Housing Boom Is on Borrowed Time

Higher rates have only just begun to weigh on home sales and prices

By Justin Lahart

The average existing home sold at a record high price last month, but sales have slowed and prospective buyer traffic is down sharply./PHOTO: JUSTIN SULLIVAN/GETTY IMAGES

The average existing home sold at a record high price last month, but sales have slowed and prospective buyer traffic is down sharply./PHOTO: JUSTIN SULLIVAN/GETTY IMAGESHousing might have been staggered a bit by higher rates but hasn’t really taken it on the chin.

It could be just a matter of time.

This has been an interesting year so far for the housing market, to say the least.

The average rate on a 30-year mortgage has risen to 5.25% from 3.1% at the end of December, according to Freddie Mac, making homes much harder to afford.

Sales have slowed, with the National Association of Realtors on Thursday reporting that there were 5.61 million previously-owned, or existing, homes sold in April, at a seasonally adjusted annual rate.

That compares with a monthly average of 6.12 million over the course of last year.

Yet it isn’t clear how much of the sales slowdown is a result of faltering demand as opposed to inadequate supply.

The number of homes on the market, relative to sales, remains very low, and prices keep going up, with the average existing home selling for a record high $391,200 last month compared with $340,700 a year earlier.

There are a lot of moving parts here.

The low level of supply probably has something to do with the large number of homeowners who now carry low mortgage rates and who are reluctant to move and end up paying more.

Affordability concerns are probably keeping some would-be buyers from going house hunting, but others might worry that rates and prices will continue to rise so that, if they don’t act now, they will never be able to own.

And high inflation—including in rents—could act as a further incentive to buy and lock in prices paid for shelter.

In the end, however, the negative influence of rising rates on the housing market will probably prevail—if it hasn’t already.

Existing home sales reflect closings, with contracts typically signed a month or two earlier, so the April existing home sales figures reflect deals signed in March or February, with buyers locking in rates that are much lower than what prevails now.

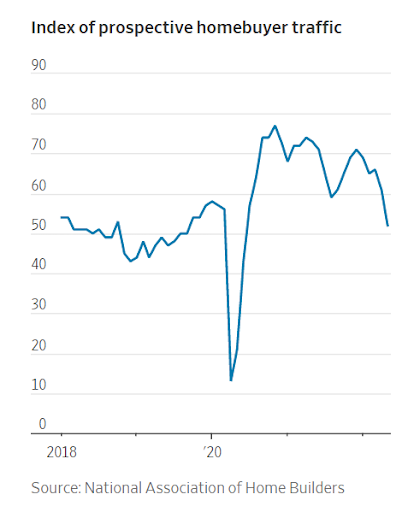

In a hint of what might be to come, the National Association of Home Builders earlier this week said that its measure of prospective buyer traffic, based on its monthly survey of builders, fell sharply in May and is now somewhat below levels that prevailed right before the pandemic.

Higher mortgage rates, rising prices and strong housing demand probably can’t coexist for very long. Here is guessing they won’t.

0 comments:

Publicar un comentario