes the foreign earnings of U.S. exporters and multinationals less valuable in dollar terms.

Last week, Microsoft MSFT +1.03% cut its outlook for earnings and revenue in the second quarter, citing dollar strength.

Yet the dollar’s momentum is fading amid signs that the U.S. economy might be weakening.

Based on the ICE index, the U.S. unit is now down 2.0% from its peak in mid-May. Reasons for this aren’t just to be found at home, though.

As it becomes increasingly clear that the current wave of inflation is a global problem, other central banks are joining the Fed in tightening policy, boosting their own currencies.

For instance, inflation in the eurozone in May reached an annual rate of 8.1%, the fastest pace since records began at the start of 1997.

The European Central Bank has said it would end its bond-buying program in July and raise its key interest rate to zero by September from minus 0.5% now.

Expectations are now building that the ECB may have to act more aggressively.

The euro has bounced 2.7% off lows that it hit against the dollar on May 12.

Similarly, the Bank of Canada last week increased its policy interest rate by a half-percentage point, its second such hike to combat inflation that is now at a 31-year high in the country.

The Canadian dollar is up 3.4% against its U.S. counterpart since mid-May.

On Tuesday, Australia’s central bank raised rates more than expected.

The pattern is likely to be repeated elsewhere.

Among major economies the notable exceptions are China and Japan, where policy is likely to be loosened or kept loose, respectively.

Japan’s 10-year government bond is currently yielding just 0.24%, compared with around 3% for U.S. 10-year Treasurys.

Still, tightening around the rest of the world could sap the dollar’s strength against most major currencies.

Of course if the U.S. economy avoids a downturn and the Fed stays hawkish, the dollar rally could go on.

But other indicators tracked by economists are starting to signal the currency might be near overvalued territory.

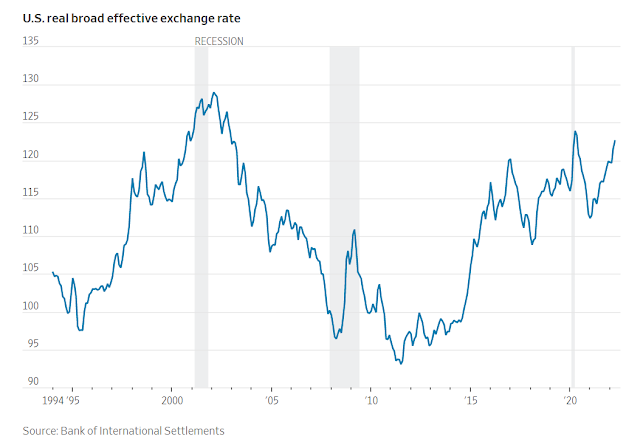

Consider, for instance, the so-called real broad effective exchange rate, which takes into account international differences in consumer prices to measure the dollar’s effective purchasing power against other currencies.

Aside from a brief spike during the height of markets’ Covid-19 panic in the spring of 2020, this rate as of April 2022 is at its highest level since the early 2000s, according to the Bank for International Settlements, which was followed by an extended period of dollar weakness.

This suggests the dollar’s strength may be starting to weigh on the country’s international competitiveness.

From that perspective, and for American multinationals like Microsoft, a reversal would be welcome news.

0 comments:

Publicar un comentario