Silver: Most Bullish 'Bubble Burst' Ever - Physical Silver Coin Prices Are Still $37-43 Per Ounce

Geoffrey Caveney

Summary

- The media narrative this week is that the silver price had a retail rally peaking on Monday, and then the bubble burst.

- First, clearing up media misconceptions about Reddit and silver last week and this week.

- About silver: An objective review of the price chart shows that the silver price trend remains quite healthy and bullish even after the short spike up and down.

- A review of leading online silver coin dealers also shows that the actual price of physical silver is at least $37/ounce and often higher, up to almost $43/ounce.

- Investors and traders should keep these actual physical silver coin prices in mind as you consider the true value of silver in the market today. A spot price below $30/ounce can be very misleading when the actual physical silver prices are $10/ounce or even $15/ounce above the financial market spot price.

The media narrative this week is that the silver price (SLV) (PSLV) had a retail rally peaking on Monday, and then the bubble burst.

The financial news media now seems to have conflated the silver market these past two weeks with GameStop (GME) and other popular retail stocks promoted by traders on the now famous Reddit forum "WallStreetBets."

Media Misconceptions About Reddit and Silver

First of all, out of respect to the actual WallStreetBets Reddit traders, I feel the need to clear up the media misconception that "Reddit was pushing up the silver price."

To put it plain and simple, this was literally never true: Not last week, not over the weekend, not in the Monday, Feb. 1, silver spike, and not now.

It's a shame that the "Reddit silver squeeze" headline was so widely reported across all the major financial news media who should have known better.

Anyone who actually looked at the front page of the WallStreetBets Reddit at any time over the past two weeks would have realized that the Reddit silver story was simply not true.

Here's the real story: One person posted an idea about a silver short squeeze on the WallStreetBets Reddit page on Wednesday, Jan. 27. That's all.

It did not take off or catch fire or go viral or become popular on the WallStreetBets Reddit page.

WallStreetBets remained overwhelmingly devoted to the GameStop stock and GameStop alone over these past two weeks.

Most traders there even viewed other retail stocks like AMC as a distraction and a diversion from GameStop. They certainly weren't pushing or promoting silver at all.

However, the financial news media reported the one isolated post about a silver short squeeze, and the whole "Reddit silver short squeeze" media narrative blew up last week and this week, based on the first report of that one isolated post that did not even become very popular on Reddit.

The media narrative was and is factually inaccurate and wrong, plain and simple. It was not fair to the Reddit WallStreetBets traders, it was not fair to GameStop stock buyers and holders, and it was not fair to the actual silver investors and traders either.

Sure, many of the retail silver buyers last week and this week were probably inspired by the GameStop short squeeze to try the same idea in the silver market.

The media attention surely encouraged more retail silver buyers as well. But they weren't the same group of Reddit traders and their followers who bought GameStop. I don't think the actual silver buyers were on Reddit much at all.

I hope this brief summary clears up some of the misconceptions about Reddit and silver that were unfortunately widely reported in the financial news media over the past two weeks.

Silver: Trend Is Still Healthy and Bullish

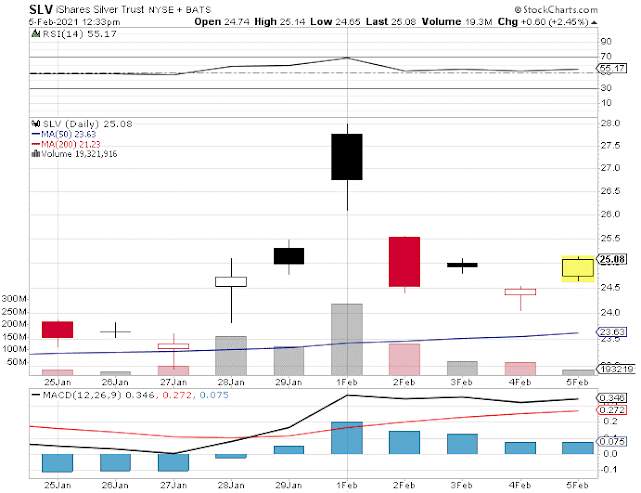

Now let's take a look at the actual price chart of the most popular market silver price fund (SLV).

First we will look at just the last two weeks, when the "bubble" and the "crash" or bubble burst supposedly happened, if you believe the day-to-day headlines about silver in the financial news media.

Here's the actual chart of this supposedly wild action for the past two weeks:

And that's it!

From around 23.50, up to touching 28 at the peak, back down to around 24.50, and then a little higher from there. (Note: these price values of the SLV fund are about a couple dollars lower than the market spot price of an ounce of silver itself.)

So this was not some massive bubble after all, nor was it a massive crash or bubble burst when it came down.

It was just a short spike up and down.

To make real sense of the price action and the sustained trend in the silver price, we need to look at a longer-term chart.

And in fact an objective review of such a chart will show that the silver price trend remains quite healthy and bullish even after the short spike up and down. For a good perspective on this, here is the 12-month chart of SLV:

The main indicator of the long-term trend is the red line, the 200-day moving average.

It's sloping upward, a healthy and bullish sign.

The blue line is the 50-day moving average, and it's steadily above the red line, another healthy and bullish sign. Finally, after all the up and down action of the past two weeks, the SLV share price itself remains in a perfectly healthy position above both the 200-day and 50-day moving averages.

This is not at all what a bubble and burst looks like.

Actual Physical Silver Price:

$37 to $43 per Ounce

You have probably read about the difference between the financial market price of silver (the current "spot price" and the futures prices) and the higher actual price of physical silver, such as the popular silver coins like the American Silver Eagle.

Last weekend, many major silver coin sellers and dealers actually ran out of their supply of physical silver coins, a reflection of the strong retail demand in this market.

In this section I want to illustrate the actual meaning of the "higher physical price of silver" in a way that readers can see and understand. To do this, I present below a review of leading online silver coin dealers, which will show that the actual price of physical silver is at least $37/ounce and often higher.

To find these physical silver coin prices, I simply did a basic Google search of "buy silver coins" and looked at the websites of the top online silver coin dealers that show up at the top of the first page of search results.

Disclaimer: The following screenshots of American Silver Eagle coin prices, as of midday Friday, February 5, are for illustrative purposes only. I am not making any recommendation or endorsement of any particular coin dealer. Neither is my intent to make a price comparison between the dealers below. The exact price of each item can depend on multiple factors, some of which may or may not be reflected in each particular screenshot below. Rather, the point is to show the overall range of prices for these American Silver Eagle coins from a variety of several prominent dealers in this market.

In each case below, I have strived to find the lowest price for any American Silver Eagle 1 ounce coin that each dealer has in stock and offers for sale.

Example #1: The dealer shows a silver spot price of $27.24/ounce, but the 1 ounce American Silver Eagle coins are priced "as low as $37.24" or "as low as $38.74":

(Source: sdbullion.com)

Example #2: The dealer shows a silver spot price of $27.24/ounce, but the 1 ounce American Silver Eagle coins are priced "as low as $37.99" or "as low as $38.00":

(Source: moneymetals.com)

Example #3: The dealer shows a silver spot price (ask) of $27.06/ounce, but the 1 ounce American Silver Eagle coins are priced "as low as $38.25" or "as low as $38.85":

(Source: jmbullion.com)

Example #4: The 1 ounce American Silver Eagle coins are priced from $39.17 up to $42.89, depending on the volume of coins purchased and the method of payment:

(Source: apmex.com)

(Please note: The other dealers may also have similar price variations based on the volume of coins purchased and the method of payment. I am showing this example here as an illustrative example only.)

Here we see how the price for a 1 ounce physical silver coin, the most basic and popular American Silver Eagle - not a special rare or antique coin with any extra markup value above and beyond its 1 ounce silver content - can be as high as almost $43, if purchased in a quantity below 20 ounces and by credit card or PayPal.

Investors and traders should keep these actual physical silver coin prices in mind, as you consider the true value of silver in the market today.

A spot price below $30/ounce can be very misleading, when the actual physical silver prices are $10/ounce or even $15/ounce above the financial market spot price.

0 comments:

Publicar un comentario