How the World’s Dullest Market Quietly Created a Synthetic Dollar Empire

Japanese government bills and deposits at the Bank of Japan have created large-scale dollar funding, which may help explain a puzzle in Chinese finance too

By Mike Bird

The trade in short-term Japanese government bills and deposits conceals a thriving world of dollar funding. / PHOTO: THOMAS WHITE/REUTERS

The trade in short-term Japanese government bills and deposits conceals a thriving world of dollar funding. / PHOTO: THOMAS WHITE/REUTERSThe Japanese government bond market is rarely considered interesting.

With yields literally pinned at zero, and trading practically nonexistent, it has limited appeal for discussion even among the most cerebral international investors.

But beneath the placid surface, the trade in short-term Japanese government bills and deposits conceals a thriving world of dollar funding, which offers hints about developments in China’s banking system too.

Foreign central banks’ deposits at the Bank of Japan have soared in recent years, jumping by the equivalent of more than $175 billion in the first quarter of 2020 alone.

Although those deposits dropped back in the second quarter, they remained 66% higher year-over-year.

In large part, the deposits reflect activity in the foreign exchange swap market, which Japanese financial institutions—banks, insurance companies and pension funds—have increasingly relied on to hedge their large overseas investments denominated in dollars.

In 2018, when the deposits were at just half their current size, Credit Suisse analyst Zoltan Pozsar explained the process: Institutions with dollars swap them for yen from Japanese firms.

Dollar-lenders profit from distortions in the currency swap market, which has typically offered a pickup since the global financial crisis.

Economists Ricardo Correa, Wenxin Du, and Gordon Liao dug into some of the processes at work in depth in a recent piece of research.

The lenders then park their yen in safe places: Deposits at the BOJ, or Japanese government bonds.

Japan’s balance of payments statistics reflect activity on the other side of the East China Sea too, as noted by Council on Foreign Relations economist Brad Setser.

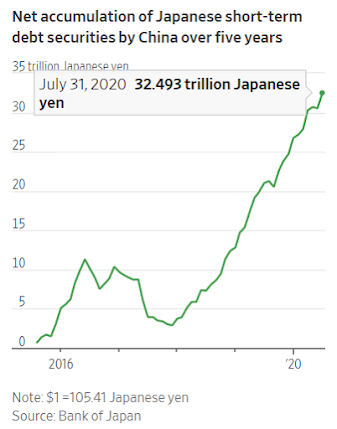

China has been the third-largest purchaser of short-term Japanese bonds in the past five years, snapping up more than 30 trillion yen, equivalent to about $285 billion, on net, narrowly behind France.

Both are distantly behind the U.K., reflecting London’s position as the world’s dominant center for foreign exchange trading.

That could go some way to explaining a China-related financial question: It offers a hint at why China’s largest state banks have seen their off-balance-sheet dollar assets rise relative to liabilities in recent years, while on-balance-sheet dollar assets are now outstripped by liabilities. FX swaps aren’t reported as balance-sheet assets.

The nexus between China, Japan and the U.S. dollar system bears watching. Precious little information is available from China, and data on the FX swap market is especially opaque.

Keeping a wary eye on potential vulnerabilities, even when difficult to identify, would be worthwhile.

0 comments:

Publicar un comentario