The Zillow Fantasy Could End in Rude Awakening

Zillow surfing may be the new great American pastime, but all the world’s lookie-loos haven’t ensured much in the way of profit thus far

By Laura Forman

Zillow become the punchline of a ‘Saturday Night Live’ skit earlier this month./ PHOTO: ROSALIND O'CONNOR/NBCBuying Zillow Group’s ZG 1.17% stock today is like buying a home at the height of the market.

Literally.

The online real-estate company posted stellar fourth quarter results on Wednesday, showcasing 63% sequential revenue growth of its automated homeflipping business.

Meanwhile, revenue for its mortgages segment nearly tripled year-over-year, while its legacy Premier Agent business is still going strong, up 35% on the same basis.

Zillow surfing, hardly new, is having a moment thanks to the Covid-19 pandemic.

It even became the punchline of a “Saturday Night Live” skit earlier this month, likening it to a 30-year old’s adult fantasy.

That fantasy appears to have long legs: Zillow is predicting home sales this year will increase 21% with home prices rising double digits.

But with Zillow’s shares up 270% over the last 12 months, including a nearly 18% gain on Thursday following its latest results, a cold shower may be in order.

Now 15 years old, Zillow has long been at the forefront of real estate’s digital transformation.

Its recent moves, including its shift into iBuying and its acquisition of virtual home touring company ShowingTime, are sure to solidify its position as the future of online real estate.

But consumer demand doesn’t automatically mean profit, which has very much been a work in progress for Zillow.

You wouldn’t necessarily know that from reading Zillow’s shareholder letters.

On Wednesday, Zillow posted quarterly unit economics for its Homes segment, which houses iBuying.

That data showed Zillow making nearly $22,000 on average per home it bought and subsequently sold before interest expense.

Even after interest expense, Zillow’s math shows it made positive returns on homes sold for the first quarter ever.

Enter Mike DelPrete, a scholar in residence on real-estate technology at the University of Colorado at Boulder, who on Thursday published a blog post noting iBuyers were “turning obfuscation of profit into an art form.”

In it, he likens Zillow’s unit economics chart to “an immaculate conception version of iBuying, where transactions magically occur without employees, customers materialize out of thin air, and technology is freely available for all.”

There are further expenses to account for, in other words.

Lots of them.

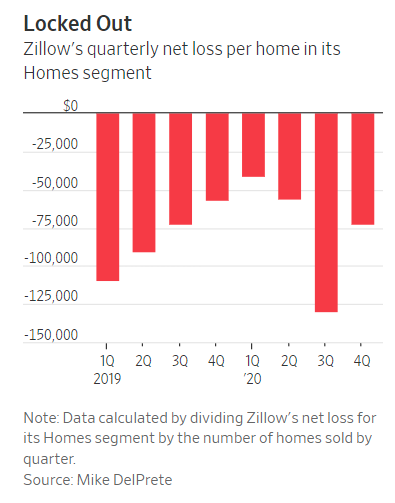

Mr. DelPrete’s math shows that, after all expenses, Zillow in fact lost $72,000 per home.

That would explain why Zillow also said its Homes business lost money, even on the basis of adjusted earnings before interest, taxes, depreciation and amortization, in the fourth quarter, while it showed positive returns on a per home basis.

The good news is that the company is making progress toward profitability.

Mr. DelPrete estimates Zillow lost nearly $129,000 in the third quarter per home on the same basis.

Yet the majority of the improvement appears to be driven by factors largely beyond Zillow’s control.

Zillow said operational improvements such as renovations, holding and selling costs accounted for roughly a third of the improvement in returns before interest expense from the third to the fourth quarter.

The majority, then, came from factors such as better-than-expected home price appreciation and faster sales velocity.

Profit in Zillow’s home business increasingly matters to its overall bottom line as the unit expands.

As of the fourth quarter, revenue for that business is nearly equal to that of its Premier Agent business, which currently makes up the bulk of its high margin internet, media and technology segment, driving overall profitability for the company today.

What, then, will happen if Zillow’s economists are overly optimistic about the future state of the U.S. market?

Fannie Mae’s January forecast shows new and existing home prices growing by an average of less than 8% in 2021 with total home sales rising by less than 4%—well below Zillow’s estimates.

Encouragingly, Zillow reported total visits to its site were up 19% year-over-year in 2020, suggesting there is still a lot of pent-up desire in the real-estate market.

The question for investors in 2021 becomes just how much consumers’ fantasies will play out in real life.

0 comments:

Publicar un comentario