You Better Have A Game Plan

by: Lawrence Fuller

Summary

- Don't bet your portfolio on either the best or worst possible outcome.

- It's far more likely that this recession and bear market are more severe than 2000, but less so than 2008.

- Use the volatility in markets as an opportunity to rebuild your portfolio as we carve out a bear market bottom.

- It's far more likely that this recession and bear market are more severe than 2000, but less so than 2008.

- Use the volatility in markets as an opportunity to rebuild your portfolio as we carve out a bear market bottom.

"Everyone has a plan until they get punched in the mouth," said Mike Tyson.

Everyone got punched recently to varying degrees, and that includes those who saw the bear coming.

If you were an investor holding a diversified portfolio, it was impossible to avoid losses in what was the most rapid bear-market decline on record over four weeks.

Now, the focus should be on how and when the economy and markets recover.

The most optimistic assert that we will have a V-shaped recovery in both, fueled by the unprecedented monetary and fiscal policy stimulus that will soon be pumping through the veins of our economy.

The most pessimistic are calling for a deep and prolonged recession and bear market that will lead to another financial crisis like what we experienced in 2008.

If you were an investor holding a diversified portfolio, it was impossible to avoid losses in what was the most rapid bear-market decline on record over four weeks.

Now, the focus should be on how and when the economy and markets recover.

The most optimistic assert that we will have a V-shaped recovery in both, fueled by the unprecedented monetary and fiscal policy stimulus that will soon be pumping through the veins of our economy.

The most pessimistic are calling for a deep and prolonged recession and bear market that will lead to another financial crisis like what we experienced in 2008.

No one knows for certain, because there are too many variables that can't be determined at this time, but I suspect that the future will fall somewhere in between the most optimistic and most dire predictions.

I also think it's extremely risky for investors to position their portfolios in such a way that they profit only from either the most bullish or bearish outlook. We need to be prepared for both.

The bottom line is that you better have a game plan, and I'll share mine after reviewing how we got here, which I think will shed light on where we are headed.

I also think it's extremely risky for investors to position their portfolios in such a way that they profit only from either the most bullish or bearish outlook. We need to be prepared for both.

The bottom line is that you better have a game plan, and I'll share mine after reviewing how we got here, which I think will shed light on where we are headed.

The Fundamentals

I think it's reasonable to argue that the stronger the economic and market fundamentals are before the onset of a bear-market decline and recession, the shallower and shorter both will be.

Unfortunately, neither were strong at the end of last year.

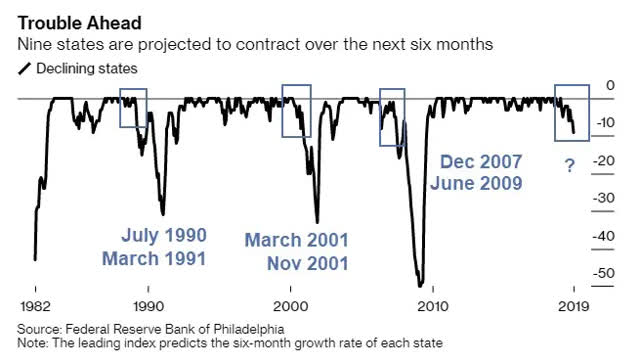

The rate of economic growth was gradually slowing, despite a $1.5 trillion tax cut implemented in 2018 and significant deficit spending by the federal government. That combination led to what was going to be a $1 trillion deficit before the latest $2.2 trillion fiscal stimulus package. In fact, nine states were projected to be in recession this year, as of the end of last year.

We had an economy that was borrowing 5% of GDP to grow 2%, which I don't describe as strong.

The stock market fundamentals were not much better, as corporate profits were in decline throughout 2019, while valuations continued to expand. This dislocation between fundamentals and price was fueled by relentless monetary policy rhetoric and stimulus from the Fed with the goal of inflating financial assets.

While it worked in markets, it had a lessening impact on the economy and promoted malinvestment. It also resulted in one of the most overvalued markets in history, based on the metrics below, which is one of the reasons why the decline was so rapid and severe.

The Technical Backdrop

The technical backdrop for the stock market had been deteriorating for more than a year prior to the bear-market decline, and it started in typical fashion with the lowest quality stocks. The Russell 2000 (NYSEARCA:IWM) was the canary in the coal mine, as this domestically focused small-cap index peaked in August 2018. It has now declined more than 40% from that high.

This is where valuations and leverage were the most extreme, and earnings quality was the poorest.

This is where valuations and leverage were the most extreme, and earnings quality was the poorest.

The Value Line Geometric Index, which is an equal-weighted index of some 1600 stocks, peaked shortly after the Russell 2000, and continued to deteriorate as we started the new year.

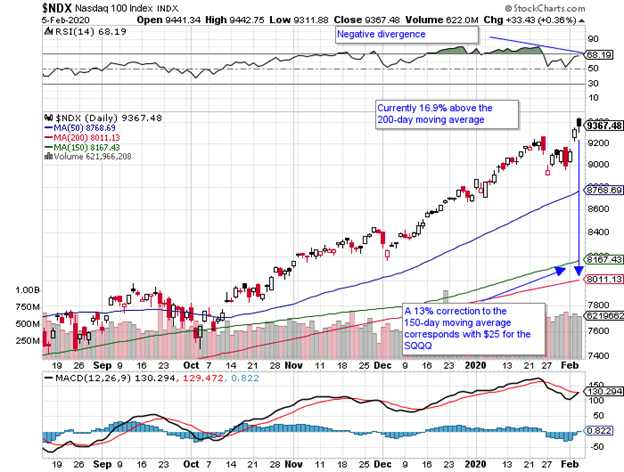

As the technical backdrop continued to deteriorate, investors crowded into the largest-cap momentum stocks, which drove the Nasdaq 100 (NASDAQ:QQQ) to all-time highs. It also carried the S&P 500 (NYSEARCA:SPY) and Dow Jones Industrial Average (NYSEARCA:DIA) to all-time highs.

By early February, the extension of the Nasdaq 100 index above its long-term moving average (200-day) became so extreme at nearly 17% that a meaningful correction was inevitable, as can be seen in the chart below. That was the highest percentage in a decade.

This was the euphoric rally that is typical at the end of bull markets called a "blow off top."

This was the euphoric rally that is typical at the end of bull markets called a "blow off top."

In summary, the fundamental and technical developments leading up to this recession and bear-market decline are not that much different from what we saw leading up to the 2000 and 2008 episodes.

It's the same cast of character with a slightly different storyline, but the result was the same. All three bubbles were blown by the malinvestment resulting from monetary policy.

History As A Guide

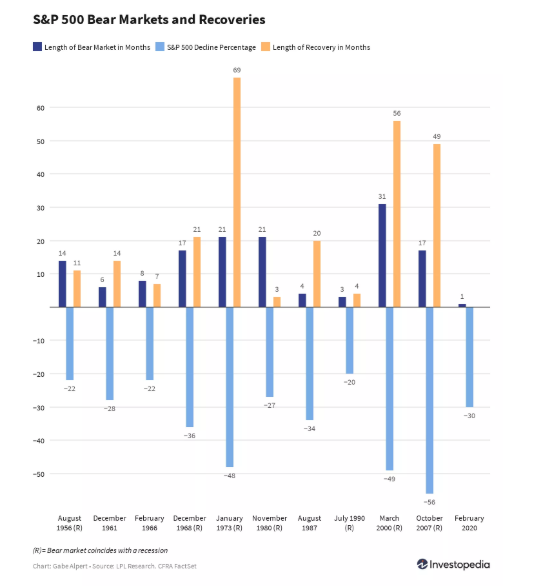

The dot-com bubble burst in March of 2000 and the S&P 500 declined 49% in what was a 31-month bear market that ended in October 2002. The recession was mild, starting in March 2001 and ending in November 2001.

What's notable here is that a new bull market was not born until well after the recession ended, but the carnage was concentrated in corporate America, while the consumer was far less impacted.

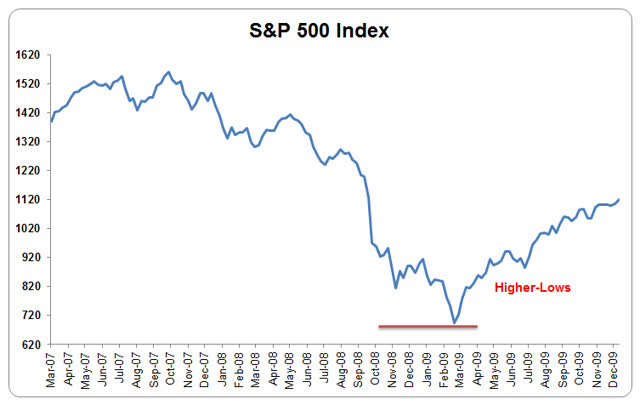

The housing bubble led to a bear market that started in October 2007 and lasted 17 months until March 2009, during which the S&P 500 declined 56%. The Great Recession started in December 2007 and ended in June 2009 in what was the most severe economic contraction since the Great Depression. The stock market bottomed before the recession ended, largely due to the fiscal and monetary policy stimulus that was enacted.

No one can calculate the depth and duration of the bear market and recession that is upon us, because we don't have enough information. Everything is a function of sentiment right now. That's what we are left with when we can't determine the fundamentals.

The greatest variable is when the coronavirus that has paralyzed our economy will be contained. Once the consensus sees light at the end of the tunnel on containment, sentiment should start to improve, and the focus will shift to economic recovery.

The S&P 500 has already cratered 34% from its all-time high in February. The crowded consensus view is that we will retest the recent lows at approximately 2,237. That is where opinions diverge on whether we see a V-share recovery or break that low to fall as much as 50-60% from our highs.

When I look at the history of bear markets, I'm left thinking that this is far worse than 2000, but not as severe as 2008. This leads me to the conclusion that a decline of 50% from the highs to approximately 1,700 on the S&P 500 is entirely possible, except for one mitigating factor - stimulus.

There's a tsunami of monetary and fiscal stimulus in the trillions that stands ready to flood into the economy and financial markets unlike anything we have ever seen in history. It's also coming to the economy's and market's aid at lightning speed relative to what we saw in 2008.

I may not like it, but it is a reality I can't ignore. I know that liquidity is what fuels markets, regardless of how long it takes for the fundamentals to recover.

Therefore, my worst-case scenario is a decline to 2,000 in the S&P 500. What makes that level important for me is that it dictates where and at what rate I will start to more aggressively deploy capital into risk assets. At the same time, I need to be prepared in case my analysis is flawed and my market outlook incorrect.

If the S&P 500 never reaches 2,000, I don't want to find myself significantly under-invested waiting for a target that never materializes. At the same time, if the market falls much lower than my target, I don't want to be in a position where I can't capitalize on it.

My Game Plan

I mentioned at the beginning that I think it's extremely risky for investors to position their portfolios in such a way that they only profit from either the most extreme bullish or bearish outlook.

What if you are on the wrong side? It's a huge gamble. Therefore, I'm preparing for every possible scenario with an all-weather investment strategy that maintains a core exposure to stocks, bonds, commodities and cash.

The cash allows me to tilt my weightings either offensively or defensively, depending on the direction that I believe the markets are most likely to be headed. This avoids the blunder of completely missing out on significant moves up in the stock market, while also allowing me the flexibility to capitalize on meaningful declines.

Given the technical and fundamental backdrop to the market leading into the beginning of this year, I was defensively positioned in my asset allocation model. This doesn't mean that I didn't suffer losses, but I softened the blow with hedges and larger cash balances than I would normally maintain. This allowed me to capitalize on the stock market plunge in mid-March by adding 20 new stocks to my equity portfolio.

I then took profits in several following the bear-market rally that followed. In the process, I was able to buy some very high-quality companies at prices that I had not seen in several years. Now, I have modestly upgraded the quality of my portfolio, and I'm looking to repeat the process during the next leg lower, should it come to pass as the consensus expects.

This process of gradually rebuilding your portfolio on pullbacks with quality names and then taking profits to reduce risk during rallies can be repeated over and over again. The key is to always have cash in the portfolio and adding hedges on those rallies helps to rebuild the cash reserves. I will repeat this process for months until we carve out a bottom in this bear market.

The significance of my downside target of 2,000 is that this is where I will no longer look to profit from a decline in the market with the hedges I use. I also will reduce the cash levels in my stock allocation significantly, while still allowing some flexibility to add exposure if we decline further below that level.

Focus On The Forest

In my experience, investors spend most of their time focused on the individual stocks, bonds, funds and other securities held in their portfolios. That focus becomes progressively more acute as economic expansions and bull markets age.

As a result, they spend increasingly less time focused on the big-picture patterns and cycles, which is a huge mistake. There should always be a balance between the two, but the top-down focus on the broad market and economic backdrop should be emphasized in the latter stages of the cycle.

I wrote about this phenomenon at its pinnacle in January in Keep Eyes On the Forest While Climbing Trees, but it was the least read article of any I had written in years. I think everyone was busy climbing their respective trees.

I fell victim to this error with technology stocks in the late 1990s, early in my career. That experience helped better prepare me for the current bear market.

I have seen a similar stampede into high-yielding investments during this most recent cycle, which was fueled by the Fed's zero-interest-rate monetary policy and its relentless backstop on risk assets for the past decade.

It convinced many who were hunting for yield that there simply was no risk. The problem is that the yield was predicated, either directly or indirectly, on an ever-growing mountain of debt.

That debt finally came home to roost, as it always does, when an exogenous event in the form of a pandemic brought economic activity to a standstill. If it hadn't been the pandemic, it would have been something else.

As we begin a gradual deleveraging process in the economy and markets, yields will fall and income will be reduced, making the high-yielding sectors of the market a far more challenging area to invest. Yet that will result in new segments of the market presenting opportunities and taking a leadership role.

Identifying those segments, sectors and securities is what I'm focused on now, as we carve out a bear-market bottom in the months ahead. The three things that are the most critical in this process are glaringly obvious.

We need to arrest the spread of the virus and develop a vaccine, determine the effectiveness of the monetary and fiscal stimulus in restarting the economic engine and have a better gauge on the direction of policy as the election approaches.

0 comments:

Publicar un comentario