China’s Economy Did Well in 2020. The U.S. Economy Did Not, but It’s Better Off. Here’s Why.

By Matthew C. Klein

This aerial photo taken on on May 8, 2019 shows a port in Lianyungang in China's eastern Jiangsu province./ STR/AFP/Getty Images

The numbers are in—China’s economy grew 2.3% in 2020 while the U.S.’s shrank about 3.5%—and they’re misleading.

Despite the extreme divergence, the U.S. economy performed better by many of the most important measures. That’s all the more impressive considering China’s superior handling of the coronavirus pandemic that originated in Wuhan.

The upshot: The U.S. should be in better shape as the world recovers in the years ahead.

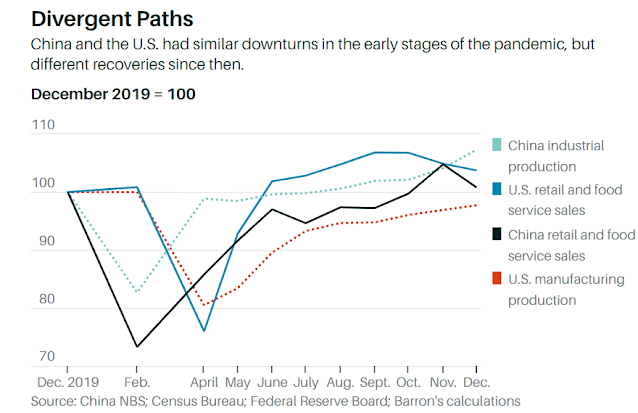

The initial impact of the virus was almost identical everywhere, with economic output falling 20% to 30% before gradually recovering. But the recoveries in each society have differed depending on how each government responded to the economic hit from the virus.

In China, the government refrained from helping workers and ordinary households directly.

Instead, the government supported politically connected businesses and local governments through cheap credit and helped exporters by intervening to prevent the currency from appreciating.

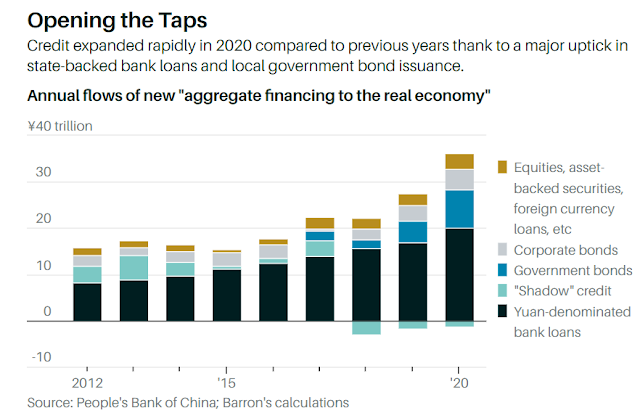

Total “aggregate financing to the real economy” rose by 35 trillion yuan (around $5.4 trillion) in 2020, compared with 26 trillion yuan in 2019 and just 19 trillion yuan in 2018.

The uptick was driven by state-backed bank loans and by a surge in local government bond issuance.

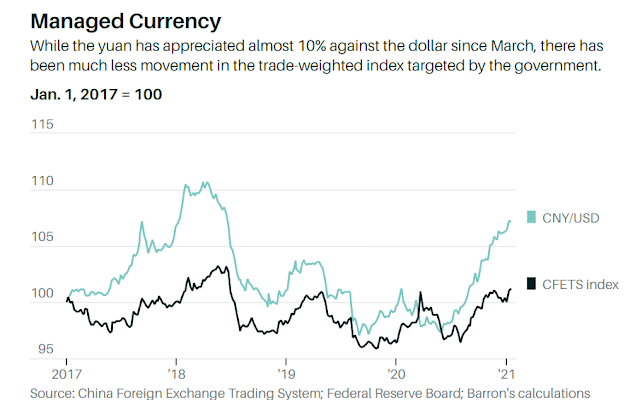

At the same time, Chinese state-controlled banks and the People’s Bank of China have been aggressively purchasing foreign assets, almost certainly to manage the exchange rate.

Since April, the big banks have bought $137 billion of foreign assets and repaid $20 billion in foreign debts, while the PBOC itself has added $234 billion in foreign exchange assets.

In other words, Chinese government-connected entities have bought nearly $400 billion in foreign currency in the space of eight months, or almost $600 billion at an annual rate.

That’s substantially higher than the rate of reserve accumulation the PBOC reported in the peak manipulation years from 2006 to 2011.

Thus, even though the yuan has gained about 10% against the dollar since the pandemic began, it’s been essentially flat against the trade-weighted basket that the government targets.

Absent any intervention, China’s currency would have appreciated far more against the currencies of its trading partners to reflect the decline in the prices of commodities that China imports and the Chinese government’s relative success at containing the pandemic.

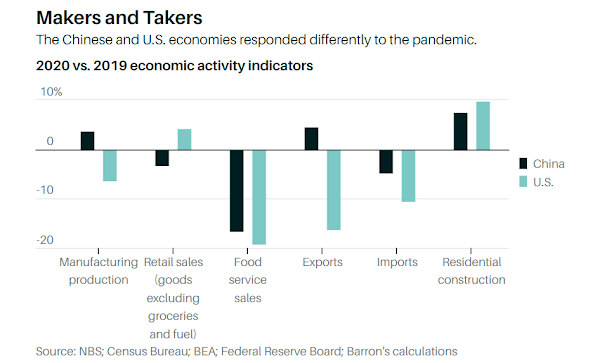

The result is that China’s recovery was led by residential construction (up 8%), infrastructure spending (up 5%), and exports (up 5%).

But household consumption lagged far behind (down 4%) because the government preferred to let the tens of millions of migrant workers who lost their jobs return to the countryside and live as subsistence farmers rather than offer urban unemployment benefits.

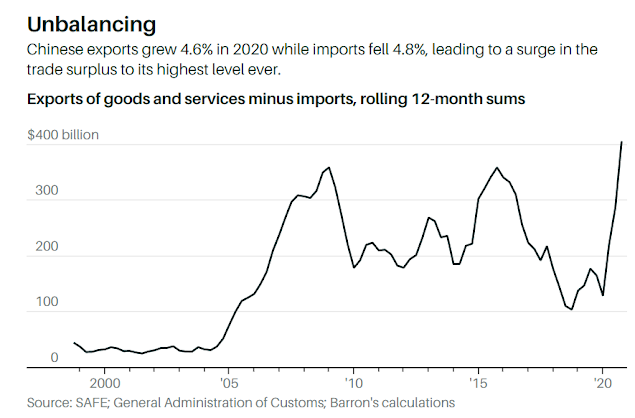

The divergence between the Chinese government’s support of its producers and neglect of its consumers caused the country’s trade surplus to widen to its highest level ever by a wide margin.

Yes, the collapse in the number of Chinese traveling abroad due to the pandemic and the decline in commodity prices have hit imports, but that isn’t a sufficient explanation.

After all, consumers who save money from deferred vacations should have more money to spend on other things, some of which may have to be imported. And Chinese exports are higher than ever. What’s the point of earning all that extra income from selling goods to foreigners if you won’t spend it on things you can’t make yourself?

It all makes for a striking contrast with the U.S. The American government provided enormous amounts of direct income support to households through one-off “economic impact payments,” enhanced unemployment insurance benefits, forgivable loans for businesses, and debt forbearance.

While much of this support was saved and used to bid up the prices of housing and stocks, the government aid was also used to finance purchases of consumer goods.

These policy differences were at least as important for the economy as the two governments’ handling of the pandemic itself. China had effectively eliminated the virus from within its borders by April, but experienced an almost identical decline in consumer spending at restaurants as the U.S., which has had almost half a million people die from the virus in three separate waves.

China’s success at controlling the virus was offset by its economic response, while America’s economic response helped cushion businesses from its catastrophic public health failures.

However, the failure of governments in the rest of the world—most notably, but not only, China—to provide similar support to their own people meant that U.S. exports and American manufacturing have underperformed, especially because the U.S. didn’t try to devalue the dollar to compensate.

As a result, America’s trade deficit has ballooned to its widest level ever.

Ultimately, China’s approach is less sustainable than the U.S. one. Relying on wasteful debt-financed investments and consumers in the rest of the world to keep your workers employed is dangerous, especially if those consumers—or at least their elected leaders—decide they would prefer to “decouple.”

Americans, by contrast, always have the option of producing more to meet their needs.

Chinese officials recognize this, which is why they have been so eager in recent months to promote their efforts to build a self-sufficient economy in part by encouraging consumption growth through “demand side reform.”

These efforts may eventually bear fruit, but the track record isn’t encouraging.

While Chinese leaders have been publicly discussing problems with China’s “unstable, unbalanced, uncoordinated and unsustainable” growth model since the mid-2000s, they haven’t managed to increase the relative importance of the domestic consumer market to the economy because that would require altering the distribution of political power within Chinese society—something the Communist Party’s elites are unwilling to do.

The U.S., for all its flaws, has greater flexibility to adjust without risking social upheaval.

0 comments:

Publicar un comentario