Victor Dergunov

Summary

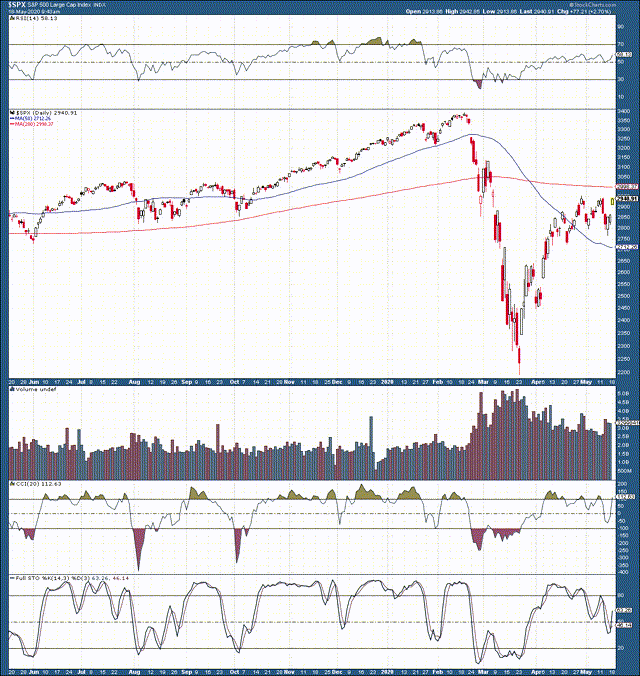

• The S&P 500 is currently at an inflection point, as the major average trades in a tight range of 2,775 - 2,950.

• Fed Chair Powell said that the recovery will likely take "some time" and that the recovery process could drag on through 2021.

• Fed "stimulus" may have prevented an all-out meltdown in equity markets but it's not likely to improve consumer confidence/spending, or prevent corporate profits from declining precipitously.

• Coronavirus is not going away any time soon, possibly ever, and the economy is confronted with unprecedented uncertainty.

• There are some bright spots in the market, but the S&P 500 could decline to 2,500 or lower going into what's likely to be an atrocious Q2 earnings season.

• Looking for a portfolio of ideas like this one? Members of Albright Investment Group get exclusive access to our model portfolio. Get started today »

Last week was choppy, with the S&P 500/SPX (SP500) unable to break above the crucial 2,950 resistance level. On the bright side, SPX bounced off critical support at around 2,775 – 2,800. Other bright spots in the market included the gold, silver, mining/GSM sector, Bitcoin and digital assets, as well as oil. This week is going to be vital, as we are going to see whether markets can continue to climb higher, or if further weakness in equity markets can be expected.

What to Expect From the Equity Market

The SPX is at an inflection point as it's trading in a crucial trading range, roughly 2,775 – 2,950. Q1 is in the books, and earnings for the quarter were largely as expected. However, Q2 is likely going to be far worse. A lot of the upcoming bad news for Q2 is largely priced in to markets, but so is much of the Fed and government-backed stimulus. What's not factored into the stock market right now is a far worse than expected Q2, coupled with a slower than anticipated H2 and a slower than expected 2021.

One of the key takeaways from Fed Chair Powell’s 60-minute interview was his quote that “The recovery may take some time; the economy could take through 2021 to recover.” This implies that the Fed Chair is skeptical that there will be any sort of a V-shaped recovery going forward, and this is logical as COVID-19 shocks are likely to be felt throughout the global economy for many months. With various sectors of the economy starting to reopen for business we already are seeing upticks in COVID-19 infections in various states.

Fed Chair PowellImage Source - Yes, a sustained recession is starting to look more and more likely…

The Novel-coronavirus/COVID-19 is here to stay, and future “waves” are very likely going to disturb economic activity, surpass consumer spending/confidence, and weigh on corporate profits going forward.

This fall’s flu and cold season is likely going to be especially difficult as the addition of the Wuhan virus to this equation could cause another wave of pandemonium around the globe.

Additionally, we may not see a viable vaccine for some time, and effective treatments for the virus remain in question. There is news of a possible vaccine breakthrough from Moderna (NASDAQ:MRNA) this morning, but it's still extremely early to say whether this will ultimately be a hit or miss on the vaccine front.

To complicate matters further, there's now debate on whether an effective vaccine is even possible for the continuously mutating virus. This creates a great deal of uncertainty, and in these extraordinarily uncertain times markets are likely to remain volatile and could experience another substantial leg lower during the summer.

The S&P 500 Breakdown

On factor to keep in mind is that no one truly knows how awful Q2 earnings will be, but I'm convinced they are going to be atrocious. For many, possibly for most firms, Q2 results may be far worse than is currently suggested by consensus estimates. Therefore, we are likely going to see another major leg down in the markets. The downturn can begin at any time throughout Q2, and will likely bottom going into Q2 earnings season. The bottom line is that for most companies, revenues and earnings will likely decline substantially. Furthermore, it's unknown when a sustainable recovery will occur, and what revenues and earnings will look like in the “new normal.”

S&P 500Image Source

We can see that the SPX has failed twice at the 2,950 level. The chart also is starting to look increasingly bearish. We have what appears to be a double top around the 2,950 level inside a developing head and shoulders pattern.

The first key level from here is 2,900. The SPX needs to trade and close decisively above 2,900 to keep technical momentum from deteriorating notably. If the SPX can make a sustainable move above 2,900 in future sessions, it then needs to retest and breakout above 2,950. This would be an ideal scenario, but given the fundamental and technical factors at hand it seems likelier that the SPX will attempt to move higher but will likely fail around these crucial resistance points.

Therefore, the next move could be lower, and it could be notably lower from here. I'm watching the neckline at around 2,775, and if this level gets breached we may see SPX move down precipitously to around the 2,650 point. This is the next level of support, and if it breaks, SPX could be headed back down to around 2,500 or lower. It’s too early to discuss lower levels, but we will cross that river once we get there.

Why the recent rebound?

We had a strong rebound on Thursday, with a slight follow-through on Friday, and now we see futures trading higher today (Monday morning). We hit a critical technical level (2,775) on Thursday, and it drew in a lot of buy interest, thus a lot of people got drawn into this market. This may very well be a “sucker rally,” therefore, if the market begins to show signs of weakness during today’s session it's likely a good idea to take profits around the highs and exit certain positions. By certain positions I'm referring to most cyclical names, and most stocks in general outside of the GSM and possibly the biotech/pharma sectors.

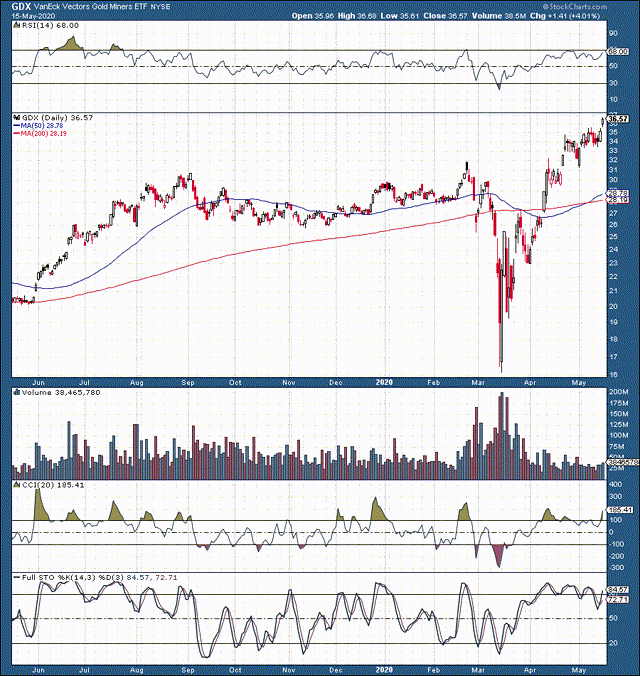

The Bright Spots in the Market

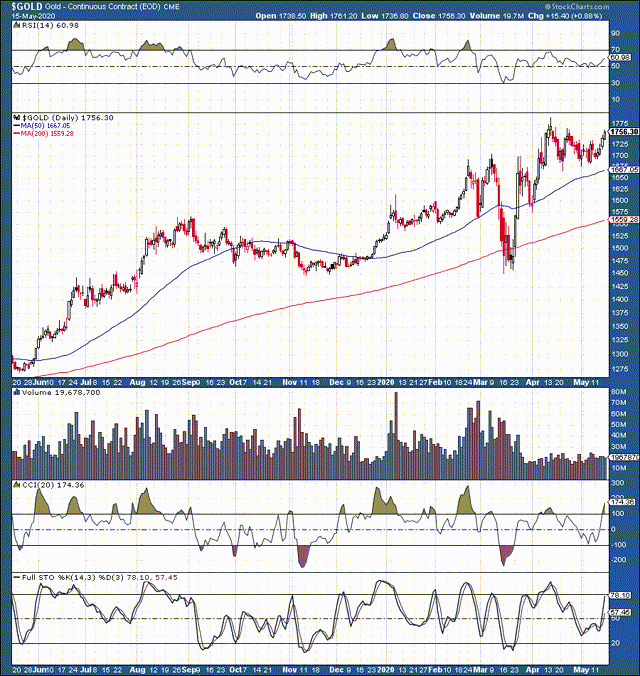

GoldImage Source

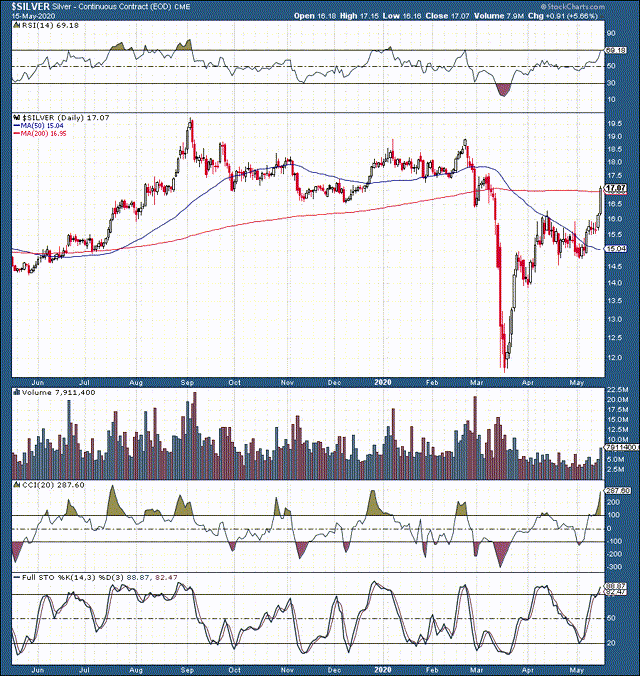

The main bright spot remains the GSM sector. Gold is approaching all-time highs and silver is up by 4.26% at the time of writing this article. This is on top of an explosive 5.66% move higher on Friday in silver.

What can I say, silver is on fire, the gold to silver ratio has declined from a historic high of 125 to around 100, and silver is likely to continue with its outperformance going forward.

Silver

Gold

Gold Miners/GDX

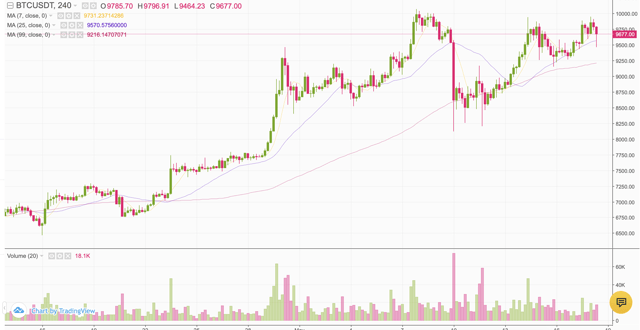

Another bright spot in the market continue to be Bitcoin and digital assets. Bitcoin has appreciated significantly since bottoming at around $6,500 about one month ago.

In fact, the digital asset has surged by around 50%, and is on the verge of breaking out above the critical $10,000 resistance point.

Bitcoin is not alone, as other key digital assets also are on the move higher with many making significant moves off their recent lows.

Why GSMs and Digital Assets are Outperforming

Another key point that jumped out at me during the Fed Chair’s interview was his assertion that the Fed was not out of ammunition “not by a long shot.” When Jerome Powell was asked what kind of ammunition the Fed had left, the Fed Chair mostly spoke about printing more money, Jerome Powell said that the Fed “prints money digitally, and that the agency also prints money physically.” In other words, the Fed seems ready to expand the monetary base indefinitely. There's also the option of negative rates but it does not appear that the Fed is quite ready to implement this policy right now.

However, all this boils down to an enormous amount of new currency in the market, digital or physical, it doesn’t matter. The price of gold has an extremely close correlation with monetary base expansion, and silver typically goes in the direction of gold.

Gold and silver miners make more revenues and earn higher profits as prices of gold and silver go up. Bitcoin and other systemically important minable digital assets are essentially inflation proof as there is a set number of coins (21 million for BTC, etc.) that can ever exist in circulation.

In addition, as fiat currencies continue to debase around the globe, gold and digital currencies become more attractive due to various factors, demand increases, and prices go up.

The Bottom Line

Despite an impressive gain of roughly 32% form the May low, the SPX and stocks in general are confronted with enormous uncertainty going forward. The Fed’s “stimulus” prevented an all-out meltdown, but the agency may not be equipped to continuously prop up consumer spending, prevent corporate profits from declining notably, and enable the economy to return to business usual any time soon.

Therefore, stocks are not immune from further losses, and a significant leg lower to around SPX 2,500 seems like a plausible scenario this summer.

Also, there is the enormous debt burden to address. With the national debt at well over $25 trillion, the actual federal budget deficit at around $3.25 trillion, national debt to GDP at 118.5%, and total debt to GDP at 134% a return to a “normalized” higher rate environment is not likely. In fact, the debt picture is likely to only get worse from here.

Thus, we can expect lower than average economic growth in the future, even after the CV situation gets resolved. On the bright side, the ever-expanding monetary base and perpetual fiat currency debasement should continue to serve as a catalyst for higher GSM and digital asset prices going forward.

0 comments:

Publicar un comentario