China: The Potential Bubble Of All Bubbles Should Be On Your Radar

Summary

Investors' focus on the markets largely is on COVID-19 containment efforts, the success of the economic restart and the upcoming election.

However, there is a massive housing bubble developing in China, the size of which dwarfs the levels of our housing market before the financial crisis.

We take a look at some key details of the growing bubble that should be on the long term radars of investors in the paragraphs below.

Before you embark on a journey of revenge, dig two graves." ― Confucius

There was a fascinating article late last week in the Wall Street Journal. It described in detail the huge potential property bubble that continues to form in China. All eyes right now on U.S. equities are focused on the COVID-19 containment and economic restart fronts, not to mention a huge election that is now just three and a half months away.

However, given what happened when the U.S. housing market started to collapse in 2007 and the ramifications from that implosion, this is something that should be on investors' longer term 'radars'. It is not something that should cause ripples in the markets this year and probably not next year, but this could be the next catastrophe in the making for equity and credit markets in the foreseeable future.

It is kind of like the classic scene in 1974's cult classic "Monty Python and the Holy Grail' where Sir Lancelot is charging the castle. He remains far, far off in the distance, and then all of a sudden he is right there slaughtering the guards.

To get a decent feel for the potential enormity of this bubble, I have pulled out myriad of factoids from Wall Street Journal's analysis below.

Factoids:

- At the peak of the U.S. property boom, about $900 billion a year was being invested in residential real estate. In the 12 months ended in June, about $1.4 trillion was invested in Chinese housing.

- The total value of Chinese homes and developers' inventory hit $52 trillion in 2019, according to Goldman Sachs Group Inc. This is twice the size of the U.S. residential market and more than even the entire U.S. bond market.

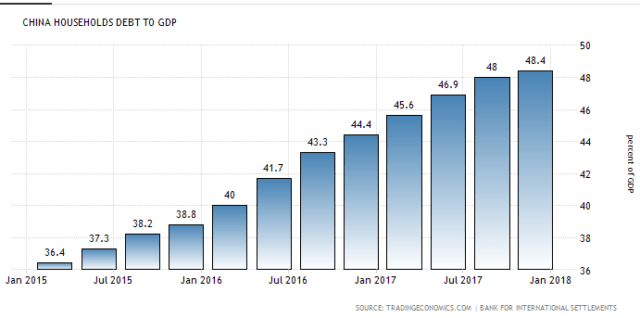

- China's household leverage ratio hit a record high of 57.7% in the first quarter. It was the biggest quarterly jump in the ratio since the first quarter of 2010 and far above levels of recent years.

- About 21% of homes in urban China were vacant in 2017 which equated to 65 million empty units, according to the most recent data from China Household Finance Survey. Among families who owned two properties, the vacancy rate reached 39.4%, and among those that owned three or more, 48.2% were empty.

- Rental yields are below 2% in major cities like Beijing, Shanghai, Shenzhen and Chengdu. 96% of China's urban households owned at least one home, according to a Chinese central bank survey released in April, far exceeding the 65% home ownership rate in the U.S.

- China accounted for around 57% of the $11.6 trillion increase in household borrowing over the decade through 2019, according to Bank for International Settlements data. The U.S. accounted for about 19%.

- In Tianjin, a city of 15 million southeast of Beijing, apartments in upscale areas sell for around $9,000 a square meter, or about $836 a square foot. That is roughly the price an average buyer would pay in some of the most expensive parts of London, even though disposable incomes are seven times as high in London as in Tianjin.

- Urban Chinese now have nearly 78% of their wealth tied up in residential property, versus 35% in the U.S.

Earlier last week there was also a good piece in South China Morning Post around authorities' growing concerns about a property bubble in China that best can be summarized by the opening paragraph of the article.

Chinese regulators have warned of heightened risks of an asset bubble in portions of the country's rapidly growing property market, as efforts to free up credit to support the coronavirus-stricken economy have been diverted into real estate"

Despite authorities' attempts to crack down again on China's 'shadow banking' system and cool the property market, it is hard to see how this turns out well. Local governments get over 50% of their revenue from land sales. One key reason that from 'the start of the year until July 6, real estate agency Centaline estimated that 50 cities, including Shanghai and Guangzhou, sold land to developers worth 2.39 trillion yuan, up 15.3 per cent over the same period last year'. China's property developers 'are among the biggest junk bond issuers in Asia, with issuance totaling $46.23 billion last year, double that of 2018, according to Refinitiv data' in a recent CNBC article.

There are also increasing tensions between China and the rest of the world around trade, Uighur concentration camps, the recent crack down in Hong Kong and the militarization of the South China Sea. It is hard to see relations improving in the coming years and global economic growth is likely to remain subdued until COVID-19 is defeated.

We have seen many bubbles over the past twenty years from the Internet Boom and Bust to start this century to the U.S. housing crisis that led to the Great Recession. Both of which were partly fueled by Federal Reserve policies. With central banks expanding their balance sheets in unprecedented ways and with sovereign debt yields near zero, who knows what bubbles we will see in the coming years.

This is one reason I continue to maintain a healthy allocation to cash in my personal portfolio and I am almost exclusivity putting new funds to work using covered call strategies utilizing long date near the money call strikes which provide maximum downside protection. This is the key reason we also established our 'option play of week' feature in the Biotech Forum in July of last year to teach and deploy these simple covered call ideas.

I am not saying the Chinese property market is going to fall apart this year or even next, but it seems likely at some point in the foreseeable future this will happen. It kind of feels like 2005/2006, a few years before our housing crash. Given Chinese housing market dwarfs the size of this country's, what will those ramifications be for global markets and economies? I, for one, don't want to find out but suspect we will at some point in the next few years.

The superior man, when resting in safety, does not forget that danger may come. When in a state of security he does not forget the possibility of ruin. When all is orderly, he does not forget that disorder may come. Thus his person is not endangered, and his States and all their clans are preserved." - Confucius

0 comments:

Publicar un comentario