Numbers Ain’t What They Used to Be in Turbulent U.S. Economy

Durable goods, jobs and home sales have all wrong-footed economists who didn’t count on big revisions lately

By Justin Lahart

An IceStone manufacturing facility in New York this month./ PHOTO: ANDREW KELLY/REUTERS

There is a rule of thumb in data watching that, if you want to understand which way things are trending, you need to watch the revisions.

What is happening with capital spending might be a case in point.

The Commerce Department on Thursday reported that U.S. manufacturers’ new orders for durable goods rose 2.3% in May from April, lower than the 2.6% gain economists expected.

Much of that increase was due to a jump in aircraft orders, which are often lumpy.

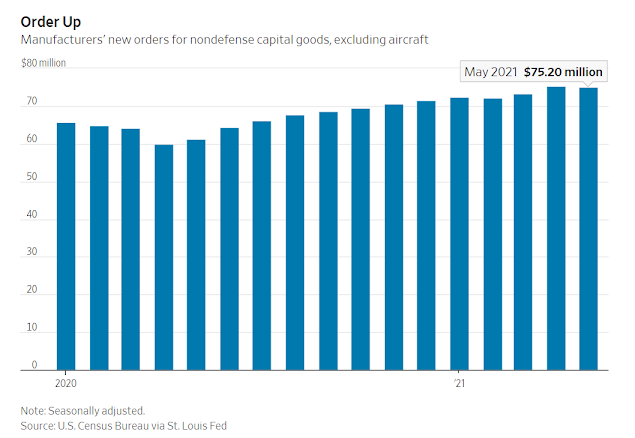

The element of the report economists home in on to gauge capital spending plans—nondefense capital goods excluding aircraft—slipped 0.1%. Most had expected it to rise.

But then there were significant revisions to the April durable-goods figures, which now show that orders for nondefense capital goods excluding aircraft rose 2.7% in April from March, versus an initially reported gain of 2.2%.

That marked the largest monthly increase since July of last year, when the U.S. economy was still lurching out of the spring shutdowns.

Revised data tend to provide a more complete picture of what is happening.

When the Labor Department releases its monthly jobs figures, for example, it has data from about three-quarters of the employers it has surveyed.

Over the next two months that response rate is usually over 90%.

If the businesses that respond early to a survey face the same conditions as the ones that respond late, then the data revisions should be minor, but that often isn’t the case.

Bigger companies can often send responses sooner, for example, and businesses in some industries tend to respond sooner than others.

They can be dealing with a very different set of circumstances than others.

Those differences might be particularly pronounced now as the economy digests surging demand, shifts in consumer preferences and supply-chain bottlenecks brought on by the easing of the Covid-19 crisis.

It might well be the case that, once it has more complete data in hand, the Commerce Department ends up revising its capital-goods orders figures higher.

Revisions can cut both ways, of course.

When the Commerce Department reported May new-home sales on Wednesday, it revised its April figures significantly lower, and the same went for March sales figures.

Maybe the May data is going to get knocked down, too.

In an unusual economic environment, first impressions can be misleading.

0 comments:

Publicar un comentario