The Coming Stagflation And The Case For Silver

Summary

- The policy response to the current financial crisis creates a real risk of stagflation once the current liquidity crunch abates.

- The recent deflationary shock has triggered an all-out government and central bank inflationary response which looks set to dwarf the response seen during the height of the GFC.

- Policy measures aimed at bailing out Main Street are likely to prove much more inflationary given the higher propensity to consume among the middle class.

- As bond yields remain pinned down by QE and inflation expectations recover in response to further fiscal stimulus measures, this should see both short-and long-term precious metal drivers turn bullish.

- Silver in particular looks like a low-risk, high-potential trade which could easily double over the next 12 months.

- The recent deflationary shock has triggered an all-out government and central bank inflationary response which looks set to dwarf the response seen during the height of the GFC.

- Policy measures aimed at bailing out Main Street are likely to prove much more inflationary given the higher propensity to consume among the middle class.

- As bond yields remain pinned down by QE and inflation expectations recover in response to further fiscal stimulus measures, this should see both short-and long-term precious metal drivers turn bullish.

- Silver in particular looks like a low-risk, high-potential trade which could easily double over the next 12 months.

Contracting economic output and rising fiscal deficits and debt monetization are an ideal scenario for stagflation to occur.

The recent deflationary liquidity shock has triggered an all-out government and central bank inflationary response which could see precious metals prices soar.

Silver in particular looks like a low-risk, high-potential trade which could easily double over the next 12 months.

Economic Contractions And Fiscal Deficits Are The Ultimate Causes Of Inflation

The recent deflationary liquidity shock has triggered an all-out government and central bank inflationary response which could see precious metals prices soar.

Silver in particular looks like a low-risk, high-potential trade which could easily double over the next 12 months.

Economic Contractions And Fiscal Deficits Are The Ultimate Causes Of Inflation

Contrary to the mainstream economic consensus, economic contractions tend to be inflationary while strong growth tends to be disinflationary.

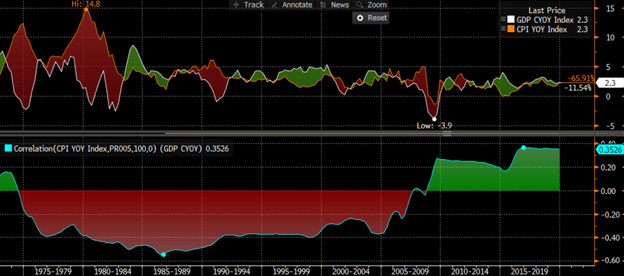

As the chart below shows there has tended to be a negative correlation between real GDP growth and inflation in the U.S. over the long term, with high inflation rates occurring amid economic contractions.

This makes intuitive sense; the fewer goods there are to go around, the more expensive they will become.

U.S. Real GDP Growth Vs Consumer Price Inflation

Source: Bloomberg

In addition to contractions in real GDP, inflation is caused by large fiscal deficits which create government liabilities out of thin air to pay for scarce real goods and services.

When the government spends money in excess of what it receives in taxes, it does not matter whether it creates a bond or currency out of thin air; the inflationary impact is the same.

For central banks that have the ability to create their own currency out of thin air thus eliminating default risk, government bonds are essentially just a form of money.

As John Hussman puts it:

Currency and Treasury securities compete in the portfolios of individuals as stores of value and means of payment.

QE Allows Governments To Run Huge Deficits At No Immediate Cost

If central banks were prohibited from monetizing debt then a large increase in bond issuance due to fiscal deficits would reduce demand for bonds due to fears that the government would not be able to pay back the money through future tax revenues. This would in turn prevent the government from running persistent fiscal deficits.

However, this is not the world we live in. For countries that can create their own currency at will, there is no constraint to continued deficits.

However, this is not the world we live in. For countries that can create their own currency at will, there is no constraint to continued deficits.

Ben Bernanke’s comments about Quantitative Easing being just an asset swap are technically correct as it simply replaces one form of government liability with another.

What is inflationary about QE is that it enables the government to continue running large fiscal deficits at no immediate cost.

Recent Surge In Money Demand Likely To Prove Temporary

What is inflationary about QE is that it enables the government to continue running large fiscal deficits at no immediate cost.

Recent Surge In Money Demand Likely To Prove Temporary

Large fiscal deficits and QE are necessary but not sufficient conditions to create high inflation.

What also needs to be taken into account is money demand.

The combination of the coronavirus and oil-price shocks has led to a surge in the demand for safe assets which has led to a temporary collapse in inflation expectations as seen by the fall in 10-year breakeven inflation expectations.

What also needs to be taken into account is money demand.

The combination of the coronavirus and oil-price shocks has led to a surge in the demand for safe assets which has led to a temporary collapse in inflation expectations as seen by the fall in 10-year breakeven inflation expectations.

U.S. 10-Year Breakeven Inflation Expectations

Source: Bloomberg

As explained here, money supply (and government bond supply) can be completely overwhelmed by a rise in money demand during times of financial crises.

However, such conditions are likely to prove temporary and the spike in demand for money should ease once financial conditions stabilize as they appear to be doing.

New Stimulus Efforts To Be Much More Inflationary Than Post-GCF Measures

Fiscal deficits and debt monetization in the wake of the Global Financial Crisis failed to create the high levels of inflation many originally expected as the money found its way into the hands of wealthier members of society who have a higher tendency to hoard money as a store of wealth rather than spend it.

Additionally, foreign central banks absorbed a lot of the increase in money and bond supply via reserve accumulation.

Additionally, foreign central banks absorbed a lot of the increase in money and bond supply via reserve accumulation.

The recent deflationary shock has triggered an all-out government and central bank inflationary response which looks set to dwarf the response seen during the height of the GFC.

Just as low volatility in asset prices lulled investors into a false sense of security with regards to financial risks, a decade of low inflation despite high fiscal deficits and debt monetization have lulled policymakers into believing that inflation is a thing of the past causing them to throw caution to the wind.

Just as low volatility in asset prices lulled investors into a false sense of security with regards to financial risks, a decade of low inflation despite high fiscal deficits and debt monetization have lulled policymakers into believing that inflation is a thing of the past causing them to throw caution to the wind.

Foreign central banks have ramped up their sales of U.S. Treasures to try stem currency weakness against the dollar over the past month and there is no guarantee that once the dollar begins to weaken again they will resume their long-term trend of purchases.

The Beijing mouthpiece Global Times noted on March 22 that ‘China needs to be vigilant about the impact of the US money-printing, with proper precautions made to its foreign exchange reserve structure.’

New Stimulus Measures Will Increasingly Be Targeted Towards Mainstreet

If there is one thing that politicians have learned from the GFC it is not that bailing out the banks is unpopular, but that only bailing out the banks is unpopular.

The financial sector is perceived to have been the sole beneficiary of the GFC stimulus to the detriment of the ordinary worker.

This time around, both the financial sector and the real economy are likely to be recipients of monetary bailouts in the form of tax breaks, stimulus checks, subsidies, welfare spending increases, and infrastructure spending.

The financial sector is perceived to have been the sole beneficiary of the GFC stimulus to the detriment of the ordinary worker.

This time around, both the financial sector and the real economy are likely to be recipients of monetary bailouts in the form of tax breaks, stimulus checks, subsidies, welfare spending increases, and infrastructure spending.

The fragile state of the social fabric in most western societies is ill prepared to experience an economic crisis and governments and central banks will do everything in their power to try to prevent one.

An additional thousand dollars in the hands of the average salaryman is likely to prove much more inflationary to million dollars in the hands of a billionaire as the former will have a much higher propensity to consume.

Increased Socialism And Protectionism To Add Fuel To The Fire

An additional thousand dollars in the hands of the average salaryman is likely to prove much more inflationary to million dollars in the hands of a billionaire as the former will have a much higher propensity to consume.

Increased Socialism And Protectionism To Add Fuel To The Fire

Even before the coronavirus shock we estimated the U.S. long-term growth outlook to be slightly less than 1% per year (see 'Brace For Sub-1% Long-Term Growth').

This now seems ambitious as the recovery from this current crisis looks set to be hindered by the response undertaken by the government and the Fed.

The Fed’s decision to buy corporate bonds looks like being only the first step on the path to increased public sector control over asset markets, while government spending levels look set to soar as a share of GDP from already-elevated levels.

Meanwhile, the trend of politicians blaming wealth inequality on the wealthy looks set to intensify and suggests that efforts to ‘soak the rich’ will gather steam.

This now seems ambitious as the recovery from this current crisis looks set to be hindered by the response undertaken by the government and the Fed.

The Fed’s decision to buy corporate bonds looks like being only the first step on the path to increased public sector control over asset markets, while government spending levels look set to soar as a share of GDP from already-elevated levels.

Meanwhile, the trend of politicians blaming wealth inequality on the wealthy looks set to intensify and suggests that efforts to ‘soak the rich’ will gather steam.

Furthermore, globalization could be set to take a decisive blow as governments look to reduce their dependence of essential goods imports in the wake of the coronavirus epidemic. This is particularly problematic given that the U.S. economy is heavily dependent on imports.

As Real Interest Rates Continue To Fall, Precious Metals Will Be The Ultimate Winners

As Real Interest Rates Continue To Fall, Precious Metals Will Be The Ultimate Winners

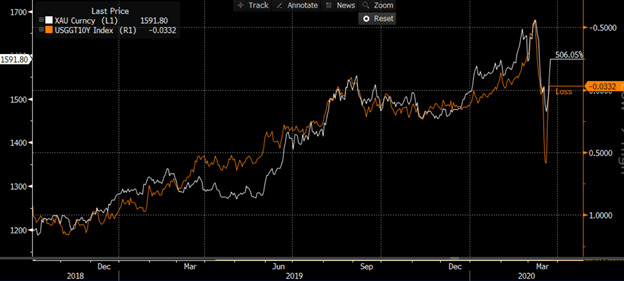

Gold prices follow trends in real bond yields in the short term while over the long term they follow the general price level.

Gold’s rally since mid-2018 has occurred alongside a fall in real bond yields but despite a fall in inflation expectations.

As bond yields remain pinned down by QE and inflation expectations recover in response to further fiscal stimulus measures, this should see both short-and long-term gold drivers turn bullish.

Gold’s rally since mid-2018 has occurred alongside a fall in real bond yields but despite a fall in inflation expectations.

As bond yields remain pinned down by QE and inflation expectations recover in response to further fiscal stimulus measures, this should see both short-and long-term gold drivers turn bullish.

Gold Price Vs 10-Year Inflation-Linked Bond Yield (Inverted)

Source: Bloomberg

The biggest winner however could be silver.

Silver is deeply undervalued relative to gold on a historical basis with the current ratio of 114x more than double its long-term average.

This may actually understate the level of silver’s undervaluation.

Silver tends to be roughly 3x more volatile than gold and so usually underperforms in precious metal bear markets and outperforms in bull markets.

This time around, silver has languished even as gold prices have risen.

If we adjust silver both metals for their historical volatility as the chart below shows, silver works out to be over four standard deviations from its long-term average.

Silver Vs Gold Price Adjusted For Relative Volatility

Source: Bloomberg

Silver has a tendency to undergo major rallies once momentum picks up. Our theory is that gold is the more convenient store of value while silver is too bulky at low price to be used as a convenient store of wealth. Once silver starts to rise though, it becomes more appealing as a store of value which is why we’ve previously seen major surges in the metal.

As James Grant noted back in 2016:

Silver is the crazy uncle in the attic of monetary metals.

0 comments:

Publicar un comentario