HSBC Has More Problems Than Covid-19

Linking East and West has been a good business for the Asia-focused bank, but it is getting harder to balance political priorities in its main markets

By Rochelle Toplensky

HSBC HSBC -4.72% was established to connect the West and the East. It has been a sound strategy for most of the past 155 years, but currently has the bank caught in a geopolitical web over which it has little control.

On Monday, the bank announced disappointing second-quarter results as a result of Covid-19-related provisions. Yet the fallout from the health crisis seems manageable compared with the political uncertainties HSBC faces in each of its main markets: China’s creeping control over Hong Kong, escalating tensions between Washington and Beijing, and the economic impact of Britain’s exit from the European Union.

It was a brutal quarter. Profits were helped by higher fixed-income trading revenue, but hit hard by lower interest rates and big provisions for loan losses—$3.8 billion in the quarter, with a warning that they could rise to $13 billion for the full year. The shares fell nearly 4% in morning trading.

Recently appointed Chief Executive Noel Quinn continues to restructure HSBC’s operations, pivoting toward Asia. In February, he announced an overhaul that included 35,000 job cuts and a promise to shift $100 billion in risk-weighted assets to Asia. Cost reductions are behind schedule, mostly because redundancies were paused in the second quarter. Mr. Quinn is considering how to move faster or do more, particularly in Europe and the U.S.

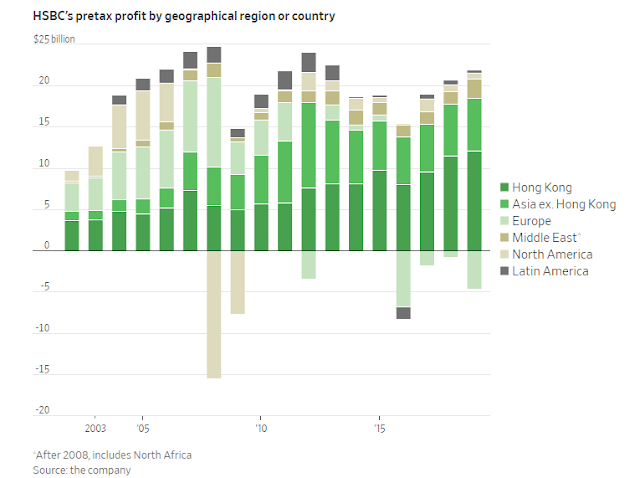

The bank has no choice but to focus on its Asian operation. It generates most of its profits, has the juiciest growth prospects and is very cost-efficient. In the first half, HSBC’s ratio of cost to income was 44% in Asia, compared to 101% in Europe and 73% in North America.

The company’s U.S. foothold is important as it provides dollar-clearing services to global clients, but U.S. retail operations are another matter. The lender continued its U.S. reorganization despite Covid-19, closing half of its branches in the country, primarily in the northeast. HSBC kept its west coast locations, which focus on wealthy clients often with strong connections to Asia.

HSBC’s shares have usually traded at a premium to European peers because of that eastern connection. The gap has shrunk recently as tensions have grown between Beijing, Hong Kong and Washington. The lender’s decision not to pay dividends this year, under extreme pressure from its Bank of England regulator, also upset retail investors in Hong Kong.

Financially, there are more tough times ahead, particularly as Covid-19 reemerges around the world. However, HSBC has a very solid 15% core Tier 1 capital ratio and, as a blue-chip player, traditionally attracts deposits in downturns. Although dividends aren’t expected until 2021 at the earliest, investors are unlikely to have to stump up additional capital.

The geopolitical questions are harder for HSBC to answer. The bank has traditionally been extremely discrete in its political dealings, but was recently forced to side publicly with China when the tensions over Hong Kong flared up. As Beijing becomes more assertive, and Washington finds unity in a hawkish stance on China, this seems likely to happen more.

European fund managers, who are paying more attention to “social” factors in their investment criteria than they used to, might start to see greater risk in HSBC. The geopolitical discount now battling with the stock’s traditional Asian growth premium could prove hard to shake.

Home

»

Banks And Banking

»

COVID-19

»

HSBC

» HSBC HAS MORE PROBLEMS THAN COVID-19 / THE WALL STREET JOURNAL

sábado, 15 de agosto de 2020

Suscribirse a:

Enviar comentarios (Atom)

0 comments:

Publicar un comentario