Wall Street’s plunge underlines Fed’s diminishing ability to limit shockwaves

Gillian Tett

This decade, America’s equity market has been like a drug addict. Until 2008, investors were hooked on monetary heroin (ie a private sector credit bubble).

Then, when that bubble burst, they turned to the financial equivalent of morphine (trillions of dollars of central bank support).

Now, in the wake of Thursday’s historic equity market crash, they must contemplate a scary question: has this monetary morphine ceased to work?

Think about it. Ever since 2016, the Federal Reserve has tried to wean the markets off its quantitative easing measures and ultra-low rates. But whenever markets have wobbled — as they did last year in the repurchase sector — the Fed always returned with a new monetary fix.

That has helped to sustain a startling bull market in equities and bonds.

Last week initially seemed a replay of this pattern: after equity markets tumbled, the Fed delivered a 50 basis point emergency cut. There was an immediate jump just after the rate cut — by 500 points for the Dow Jones Industrial Average — but it fell later that day.

And this week the respite from a Fed hit was even more shortlived: on Thursday it pledged new asset purchases and $1.5tn support for repo markets but after a brief rally, equity prices crashed again, closing almost 10 per cent down. This is the fifth-largest daily decline on record — which is chilling given that the four other episodes were 1987 and the three worst days in 1929.

If you want to be optimistic, it is possible to argue (or hope) that the magnitude of Thursday’s crash can be partly blamed on the pesky robots. An ever-swelling proportion of the market is traded according to computer-driven strategies, and these unleash waves of automatic selling (or buying) when technical levels are breached, fuelling volatility.

The swings were probably further amplified because some asset managers engaged in forced selling to meet margin calls, creating pockets of bizarre price swings. Take gold. Normally this rallies in a crisis. But on Thursday it tumbled more than 5 per cent. This is a hint that somebody was selling whatever assets they had to hand that were liquid and valuable.

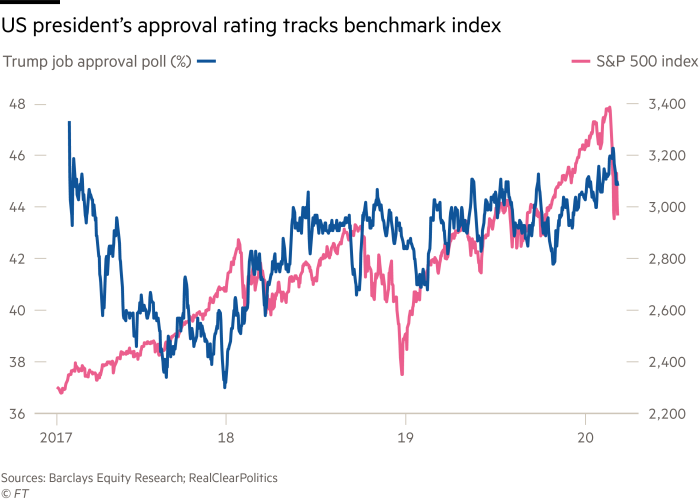

And if you want to be truly cheerful it is also possible to think — or hope — that the sheer magnitude of Thursday’s share price crash has actually created the seeds of its future reversal. After all, one thing we have learnt from President Donald Trump’s tweets is that he is obsessed with the stock market (which is no surprise, perhaps, given how closely it correlates it to his approval rating).

It is possible that a 10 per cent market crash is the one thing that will force Mr Trump to acknowledge the severity of the coronavirus crisis and force him to back proper responses to contain it (free mass-testing and more controls on movement). If that emerges in the coming days, it will cheer investors.

However, there is another way to interpret Thursday’s dramatic moves: investors may be starting to contemplate a world in which financial morphine no longer functions. After all, another startling detail about Thursday’s drama was that the yield on 10-year bonds rose to 0.88 per cent, compared with 0.76 per cent two days earlier.

This is alarming — and odd — given the Fed support announcement on Thursday; doubly so, since Wall Street analysts now predict that the US central bank will cut rates to zero next week.

Maybe this can be blamed on more forced selling (there are rumours of hedge funds engaged in relative value strategies being forced to unwind positions in a manner that distorts bond prices).

But it might also reflect something else: some investors no longer think that a shot of cheap money works in the face of medical uncertainty, a global recession, looming corporate defaults and weak political leadership.

Either way, the key point is this: Thursday’s crash not only pushed March 12 2020 into the history books; it also undermined the image of central bank omnipotence.

If President Trump thinks he can reverse the rout by demanding more Fed action, he is gravely mistaken. Prepare for more market spasms.

0 comments:

Publicar un comentario