There’s a way to make sense of this rally, as long as there’s a swifter economic recovery than anyone thinks posible.

By John Authers

Bad News? Buy Stocks

What’s going on? Stock markets were up almost everywhere to start the month. This was despite a list of bad-news items that might be expected to push down share prices in normal circumstances:

- China has paused imports of U.S. agricultural goods, which it undertook as part of last year’s “phase one” agreement to avert a trade war. This issue dominated international investing throughout 2019, when news as bad as this would inevitably have caused a major “risk-off” spasm.

- In Europe, doubts intensified over whether the potentially revolutionary package to allow common borrowing in response to the coronavirus will happen, or will make much difference in the short term if it does.

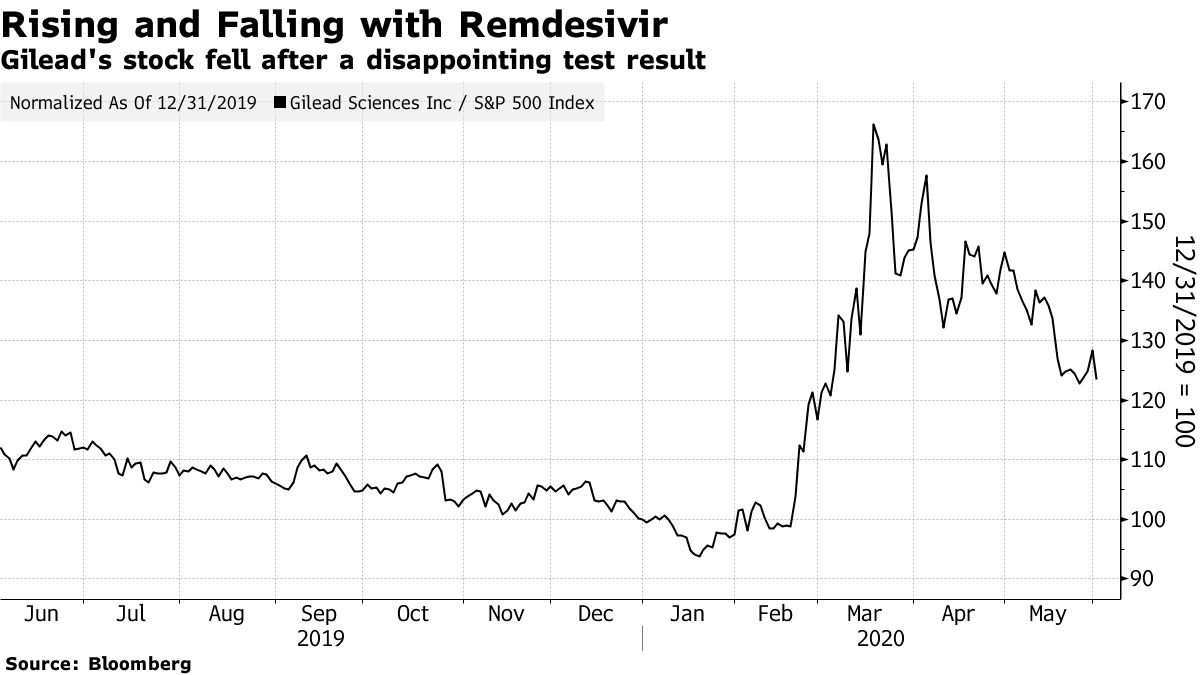

- Gilead Sciences Inc.’s share price took a sharp tumble after results showed that its Remdesivir drug might not be as useful in treating Covid-19 as had been hoped. Earlier in the pandemic, more positive results had not only sent Gilead’s share price soaring, but also lifted the entire market;

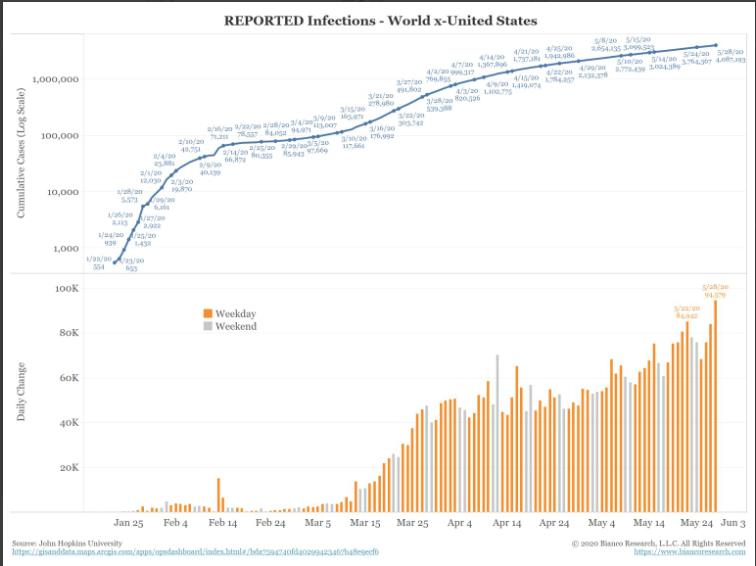

- Global Covid-19 infections, outside the U.S., hit a new record. Brazil in particular appears to be in a very dangerous position. The following chart is from Bianco Research.

- The rally in West Texas Intermediate crude paused as investors pondered whether meetings to thrash out a continuation of supply caps beyond the end of this month would happen on schedule. The breakdown of talks in early March triggered the worst week for the markets this year.

- The U.S. is currently undergoing a spasm of civil unrest on a scale not seen since at least 1968, the year of the assassinations of Martin Luther King and Robert Kennedy. New York City is under curfew as I write.

Add to all this that equities are rallying while most other asset classes are failing to confirm an expansion ahead. Bond yields and industrial commodities remain low; gold continues to sit at levels it hasn't seen since 2012.

We can mention all the usual caveats: Economic growth doesn’t correlate with stock market returns in the short run, and generations of equity investors have been conditioned to “buy when there’s blood in the streets.”

Still, a disconnect this extreme between nightmarish scenes on the streets of the U.S. and a global pandemic, on the one hand, and a continuing rally in the stock market, is something truly special.

This tweet, from a user who hides behind a pseudonym, sums up my own feelings almost exactly: “After watching markets for 25 years, I have to say, this is the most extreme disconnect I have ever witnessed with regards to price against P/E, massive unemployment and drop in GDP, riots, failing trade wars, frauds, income inequality, etc.”

Equity prices are dependent on future earnings, and on the interest rate we use to discount them. The rally in share prices is the product of well-founded expectations of higher corporate profits and low interest rates into the future.

Let’s look at how well this stacks up:

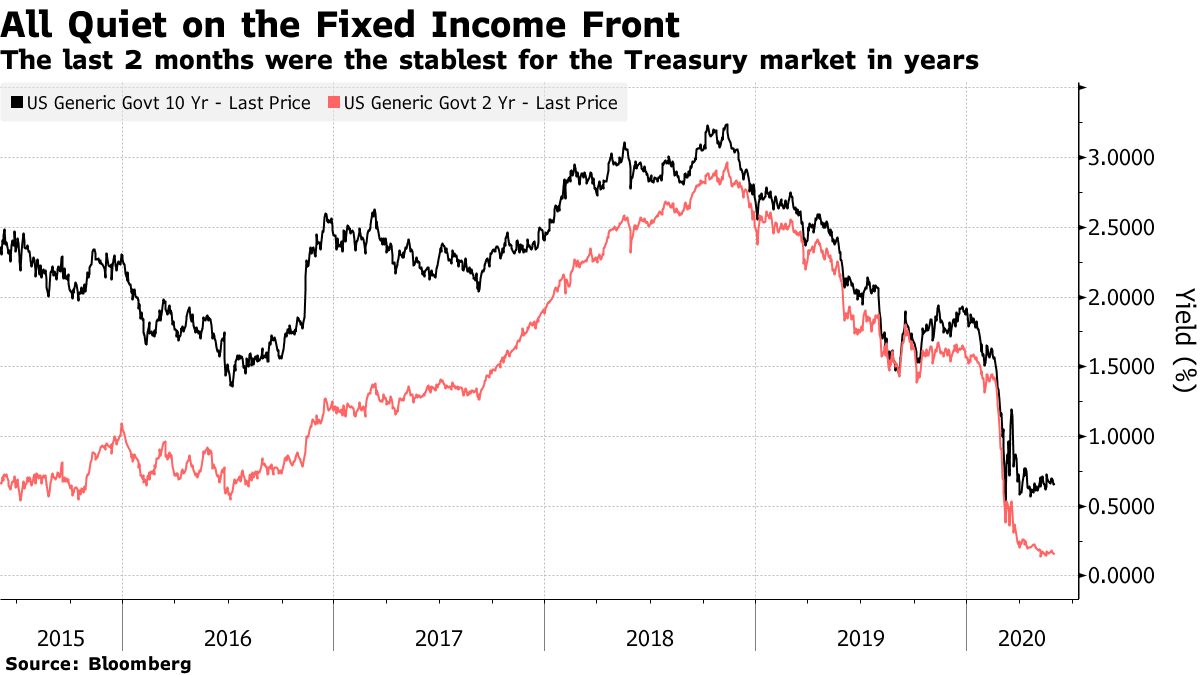

The Federal Reserve has made it known that it is actively discussing yield curve control — intervening to ensure that yields at particular points on the curve remain at a given low level. And, to quote my Bloomberg Opinion colleague James Bianco, “the market is behaving as though yield curve control is already taking place. 10-year yields have been stuck in a tight range for two months.”

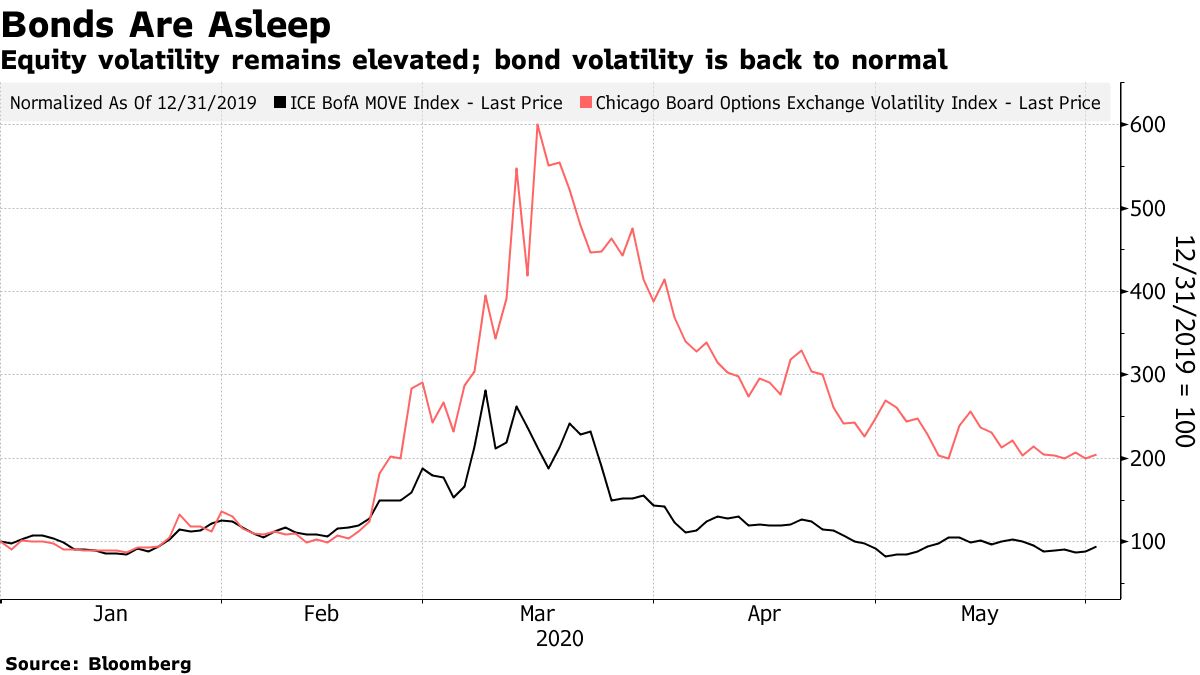

Bond volatility, as most popularly measured by the BofA MOVE index, is lower than when it started the year. Equity volatility, as measured by the CBOE VIX index, is still double the level at which it started the year. In such alarming and uncertain circumstances, low yields aren’t surprising; such steady and unmoving yields are remarkable:

So investors are making a clear bet that the next few years will see financial repression — deliberate intervention to force the public and the corporate sector to lend money to the government at uneconomically low interest rates. This has happened before, notably in the years after World War II. In such conditions, equities can be relied on to beat bonds.

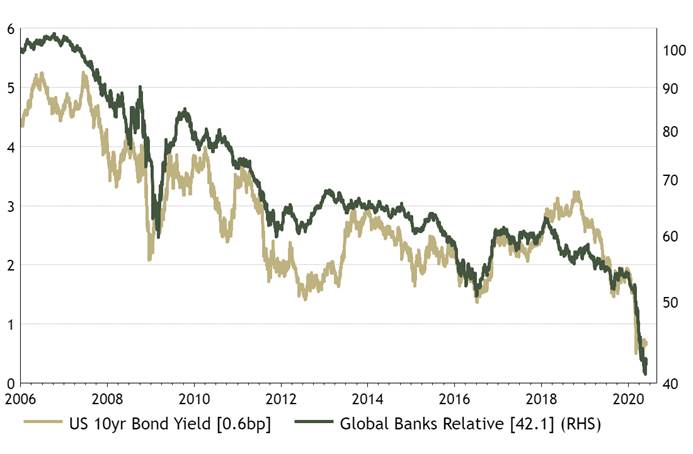

There is also the problem that, to quote Ian Harnett of London’s Absolute Strategy Research Ltd., “financial repression means repression of financials.” A forcibly flat yield curve makes it very hard for banks to make money. And if banks aren’t making money, it grows harder for them to extend credit and fuel economic growth. Repression may be a relatively painless way to pay for the money the government had to throw at the coronavirus problem; it doesn’t augur well for growth or a vibrant stock market:

Future Earnings

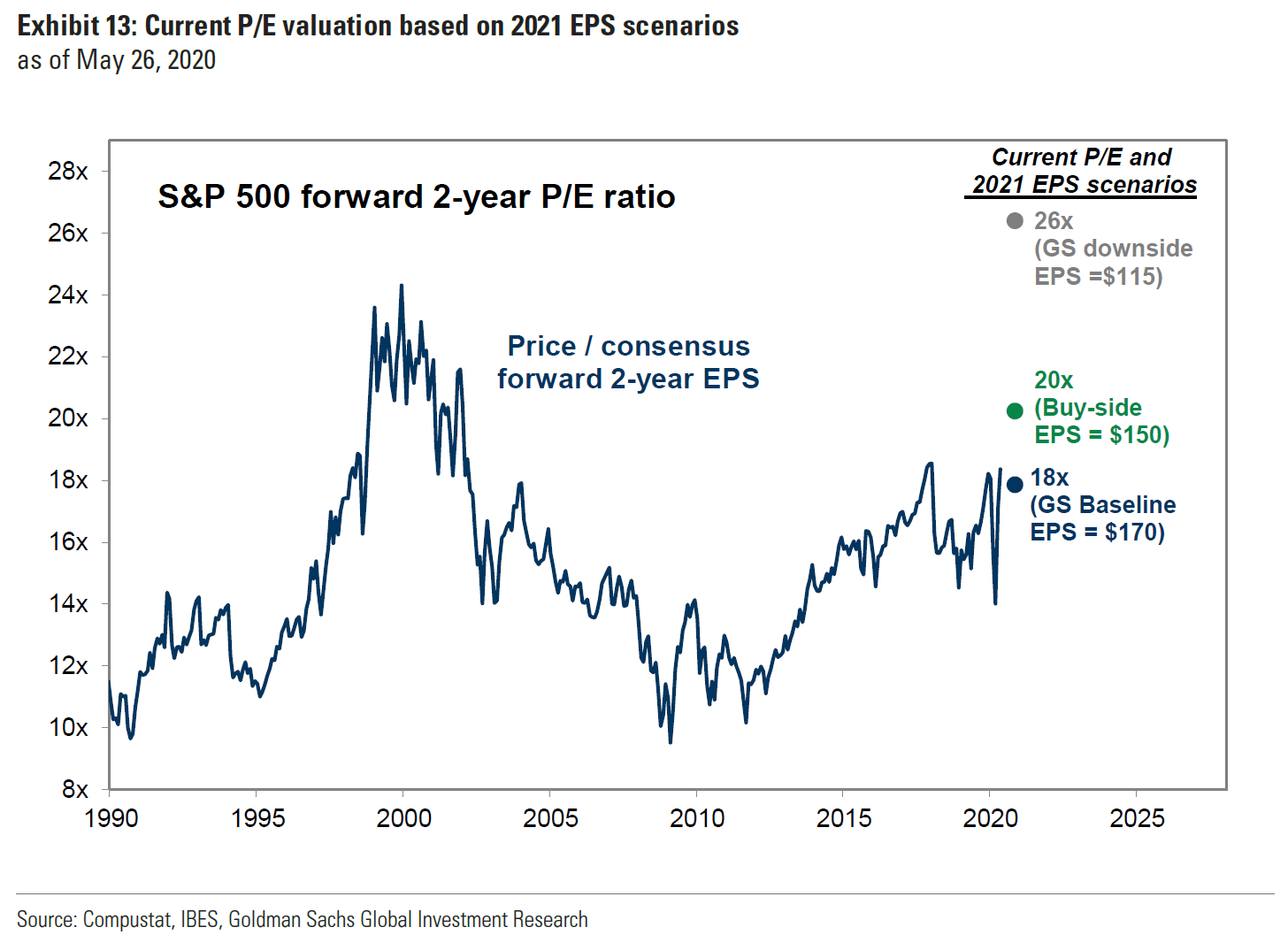

As I have pointed out before, prospective earnings, as in the multiple of expected earnings for this calendar year, are close to the all-time high set at the height of the dotcom bubble. This is somewhat misleading, though. Everyone knows this year’s earnings will be terrible. A very high multiple of this year’s earnings can be justified if there is valid confidence in a rebound next year.

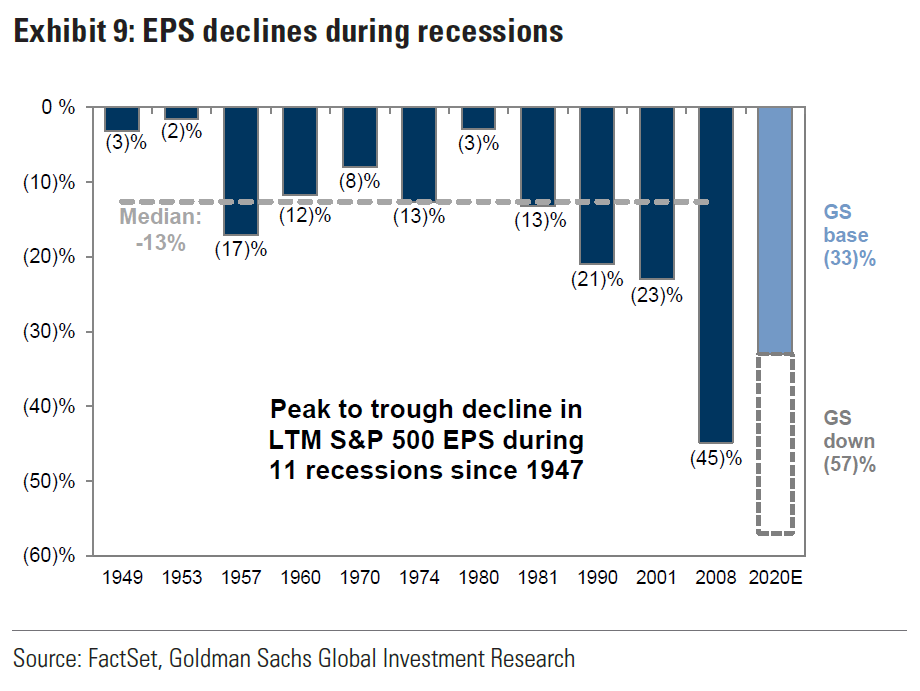

If we look at past nosedives, a V-shaped recovery doesn't seem so unlikely. These numbers come from David Kostin, chief U.S. equity strategist at Goldman Sachs Group Inc. This is what happened to U.S earnings during previous postwar U.S. recessions, along with Goldman’s base and worst-case scenarios for the current one:

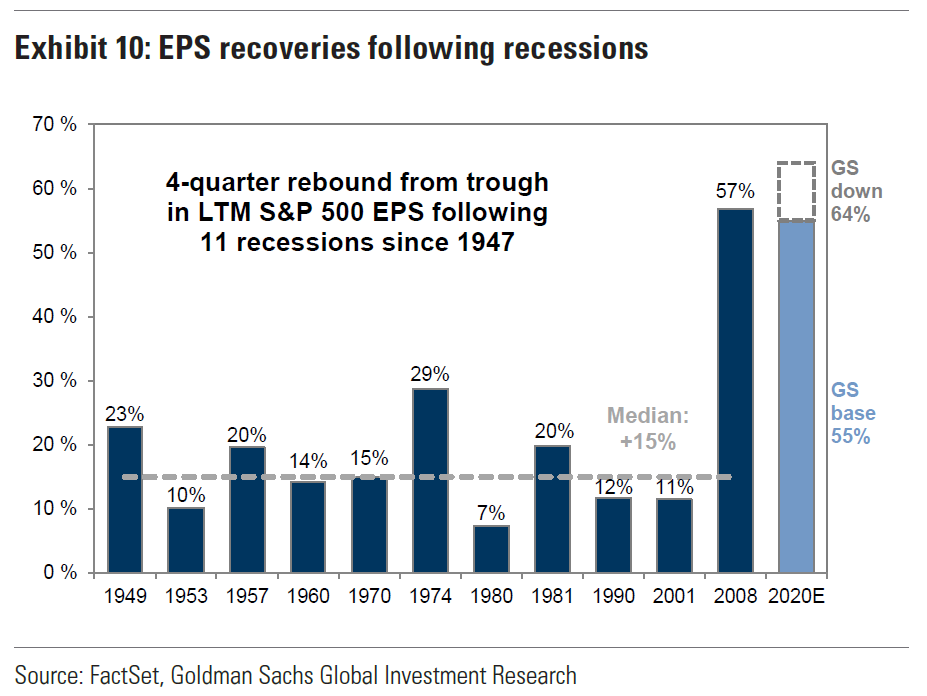

And this shows us the subsequent recoveries. After falling an average of 13%, earnings bounced back by 15% over the next four quarters, essentially forming a perfect V:

If next year’s earnings turn out to be in line with Goldman’s baseline forecasts, then the market is trading at a high but reasonable 18 times 2021 earnings. It is higher than that if the more bearish estimates from buy-side firms are right; and at an all-time high of 26, significantly above even the worst excesses of 2000, if the worst-case scenario is correct.

So the market is plainly working on the assumption that things will turn out about as well as can reasonably be expected:

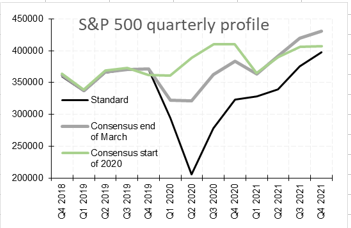

Markets are indeed braced for an almost perfect V-shape, based on how expectations for standard consensus earnings have moved this year, as this chart from Andrew Lapthorne, chief quantitative strategist at Societe Generale SA, shows. By the end of next year, earnings will be higher than they were in 2019, and barely any lower than was expected at the end of March:

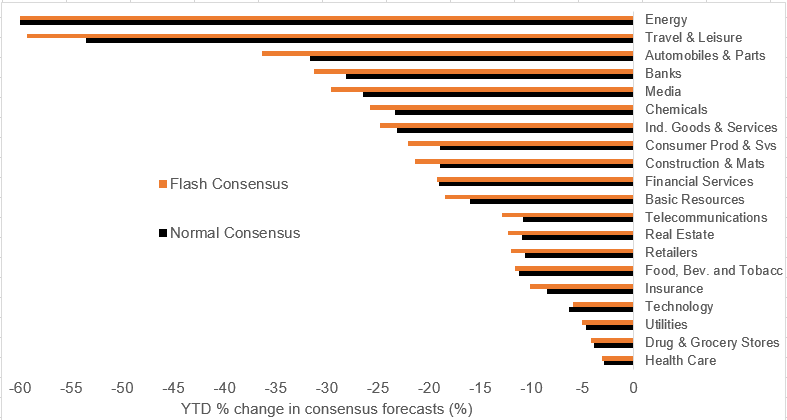

Breaking this down further, however, Lapthorne also looks at “flash” estimates — those most recently changed, and which presumably most fully take into account all the information now available. This is a relatively quiet time for revisions, as the first-quarter earnings reporting season is over, but the picture is clear.

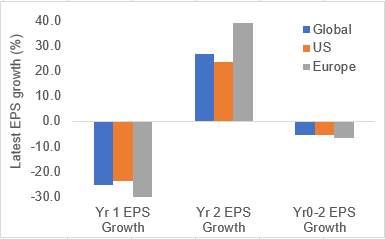

Markets are braced for horrendous growth this year, particularly in Europe, and a strong rebound in 2021, again particularly in Europe. Overall, it looks as though earnings are expected to be a bit more than 5% lower next year than in 2019. This makes the fact that the S&P 500 is now higher than it was at any point in the first 10 months of last year a little difficult to explain, low interest rates or no low interest rates:

For a more dramatic presentation of how estimates have moved, this chart shows both the overall consensus change and the flash revision. Technology and a few defensive sectors are relatively unscathed, but expectations for many more economically sensitive sectors are still savagely reduced.

This means there is room for a recovery, though estimates for some sectors are continuing to fall. If the market is also banking on yield curve control to keep rates low, it is hard to see how dreadful falls in earnings like this can be avoided for financial sectors.

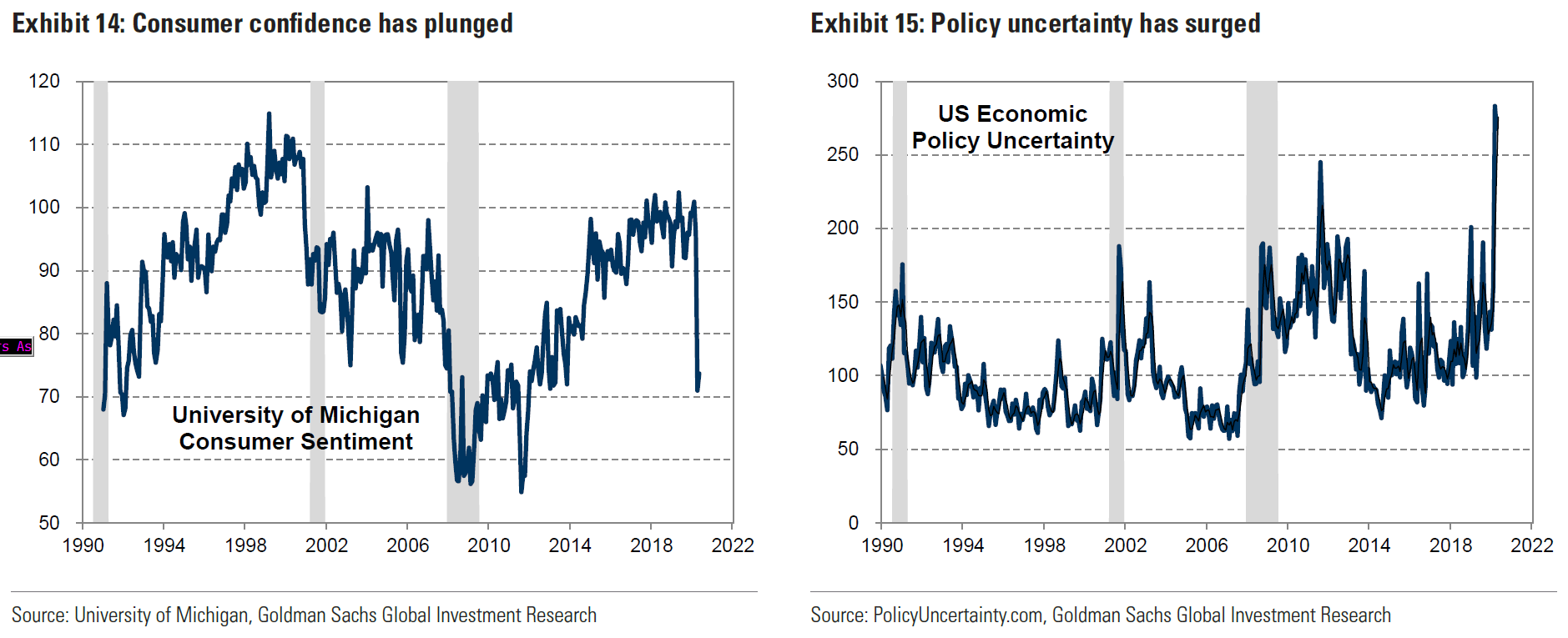

All of this is against the backdrop of a market that entered the crisis looking expensive, and of very high policy uncertainty, coupled with very low consumer confidence. It does look as though reopening in the U.S. is happening relatively smoothly thus far, in terms of the number of coronavirus cases if not in terms of the situation in the streets.

If it turns out that we can put the virus behind us much sooner and more completely than many experts have led us to believe, then there is a decent chance of doing better than these earnings numbers, in which case the current pricing won’t look mad. But it is a narrow route:

Kostin has a diplomatic way of putting this which I think makes sense:

From a fundamental perspective, we believe the current index level implies expectations of an achievable but optimistic path of normalization, and that meeting that expectation would validate the existing market level rather than push it substantially higher. At the same time, numerous medical, economic, and political risks dot the investment landscape.In other words, this market isn’t quite as utterly crazy as it might look at first. But it is priced for perfection amid conditions of extreme uncertainty, and risks are almost all to the downside.

The most likely way for this disconnect to be resolved is by share prices falling again. Let us all hope that it is resolved by a swifter recovery from the lockdown conditions and in the economy, than anyone now thinks possible, ideally coupled with a historic resolution of America’s deep problem of racial injustice.

The latter alternative looks less likely.

It’s a charming but also an inspiring and surprising story. If they could overcome some of the horrible disabilities that nature had forced on them, then the rest of us can put up with being cooped up inside.

0 comments:

Publicar un comentario