by: Altitrade Partners

Summary

- There appears to be a second wave of COVID-19 hitting China, Germany, Spain and Singapore while, at the same time, Japan has moved to a national state of emergency.

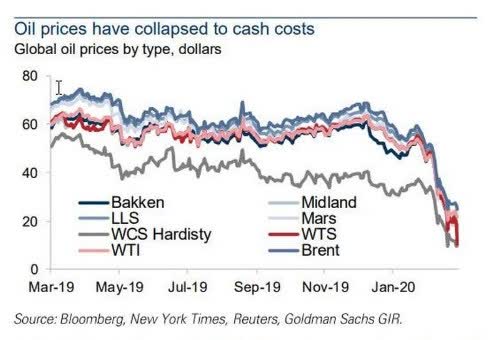

- Crude oil prices have collapsed to a level that will cause major economic dislocations around the world.

- Relations between the U.S. and China are likely to become more strained as an investigation into the origins of COVID-19 gets underway.

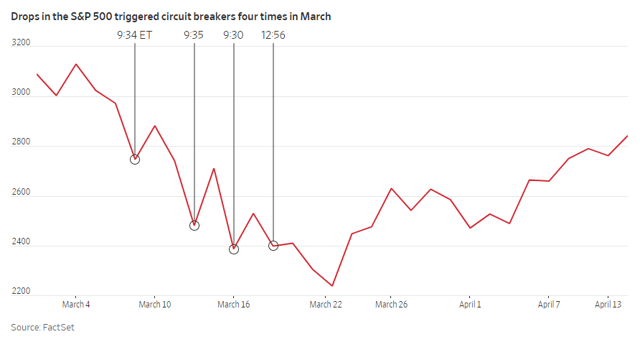

After an initial panic, complacency seems to have resumed among many investors, as the VIX has fallen from a high of 85 to below 40.

- Crude oil prices have collapsed to a level that will cause major economic dislocations around the world.

- Relations between the U.S. and China are likely to become more strained as an investigation into the origins of COVID-19 gets underway.

After an initial panic, complacency seems to have resumed among many investors, as the VIX has fallen from a high of 85 to below 40.

We would like to start off this article with a basic premise for what is to follow:

The Coronavirus, and its future path, will be the single-most important factor in shaping the global economy for the next 18-24 months.

Now, that statement might seem obvious to some, but if that is the case, based on the global data that we have been seeing lately, why are there so many individuals who are taking the seriousness of this pathogen so lightly?

And why has the U.S. stock market priced in such a confident view for the short-term resolution of this horrible pandemic, when the best guesstimate by scientists and health officials is that a vaccine will take at least 12-18 months to develop?

We are very bearish on the U.S. stock market, because will believe that the impact of COVID-19 has been severely underestimated by many on Wall Street.

We also believe that we are going to see another leg down in the major stock market averages sometime between now and late Fall of 2020. While we will not attempt to speculate exactly where the bottom will be, we are absolutely convinced that it will be below the March bottom that we have already made.

Part of our thinking is that President Trump is far too optimistic about his timeline to re-open the country for business, and that even if he does accomplish his goal by the early part of June, we do not believe that we will return to "business as normal" for at least another six months after that.

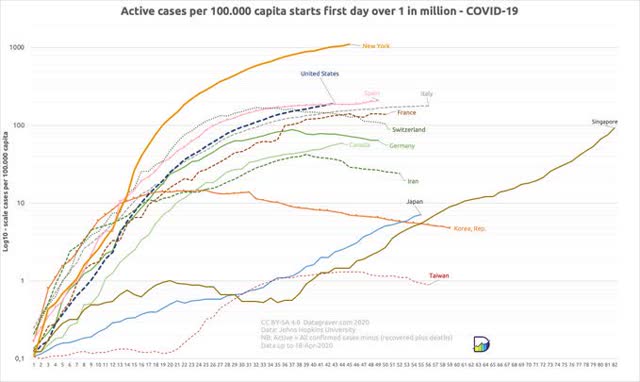

The recent news of several countries around the world facing a second wave of the Coronavirus should cause investors sit up and take notice of how potentially devastating COVID-19 could become; both economically and for society as a whole.

We are beginning to see signs of a second wave appearing in several countries around the world, after initially having some success in containing the spread of this deadly virus.

Those countries include China, the first epicenter of the virus, now along with Germany, Spain and Singapore.

It was announced earlier today that the death toll in Spain has now reached 20,000, placing it in the same category as the United States & Italy.

Recent news over the past week continues to show extremely difficult and troubling data.

Here is just a sampling of recent global news within the past few days:

Here is just a sampling of recent global news within the past few days:

- Wuhan revises citywide Coronavirus death toll 50% higher

- US sees huge spike in deaths on Thursday

- NYC cancels all 'nonessential' events for the month of May

- Global death toll passes 150k

- Illinois closes schools for rest of year

- NY total cases: 229,642

- NY reports slight drop in hospitalizations, ICU admissions, but deaths ' basically flat' at 630

- NJ reports 300+ deaths

- Italy reports slowdown in new cases but slight uptick in deaths

- Texas cancels school until end of year

- France reports 761 new deaths

- Iran holds 'military parade' with equipment used to fight the virus

- Spain death toll tops 20k, joining US & Italy

- Report claims 7,500 died uncounted in UK nursing homes

- US total cases passes 700k, deaths near 40k

- NY Post claims nursing home deaths in NY went uncounted

- Spain extends lock-down by 2 weeks

- Saudi Arabia reports record new cases for 4th day in a row

- Sweden reports 606 new cases

- Belgium reports 1,000+ cases

- Japan case total passes 10k

- Phoenix TV station warns of under-counting of deaths

- Iran death toll crosses 5k as country's reopening begins

- UK reports another 900 deaths

- California reported 87 new deaths, bringing its statewide total to 1,072

- Belgium reported more than 1,000 new cases in 24 hours, with 1,045 new cases of the virus, and 290 new deaths, for a total of 37,183 cases and 5,453 deaths

- Belgium, the Netherlands and several other countries in Europe, as well as Russia, report a startling acceleration in the virus.

- LA County revealed that it suffered its deadliest streak yet during the last 24 hours, reporting 81 deaths, along with a huge jump in cases (642).

Source: Zero Hedge

Are investors being myopic by ignoring this kind of data and sticking their heads in the proverbial sand?

Is the world even close to reaching some sort of "normalcy" amidst these distressing headlines? Can we have economic normalcy without social normalcy?

How long will it take for investors to stop minimizing the impact of the Coronavirus on the former by ignoring of the long and arduous timeline necessary to achieve the latter?

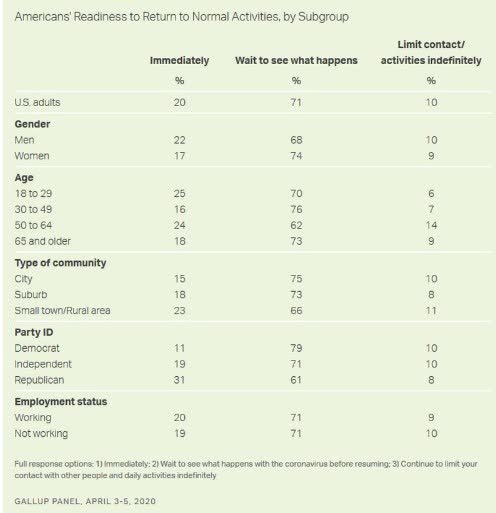

According to a recent Gallup poll, even after opening the U.S. economy, many people say they will not return to normal activities immediately.

What could this type behavior do to an anticipated "V"-shaped recovery?

Investors seem totally unprepared to accept that the damage and subsequent long-term economic and social consequences, due to the initial wave of the Coronavirus, have not been adequately discounted in equity prices.

Are we prepared for the possibility that we could experience a second, more deadly, wave of COVID-19 as we move towards the early autumn months?

This is the importance of social distancing, said Michael LeVasseur, a visiting assistant professor of epidemiology and biostatistics at Drexel University’s Dornsife School of Public Health. Since individuals are likely capable of transmitting the virus when they are asymptomatic, limiting the number of contacts any individual has to the household, for example, will limit the spread of the virus.

So, what happens if we loosen up social distancing measures? It depends on the point in the so-called “curve” that each state or municipality decides to lift its guidelines.

If we have the public health infrastructure that individuals can report to a testing clinic to receive a test and then self-isolate while awaiting results, maybe it would work, LeVasseur said. If we don’t, then they’ll likely continue infecting people and we will see a surge of cases.

I don’t believe that we go back to normal at all, LeVasseur said. Not until there’s an effective treatment or vaccine, anyway. We can regain some semblance of normalcy, but we will need to remain vigilant as citizens and scale up our public health efforts in order to prevent future surges.

Source: Huffpost

Our observations of the general public show us that not enough people are taking COVID-19 seriously; that puzzles and disturbs us. I have even seen this in some of my own family, and have tried to plead the case for taking stronger safety precautions to avoid transmission of the virus to other, older family members.

Not only is the President of the United States downplaying the risks of this global pandemic, but so are many American citizens. Could they be taking their lead from the President? It is apparent that investors certainly are.

President Trump seems to believe that we'll have a "V"-shaped recovery and it will be as if nothing ever happened. The "world's greatest economy ever" will simply pick up where it left off. The fear investors are feeling will pass, along with the virus.

But this Coronavirus could create a different kind of fear; primal-like in nature.

During the Spanish Flu Pandemic in 1918, the second wave of the pandemic resulted in five times more deaths than took place in the first wave.

There were 3 different waves that took place during this historically deadly pandemic. The first wave occurred in March 1918. The second wave took place in the fall of 1918. The third wave that started in the Winter of 1918 finally exhausted itself by the summer of 1919.

It was the second wave of The Spanish Flu that exacted the largest death toll among its victims. In all, over 50 million of the world's population ultimately succumbed to this deadly pathogen.

Source: Center For Disease Control and Prevention

The recent COVID-19 virus also began to claim a statistically significant number of victims in March of 2020. If a second wave were to occur, it is expected to happen as the weather becomes cooler in the autumn months. This would be similar to the pattern seen during The Spanish Flu, which began a second wave in the Fall of 1918.

This second wave, should it happen, would have a major impact on the three most popular sports played in the United States; football, basketball and hockey. All of the playing schedules for these three spectator sports are heavily weighted during the months between September and April.

That would have a tremendous impact on the American lifestyle.

Some are even saying that COVID-19 could become seasonal, like the existing seasonal influenza's that we are accustomed to dealing with every year.

For those who would treat the Coronavirus as just another influenza, remember that the COVID-19 virus killed more Americans in one month than the ordinary flu kills in one year.

The other major difference between COVID-19 and other influenza's, is that with the Coronavirus you can be asymptomatic for up to two weeks. This allows the COVID-19 virus to spread among the general population in a very stealth-like manner.

The speculation regarding where the Coronavirus came from and where it originated has become a topic of much discussion recently.

We expect to see a major deterioration in China-U.S. relations, based on China's apparent part in the spread of the COVID-19 pandemic. Just the other day, during the daily press briefing by the White House Coronavirus Task Force, President Trump was asked about the possibility that the virus may have been manufactured and released by a bio-lab in Wuhan. While he would not go into any details, he made it very clear that he was "not happy."

The necessity of portraying an atmosphere of progress and performance, during the China trade deal negotiations, was a tool used by the Trump administration to slowly cajole the markets higher.

In many ways, they are using many of those same tactics, not to necessarily cajole the markets higher, but to bolster the economic outlook in a post-COVID-19 world, in order to circumvent a stock market meltdown.

President Trump and his economic team, along with The Fed, could not then, and cannot now, afford to disrupt the illusion of the "economic wealth effect", that has kept consumers spending on just about everything, while continuing to push stock prices to historically high valuations.

Trump likes to call himself "The Stock Market President" and any talk that would endanger stock prices from continuing to march onward and upward, is viewed as heresy by the President.

Over the past few months, the stock market has listened to the soothing reassurances of President Trump, while investors have participated in what may well be remembered the greatest bull-trap and sucker's rally in history.

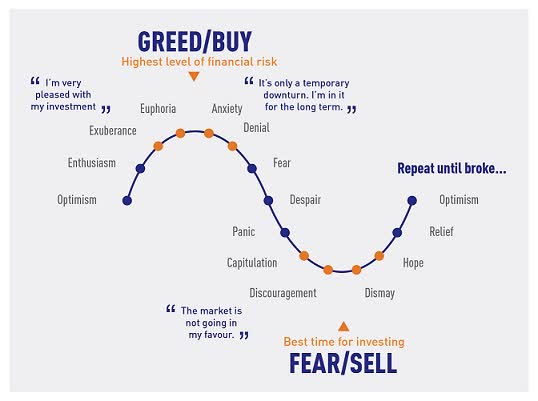

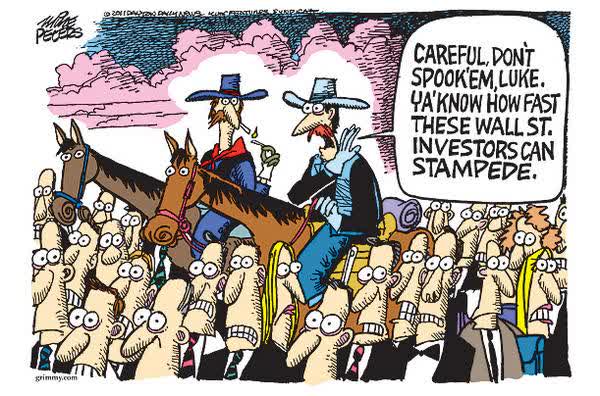

We have long looked at market psychology as an important factor in driving the decision-making process for investors. In fact, we have often said that the market, in its most basic form, is nothing more than "emotions in motion".

Yet, many today do not understand the emotional implications of what this global pandemic means for society and how it could change the deeply ingrained behavioral patterns of investors.

Fear and greed are the two most basic emotions that investors will experience everyday in the financial markets. How you process those two emotions will ultimately determine your success or failure as a trader or investor.

The euphoric feeling of making profits, driven by greed, or the frightening feeling of losing money, driven by fear, are both non-primal like in nature.

While greed has less strength, i.e., emotional impact, on making investment decisions than fear does, it is nonetheless a a contributing factor in the dynamics of the markets.

While greed does not necessarily create an immediate "call to action", the feeling of fear does. How we process these two strong emotions will have a major impact on the actions we take in the financial markets. There is a big difference psychologically in how an investor makes buy and sell decisions based on greed versus fear.

As an example, greed will generally elicit a positive feeling. You are making money; hence you view yourself as being successful in your trading and/or investing activities. That positive feeling can even release endorphins in the brain, leading, many times, to a feeling of being giddy or overconfident.

In these circumstances, you are not required to make an immediate decision because everything is going your way, and you feel that it will most likely continue. You can maintain a somewhat relaxed composure.

On the other hand, fear will usually elicit a negative feeling. It makes you nervous and anxious. Your mind can become distracted when you are fearful. You begin to question yourself when you are in a losing investment position. Your heart begins to beat faster. You may be perspiring. Your hands might be getting sweaty. Your decision-making abilities may become impaired. In its worst form you may begin to sense a lack of control and even experience a sense of fight or flight ---- "I need to get out of this position, NOW".

Oftentimes, when a position is going against you, a feeling of helplessness can surface. As an investor watches a losing position continue to go against them, they sometimes may resort to trying to rationalize a feeling of hope.

Hope is not an investment strategy. The mere fact that an investor would begin to play the mind game of replacing rational, objective thinking with abstract, subjective thoughts should tell you that you are in trouble emotionally.

That is why disciplined traders use stop-losses to eliminate the games that your emotions can play with you in navigating the markets.

Denial is quite normal human behavior. It often acts to deflect fear, anxiety and responsibility, while, at the same time allowing us to maintain a necessary illusion to protect our fragile egos.

Are investors playing those same mind games now by hoping that the Coronavirus will not become an even larger problem, from both a health and economic perspective, in the future? The $64,000 question is, are investors in a mental state of denial?

Judging by both the health and economic headlines, we would have to answer that question with a resounding and emphatic YES!

The markets are not a matter of life and death. There will always be another day tomorrow. Only death is permanent. C'est la vie.

However, experiencing something as raw as the primal-like fear of death could dramatically affect people's overall mental well-being and their ability to process information and make cogent decisions.

Primal-like fear would likely create the associated primal urge to immediately protect oneself, other tribe (family) members, and everything that one values.

We all should understand that when a fight or flight mentality takes hold, people tend act first and then re-assess the situation they are facing later. It's akin to the saying "Shoot first and ask questions later".

That assessment of what things are most important may also contribute to a change in the prioritization of our lives, our ethics, our personal relationships and our financial situation.

Primal-like fear could have an unintended and possibly unexpected effect on the human psyche, and, hence investor behavior. If you factor in the possibility of such primal-like fear turning into a crowd mentality, you can understand how quickly a major panic could set in.

We are willing to bet that, after the past few days there are more than a few Crude Oil traders who know what primal-like fear feels like.

Don't think that a drop of that magnitude could happen in the equity markets? It could, even despite the 7%, 13% and 20% circuit breakers. Primal-like fear is just that strong.

The rush for something as simple as toilet paper has already caused massive panic among consumers; resulting in sudden uncontrollable fear or anxiety, which then can lead to wildly unthinking and irrational behavior, such as hoarding. And that's just one of many possible items that could be impacted.

What about money? Could we see a sudden rush by the panicked masses for cash, which in turn could lead to the hoarding of money? Some would say that we have already seen that happen when just about every liquid asset was sold in the March meltdown.

The March mini-crash was driven by mostly external factors. There was a sudden need for liquidity, driven by the decoupling of global markets. The corresponding fallout that resulted, caused massive selling in just about every asset class, including safe-haven precious metals.

The financial system was already beginning to show signs of stress as early as last November/December when the repo-market began to exhibit some very strange behavior. That, for us, was the proverbial canary in the coalmine.

Both consumers and investors seem to be either immune or ignorant to what the potential impact of experiencing societal primal-like fear could be. Suffice to say that what we have seen so far, could become much, much worse.

We are already seeing the economic effects of the first wave of the pandemic on things like unemployment, consumer confidence, and a host of other economic indicators.

The global economy has experienced an unexpected short-term shock that will unfortunately result in long-term economic consequences. The impact that these changes will have in the underlying structure of the global economy cannot be magically fixed by any amount of central bank intervention. In fact, such Modern Monetary Policy initiatives will ultimately create another, more severe set of problems.

So, what could things possibly look like for society and stock market investors if the unimaginable happens?

What if history were to repeat itself and we are once again faced with a situation like the Pandemic of 1918?

What if history were to repeat itself and we are once again faced with a situation like the Pandemic of 1918?

Don't think that it could happen? Think again.

“There are only patterns, patterns on top of patterns, patterns that affect other patterns. Patterns hidden by patterns. Patterns within patterns. If you watch close, history does nothing but repeat itself. What we call chaos is just patterns we haven't recognized. What we call random is just patterns we can't decipher. what we can't understand we call nonsense. What we can't read we call gibberish. There is no free will. There are no variables.”

~ Chuck Palahniuk

“That is the key to history. Terrific energy is expended - civilizations are built up - excellent institutions devised; but each time something goes wrong. Some fatal flaw always brings the selfish and the cruel people to the top and it all slides back into misery and ruin.”

~ C. S. Lewis

Please understand, this is not intended to be alarmist, but simply to offer information in preparation for a scenario which may, or may not, happen. As the saying goes: "Be prepared for the worst and hope for the best".

Our belief is that even without a second wave of COVID-19, the stock market has not yet reached a bottom. The colossal collapse of oil prices, and the reverberations across entire economies should ensure that a new bottom will be made in the stock market. If we were to experience a second wave of the Coronavirus, we believe that the subsequent market sell-off would certainly be accompanied by a much lower bottom in stock prices.

Putting the Coronavirus aside, and, instead, turning to recent economic headlines, here we see a baker's dozen of news regarding the economy and business indicators:

- US Industrial Production Crashes By Most Since End Of World War II

- Far Worse To Come: COVID-19 Collapse Of State & Local Governments

- Housing Starts Collapse By Most In 36 Years

- Philly Fed Collapses By Most Ever To 40 Year Lows

- 22 Million Jobless Claims In 1 Month: Last 4 Weeks Erase All Jobs Created Since The Great Recession

- Bullard Warns "Depression" Is Possible; Says Americans Should Wear A Badge With Covid Test Results

- "A Bad Global Precedent" - Chinese GDP Collapses More Than Expected, Worst Since At Least 1992

- US "Leading" Economic Indicators Crash By Most In Over 60 Years

- Guggenheim CIO Sees S&P500 Falling As Low As 1,200

- The "Best" Economy Ever? Neither Before, Nor After Coronavirus

- Goldman Now Sees A 123% Plunge In Q2 S&P Earnings, $850BN Drop In Corporate Cash Spending

- Retail Sales Were Bad; The Reality Is Catastrophic

- US Economy Contracting "At Sharpest Pace Since World War Two" & "The Worst Is Yet To Come"

This certainly doesn't look like the set-up for a "V"-shaped recovery to us.

We mentioned that falling oil prices could be the next catalyst for a swift move down in stock prices.

The carnage from this unexpected and historical drop in the price of crude may have just begun in earnest, as the price of Canadian oil just turned negative, as Goldman Sachs predicted three weeks ago.

The carnage from this unexpected and historical drop in the price of crude may have just begun in earnest, as the price of Canadian oil just turned negative, as Goldman Sachs predicted three weeks ago.

Some may counter with the argument that the markets are a discounting mechanism; that investors look forward, not backwards. That is true, but the economy and business environment that we see ahead in no way justifies stock prices being anywhere near their current levels; 24,242 for the Dow-Jones Industrial Average and 2875 for the S&P 500, as of the April 17, 2020 close.

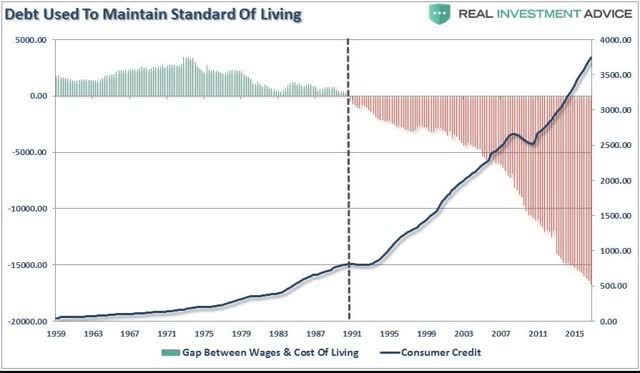

Consumer spending accounts for roughly two-thirds of GDP. Areas such as dining out, leisure activities, air travel, vacations, buying cars, home improvements, and spending on non-essential items ARE NOT likely to return to pre-Coronavirus levels anytime soon even if the "all-clear" is given to people currently locked down and sheltering-in-place.

Why? Because the consumer is going to hoard every last dollar that they can get their hands on. The consumer spending spree is over. As a country, we have been living beyond our means for years; racking up debt on credit cards, refinancing homes, buying automobiles with cheap loans, etc.

Do you really think that with all of the uncertainty surrounding this pandemic, and the huge amount of consumer debt that has been built up over the years, that people going to be as frivolous with money as they once were? We think not.

And, as if the debt-bomb isn’t bad enough, many Americans are now paying their rent by credit card.

People are going to retreat into a mindset of austerity. They would rather keep their money to ensure that they can pay the rent/mortgage, utility bills, keep their cell phones working, buy food etc. Most likely, even spending on clothes will not be viewed as essential.

Consumers are going to become misers; pinching every penny because they don't know how long this virus will last, and more importantly if the money the government is providing will continue and for how long?

Remember during the banking crisis of 2008-09 how TARP money was being hoarded by the big banks, when the government was pushing for them to loan the money out to stimulate the economy.

The same thing is happening now, but it is the consumer, not the big banks, that will be holding on tightly to any money that comes their way.

The same thing is happening now, but it is the consumer, not the big banks, that will be holding on tightly to any money that comes their way.

Whether, or not, there is a second wave, we are about to see a steep decline in consumer spending in this country, and it is likely to last for a very long time. The impact that will have on GDP, corporate earnings, and stock valuation levels will be devastating.

To add to that, the one primary reason for stock prices reaching new highs almost without interruption during the 11-year bull market was the effect of corporate stock buybacks. These massive buyback programs were the proverbial floor underneath the stock market.

That floor underneath stock prices no longer exists, and sellers are going to have to find another source of buyers to make up for the demand for equities. But who will that be? The Fed? Perhaps, but even then, it would take such massive amounts of money that it would surely cause the collapse of the U.S. dollar.

Why do you think that the demand for physical gold and silver has been so overwhelming?

Because the dollar will eventually be dethroned as the world's reserve currency. The printing presses over at the Treasury are running at full steam and there doesn't appear to be any let-up on the horizon.

Because the dollar will eventually be dethroned as the world's reserve currency. The printing presses over at the Treasury are running at full steam and there doesn't appear to be any let-up on the horizon.

We hate to say it, but the writing is on the wall. We are not going back to any sort of normalcy in society or the economy for a long, long time. You can't just hit the light switch and expect everything to become bright again.

The impact of this shock will be felt for years to come, and the current damage done to the economy and corporate earnings will take years to heal.

Unfortunately, buyers of equities today who think that there will be a "V" shaped recovery are simply not being realistic, are still living in the past, and are trying to revive a dead bull. The "Buy The Dip" mentality will prove extremely painful to those who are chasing overvalued stock prices.

The Fed is simply kicking the can down the road once again; fearful of destroying the "wealth effect". It is the illusion that they need so badly to maintain in order to keep this house of cards they have created from collapsing.

The worst consequence of the actions by the Fed with all of this ZIRP and QE has been forcing those retired senior citizens who used to buy CDs and money-market funds, because they were safe, into risk assets such as closed-end funds, mREITs, Midstream LPs, BDCs, etc. because they were literally starved for yield. Many of those high-yield investment alternatives are not only down anywhere from 30-80% in price, but many have also drastically slashed or eliminated their dividend payouts.

The worst consequence of the actions by the Fed with all of this ZIRP and QE has been forcing those retired senior citizens who used to buy CDs and money-market funds, because they were safe, into risk assets such as closed-end funds, mREITs, Midstream LPs, BDCs, etc. because they were literally starved for yield. Many of those high-yield investment alternatives are not only down anywhere from 30-80% in price, but many have also drastically slashed or eliminated their dividend payouts.

Just take a look at NRZ, a perceived safe mortgage REIT. The shares are down to $5.75 from a record-high price of $17.66 just two months ago. It got as low as $2.91 before the recent rebound.

That's a loss of some 67% in value. Add to that the reduction in the dividend from 50 cents to 5 cents.

That's a 90% reduction in dividend income. And that is just ONE OF MANY of the horror stories that conservative investors have been subject to. All because the Fed has forced people, who have no business investing in equities, to chase yield.

That's a loss of some 67% in value. Add to that the reduction in the dividend from 50 cents to 5 cents.

That's a 90% reduction in dividend income. And that is just ONE OF MANY of the horror stories that conservative investors have been subject to. All because the Fed has forced people, who have no business investing in equities, to chase yield.

Will those who have seen their retirement portfolios decimated in the span of less than two months be spending any money in the U.S. economy? We all know that they no longer have the money to spend that they once did, so the answer is a resounding NO.

Many similar-type investments are in shambles along with the portfolios of those investors who had to make the difficult decision to abandon the safe-haven of CDs and money-market funds to generate some level of spendable income.

Yet, many investors, so much like Pavlov's dog, are salivating every time stock prices retreat.

They cannot shake the behavioral urge to step up and "buy the dip". This dip may, without notice, turn into a dump at the slightest sign of a second wave of COVID-19 as some countries are beginning to experience.

They cannot shake the behavioral urge to step up and "buy the dip". This dip may, without notice, turn into a dump at the slightest sign of a second wave of COVID-19 as some countries are beginning to experience.

Investor's responses have become so conditioned to any market decline, irrespective of the severity, that they simply view it as another opportunity to pile into equities. This type of behavioral conditioning, which triggers an almost automatic buying impulse, is especially dangerous in today's environment.

Complacency has once again returned to Wall Street, as the market rally has softened fears of economic fallout from the pandemic. Like the Sirens in Greek Mythology whose sweet music lulled normally vigilant and cautious navigators to throw caution to the wind, so stock market investors appear to be doing the same.

Don't think that investors are complacent? Here is a smattering of comments posted to recent bearish articles on Seeking Alpha.

We could literally post hundreds more:

We could literally post hundreds more:

"Next leg down" ???? I guess I missed it, but did we have a first leg down? Buy the dip.

March 20 was the bottom of this cycle for the foreseeable future. We will not see those levels again unless we have WW3.

Well technically the bear market is already over. Shortest in history.

It wasn't really a bear market. We just had a correction and the bull market is still intact as I've been saying for weeks.

Doesn't matter man. Just hush and keep investing

Only 50%? You should be 100% in equities. Where's your conviction?

These dangerous Sirens, whose charming music and angelic singing voices caused many innocent victims to shipwreck on the rocky coast of their island, perhaps have returned; this time to the canyons of Wall Street, to lure unsuspecting investors with a similar bewitching appeal.

Many investors are saying that "the bottom is in".

But is it?

But is it?

We don't believe that it is. Bear market rallies are historically the most vicious types of stock market rally. These rip-your-face-off, short-term spikes, in price typically are fueled by massive short-covering. They generally last a day or two before the trend of lower stock prices continues.

Since the market low reached on March 23, 2020, we have seen an approximate 30% rebound in stock prices. We expect this rally to soon falter as the news cycle turns to new concerns about a COVID-19 resurgence.

It was interesting to hear the talking heads on CNBC all-throughout the market decline emphasizing how orderly the selling was. Bottoms are rarely made in the midst of "orderly selling". They end with frenzied selling, deer-in-the-headlights type fear and capitulation. We have seen none of that so far.

So, while some people choose to ignore the social guidelines that have been issued related to public health, taking no heed of the dangers to both themselves and others, we wonder what it would take to shake them out of this attitude of complacency?

We wonder the same thing, as it relates to stock market investors. Would a sudden resurgence of the COVID-19 Pandemic be enough to trigger a change in market psychology and force investors to take their heads out of the sand?

Forget about fundamentals. Forget about the Fed. Forget just about everything that you think you know about markets. Primal-like fear, should it take hold, could turn the financial world upside down and inside out.

In such a case, expect a wholesale dumping of equities to a degree never seen before. Thus far, we have triggered the 7% circuit breaker on the NYSE four times. We never got to the 13% or 20% level, which would trigger additional trading halts.

Ordinary fear is nothing compared to Primal-like fear. The fear that was felt during the March meltdown in stock prices took place against a backdrop of a BTD mentality. Frightening, nonetheless, but a far cry from actual primal-like fear.

Take away that Buy-the-dip mindset and the accompanying urge to buy stocks, no matter what, and you have set the stage for a much different kind of fear that will grab hold of investors, and may result in the most panic seen in the stock market since October 19, 1987, when the Dow-Jones Industrial Average fell 22.6% in one day.

As we said earlier in this article, history oftentimes repeats itself.

Bear markets don't end on a buy the dip mentality. They end when wide-ranging complacency turns into outright boot-shaking fear. We are far from seeing anything near resembling a sick-to-the-stomach, gut-wrenching anxiety that causes panicked investors to literally puke up their stocks in a total, desperate act of capitulation. When that finally happens, the bottom will be in; not until then.

In summary, the three major dynamics that we believe will lead to another meaningful leg down in the major U.S. stock market averages are:

- The possibility of a second wave of the Coronavirus appearing in the early autumn months of 2020, thus causing further unanticipated business stress in the U.S. economy as a result of a Primal-fear response by investors.

- The consequences of a continuing demand-shock for crude oil around the world, resulting in many oil businesses to become insolvent.

- A deterioration in China- U.S. relations, which could negatively impact the prospects for global trade between the world’s two largest economies.

By the way, for those of you who think that you can simply ignore all of the bad economic news and the negative impact of COVID-19 on the global economy, due to the fact that the Federal Reserve will throw as much money at this problem that they need to rescue markets, think again.

As was pointed out by One River Asset Management Founder Eric Peters, in a recent interview:

Whether or not the central bank's decision is setting us up for an even more dramatic reversal later on no longer seems like a matter of speculation. The rapidity with which the market unraveled in March - erasing three years' worth of artificially inflated gains in three weeks - is evidence of what happens when artificial supports finally give way, leaving chaos in their wake.

Oh well, live by the Fed, die by the Fed.

0 comments:

Publicar un comentario