Whistling Past The Graveyard

by: Eric Parnell, CFA

Summary

- The stock market rebound continues.

- Focus on quality with stock allocations.

- A key near-term downside risk looms ahead.

- Focus on quality with stock allocations.

- A key near-term downside risk looms ahead.

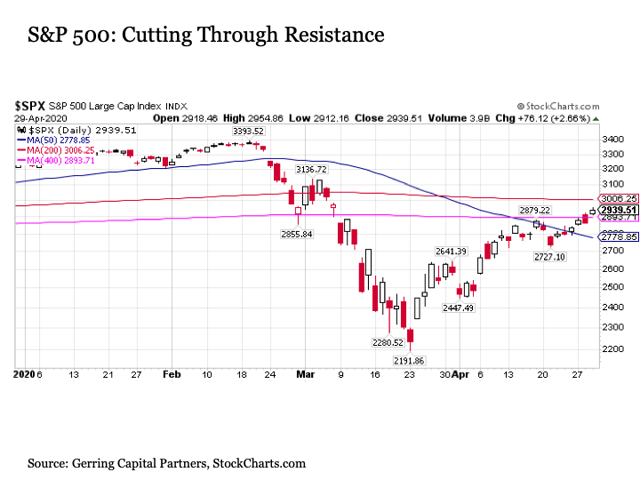

The U.S. stock market continues its remarkable rebound. The S&P 500 Index has now rebounded by a +35% from its March 23 lows nearly six weeks ago. In the process, it is increasingly showing the same post Great Financial Crisis (GFC) swagger that so many investors have become so accustomed over the last decade. New all-time highs straight ahead?

Maybe. We can't rule anything out. But regardless of how well the stock market may be performing as of late, it does not mean that the underlying challenges confronting the economy and markets have gone away.

Like a hot knife through butter. The S&P 500 first arrived at key resistance zone between 2800 and 3000 more than a week ago now on April 17. This range contained three key technical resistance levels in its 50-day, 400-day and 200-day moving averages.

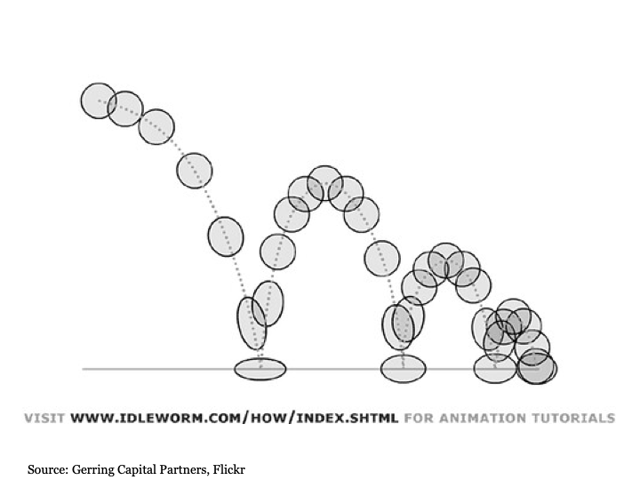

Historically during the start of major bear markets over the past century, stocks have rebounded following an initially sharp correction, only to see these bear market rallies frequently fail and roll back over at these key resistance levels.

As a result, monitoring how the S&P 500 responded once arriving at these key resistance levels has been critically important in recent days. And what we are seeing so far is that the S&P 500 is making quick work in clearing these critical technical levels so far.

After initial hesitation, the S&P 500 advanced through its 50-day moving average late last week. And on Wednesday, the benchmark index quickly advanced past its 400-day moving average with barely a pause. The remaining hurdle among this resistance trio looms ahead in the 200-day moving average just above 3000.

While it remains to be seen whether the S&P 500 can clear this third test, the manner in which it has been advancing in recent days suggests that it may make equally quick work of driving past its 200-day moving average resistance as well. From there, the next major stop for the S&P 500 is at previous all-time highs.

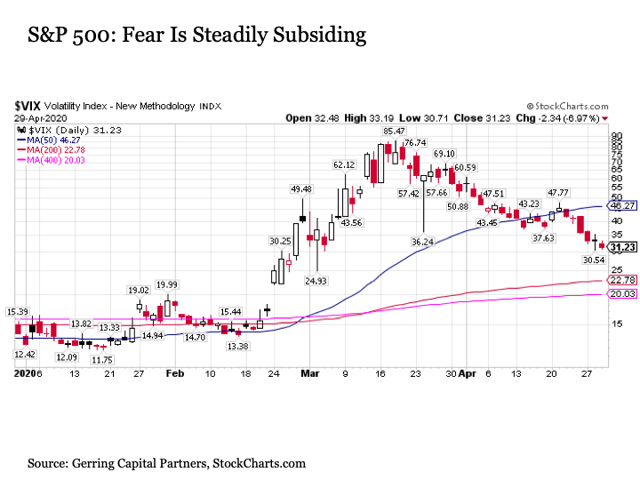

The steady decline of the CBOE Volatility Index, or the VIX, provides added support to the notion that the next move for the S&P 500 may be higher instead of lower as it cuts its way through resistance.

Whistling past the graveyard. The fact that the S&P 500 Index has been performing so well for so many weeks now since bottoming on March 23 is extraordinary in the context of what is taking place in the world outside of Wall Street. While the strong rebound in stocks thus far is not at all surprising from a technical perspective (stocks historically have almost never gone down in a straight line even in the worst of bear markets; they almost always rebound with a comparable pace to the preceding correction), it has virtually nothing to do with fundamentals.

The economy has effectively ground to a halt for more than a month and a half and counting.

Corporate earnings projections are being slashed on a daily basis, and the clarity on forward guidance is virtually nil as most corporations really have little idea how things are going to play out from here. Sure, selected companies like Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX), and Zoom (NASDAQ:ZM) have been thriving during COVID-19, but these are the selected exceptions and not the norm.

And all of this fundamental deterioration is taking place at a time when stocks were already trading at historically peak valuations and are becoming increasingly more expensive with each passing day as the "P" in the P/E ratio continues to rise at the same time that the "E" implodes. Dangerous is apparently still the S&P 500's middle name.

So what explains the rally? I mean, what rational fundamental investor when looking at a market where the underlying economy is stalled and corporate earnings are collapsing with a multi-year outlook that is about as clear as a foggy day in San Francisco and stock prices that are already about as expensive as they have been in history wouldn't want to be backing up the truck to buy stocks day after day after day, right?

Umm. . . While we did see positive net inflows from retail and institutional investors into domestic equities totaling +$30 billion over the three week period ended April 15 according to the Investment Company Institute, overall domestic equity fund flows since the market bottom have been marginally negative at around -$2 billion in outflows.

In short, it's not the retail or institutional investor that is driving the rally.

Of course, the source of the rally is no secret. It is NOT the twisted-into-pretzel explanations that I've been increasingly hearing lately in the financial press including the one that I am listening to right now as I type trying to rationalize the rally.

Today's stock gains day after day after day are simply just not being driven by some notion of what earnings are going to be in 2021 or 2022 or 2025, because this is almost impossible to predict right now. Instead, the answer is the same answer it has been for the last decade. It's the Fed.

The U.S. Federal Reserve has expanded their balance sheet by an incredible $2.4 trillion over the past eight weeks. And this liquidity spillover is likely to continue for the foreseeable future.

Whether it will continue to be enough to power stocks higher as economic conditions continue to deteriorate and corporate bankruptcies continue to mount remains to be seen. But investors should be fully cognizant of the fact that stock market gains to date and further gains from here will be heavily dependent on central bank liquidity continuing to drive stocks higher despite the deeply bleak underlying reality.

FOMO? The more the stock market continues to climb, the greater the anxiety accumulates among investors that may look at the fundamental reality and think that the stock market is crazy, but at the same time are asking themselves whether today is just the latest in a long line of post GFC examples of the stock market freight train leaving the station to the upside following a breathtaking correction.

As a result, some investors may be increasingly feeling the fear of missing out and the need to increase their stock market allocations despite the fact that their instincts are screaming the exact opposite.

Discipline over emotion. It is important to remain disciplined and dedicated to your investment philosophy and approach regardless of what is taking place in the stock market or any portfolio asset class for that matter at any point in time. And for a balanced asset allocation strategy, this includes maintaining allocations across asset classes that are optimized through the ongoing inclusion where necessary of each worthwhile individual asset class including stocks at any given point in time.

In short, if you're feeling the fear of missing out on stock market upside, you should have been allocated to stocks at least to some meaningful degree throughout. With this in mind, the key question is the following: how to best maintain this stock allocation during the most difficult of times?

Quality is key. In the current market environment, an emphasis in the stock segment of your broad asset allocation portfolio on quality and low volatility is paramount. The idea of quality includes a focus on balance sheet factors such as liquidity and solvency risk as well as income statement elements such as operating consistency and profitability. And if recent early post Fed liquidity flood signals are any indication, this emphasis on quality may be particularly important going forward.

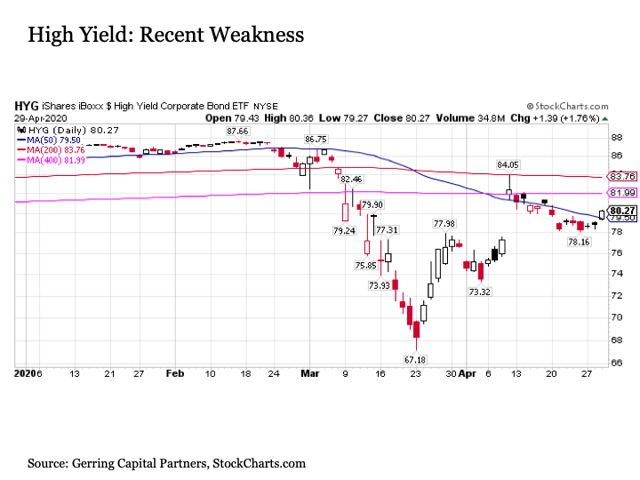

Consider the following from the high yield corporate bond market. Since the day before Good Friday on April 9 when high yield bonds popped on the news that the Fed would include purchases in the speculative grade space as part of its alphabet soup rescue programs, this area of the market has been adrift ever since.

While it has picked up a bit over the last three trading days, high yield bonds have the look of a market segment that is still drifting down.

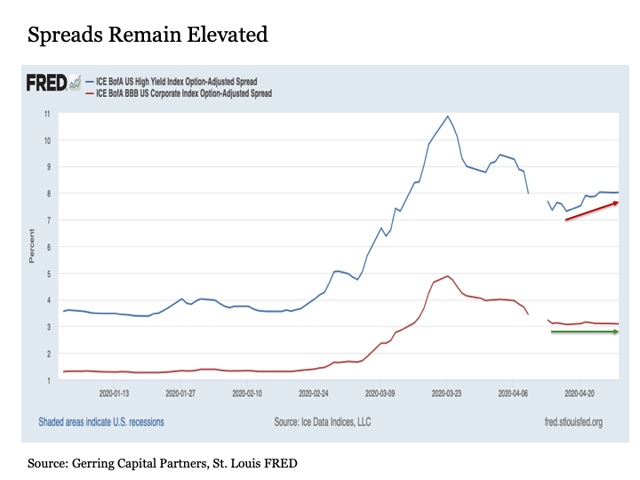

Recent trends in bond yield spreads relative to U.S. Treasuries are even more revealing.

Although the Fed has committed it will do way beyond whatever it takes to support the financial system, we see that bond spreads remain elevated not only in the high yield space but also among investment grade BBB credits.

Moreover, it is telling that since blowing out to cycle wide spreads on March 23 and subsequently coming back down to post correction low spreads on April 17, that high yield spreads have since widened by 71 basis points while BBB spreads have only increased by 2 basis points.

This suggests that investors may be increasingly conceptualizing that while the Fed may be overwhelmingly there to supply lending, this may not include any specific issuers in the high yield space other than a select group of fallen angels. Moreover, the Fed is not in the position to drive demand and cash flow for underlying issuers to service their debt.

Put more simply, the Fed's actions will only do so much to prevent widespread corporate bankruptcies. And these defaults are likely coming in a meaningful way in the speculative grade area of the market where the Fed has much less of an incentive to defend. As we all know, when a company falls into bankruptcy, their stock price effectively goes to zero.

As a result, if you are feeling the inclination to maintain or increase stock allocations, focus on those companies whose credit ratings are at least investment grade, which is BBB or better.

From my perspective, my preference is to focus primarily on companies that are single-A rated or better as an extra layer of protection, as I continue to believe that BBB will eventually become the new high yield before it's all said and done.

Of course, don't just rely on the credit rating as a guide, however, as you must do your own homework to confirm that corporate liquidity and solvency is strong. After all, it is easy to forget that AIG was once prime AAA rated as recently as 2005 not that long before the onset of the financial crisis.

And I would contend that a number of companies currently rated BBB are in better financial shape than others that are rated in the AA and A range. As always, do your own homework and verify before making any securities purchase.

A developing and critical near-term risk to the Outlook. While everything certainly seems ducky for the U.S. stock market, a significant near-term risk is rising that warrants close attention in the coming weeks and months. And from my qualitative observation, the stock market appears to be vastly underestimating this risk to date. What is this risk? It is the lifting of "stay at home" measures.

I also understand the argument that current "stay at home" measures may be doing more harm than good at this point along with the notion that the death rate may be much lower than originally thought and that many hospitals across the country are now struggling with being not busy enough instead of too busy.

I believe the argument makes sense to begin opening sooner rather than later if not now some of the more rural parts of the U.S. where the virus remains non-existent. And I'll even go so far as to say that I'm holding out the hope (based on nothing scientific mind you) that the upcoming hot summer weather keeps the virus in check.

But despite all of these considerations, the fact still remains that a quickly spreading virus does not care whether your livelihood is at risk, whether you have the right to assemble, or what anyone's opinion may or may not be about what to do next. All the virus cares about is finding a new host to continue its spread.

"A premature easing (of social distancing) would come at an irrevocable cost, so we should approach the issue very carefully, and invest deep thought into when and how to transition"

-- Kim Gang-lip, South Korea Vice Health Minister, April 13, 2020

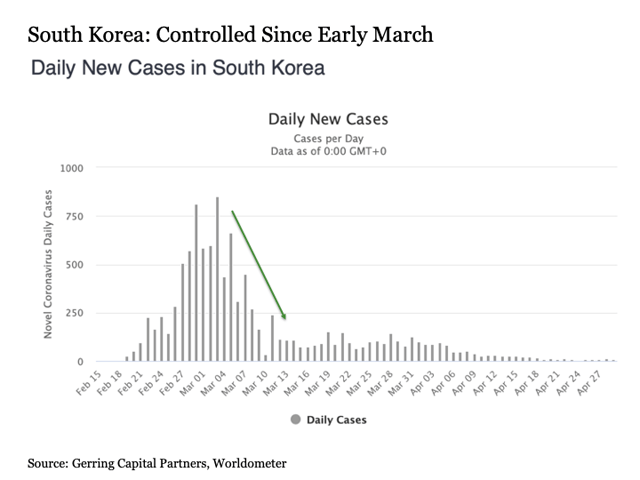

WWSKD? If any country has done COVID-19 about as well as they could, it has been South Korea (I would contend that Taiwan has done even better). As a result, when it comes to how to navigate a global pandemic, I am inclined to listen to what the political officials in South Korea have to say, for unlike the United States they have done major health outbreaks numerous times in the past.

In the case of South Korea, they had their first reported case of COVID-19 on the same day that we did here in the United States. But thanks to widespread testing and tracing along with strict social distancing measures, their active cases quickly peaked in early March and had largely abated by mid-March. But despite this success, they remain continually mindful of social distancing practices many weeks after the worst was behind.

Given that South Korea has been through this before and we in the U.S. have not, we would be well served to heed the sentiments contained in the quote above.

Of course, South Korea is an exceptional case, so what about situations that are more like the U.S. for a more comparable circumstance.

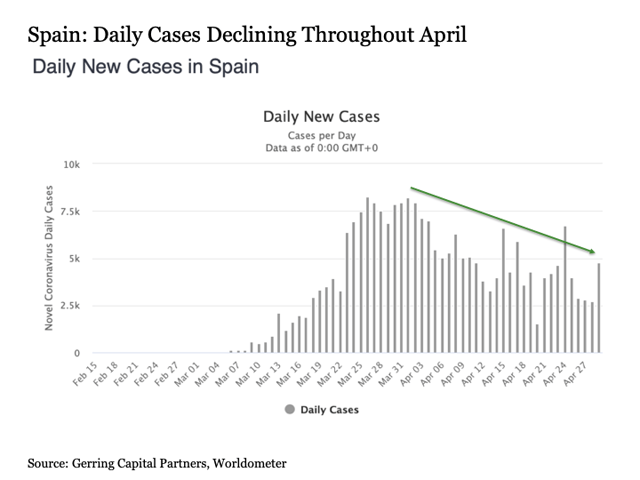

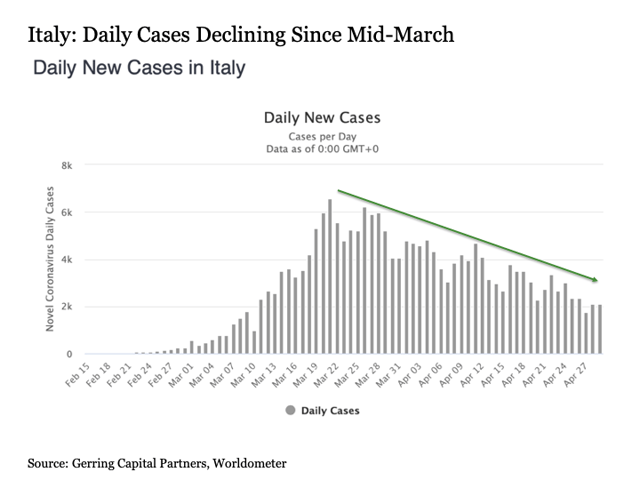

Spain and Italy. These countries were among the hardest hit by the coronavirus. They are the only other nations outside of the U.S. that have more than 200,000 recorded active cases to date (we in the U.S. now have more than 1,000,000 recorded active cases btw and this doesn't include the potentially many more that remain unaccounted for). Both of these countries have made good progress over the past many weeks.

The number of new active cases in Spain peaked at the start of April and has been falling ever since.

And after a month of trending in the right direction, Spain is just now taking initial steps to relax social distancing measures.

The situation in Italy has also shown good progress. After peaking in mid-March, the number of new active cases has been steadily declining in the many weeks since. And like Spain, they are now starting to take preliminary steps to start to reopen their economy.

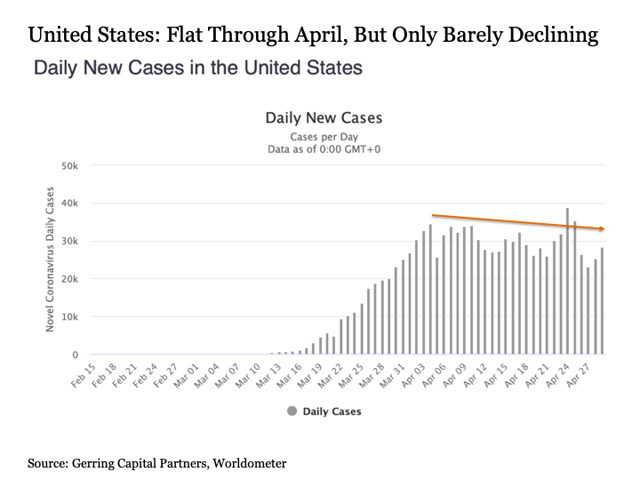

What about U.S.? We have arguably the best medical system in the world in this country. But we also have the highest number of active cases by 4x and deaths by 3x versus any other country in the world (the latter reading is still good on a per one million basis, but the absolute number is still high globally).

But unlike many of its global peers, the number of active cases each day remains stubbornly high to date. Unlike so many other countries that are only now just starting to reopen after weeks of declining new active cases, the U.S. is still seeing active cases come in at plateau levels to date.

Jumping the gun? This raises the question as to whether we are moving too soon in reopening many parts of the U.S.

For not only are new active cases stubbornly flat, but the two-day death total of 4,860 on April 28-29 was exceeded only twice before on April 14-15 and April 21-22. In short, we remain near highs in terms of deaths to date.

We have already seen in cases like Singapore, Japan, and Hong Kong that the threat of a second wave outbreak is real. And these took place in countries where they are experienced in dealing with virus outbreaks and had done well in driving the new active cases per day toward zero. It's not a question of whether we want to reopen. We most certainly do. Instead, it is a question of whether we are truly ready to reopen.

Key missing elements. An added risk to our increasing reopening plan in the U.S. is the following: one of the primary reasons for enacting "stay at home" measures in most states across the country over the past month and a half was not only to "flatten the curve", which we have achieved thus far despite the curve's stubbornness to not start falling down the other side, but it was also to buy time so that we could be as prepared as possible with the necessary testing, tracing, and treatment so that the economy could restart most effectively once it was time to go back out.

Unfortunately and at least to date, while Gilead Sciences (NASDAQ:GILD) has provided us with some promising initial treatment readings for remdesivir, we as a country are simply nowhere close to being ready when it comes to testing and tracing. In short, we are now reopening our state economies not much more prepared than we were when we closed everything up.

Potential irrevocable cost risk. Our potential lack of readiness to reopen our economy looms as arguably the most significant downside risk to the economy and its markets in the months ahead. Consumer and business confidence has already been badly shaken by COVID-19 over the past two months. And the restart of the U.S. economy is likely to be cautious and uneven anyway.

But if we were to restart our economy prematurely only to have to head back indoors due to a major second wave, third wave, fourth wave outbreak, this would be particularly damaging for both consumers and businesses, as it would dash any notion that the worst of it all is now behind us. I would postulate that no amount of fiscal or monetary stimulus would be able to offset the economic and psychological damage of having to repeat "stay at home" measures over the coming months.

Once again, hopefully ongoing social distancing efforts and the coming hot weather keeps COVID-19 at bay - only time will tell. In the meantime, this looms as a major downside risk to the near-term outlook.

Bottom line. The S&P 500 Index is showing great determination to continue rising despite the deeply poor underlying fundamentals. Given this disconnect in an already expensive market, investors seeking to either maintain existing stock weightings or add to an existing allocation are likely to be well served to emphasize financial quality and low price volatility in their stock selection while leaning away from stocks whose underlying credit rating is speculative grade.

Disclosure: This article is for information purposes only. There are risks involved with investing including loss of principal. Gerring Capital Partners and Global Macro Research makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made.

There is no guarantee that the goals of the strategies discussed by Gerring Capital Partners and Global Macro Research will be met.

0 comments:

Publicar un comentario