by: KCI Research Ltd.

Summary

- In the financial sector, there are few large banks as loathed as Deutsche Bank.

. Deutsche Bank has underperformed its U.S. peers dramatically as European Banks have struggled mightily with negative interest rates and the fallout post the GFC.

- Proponents of the lower for longer narrative have made DB a fulcrum stock, and the tide appears to be turning.

. Deutsche Bank has underperformed its U.S. peers dramatically as European Banks have struggled mightily with negative interest rates and the fallout post the GFC.

- Proponents of the lower for longer narrative have made DB a fulcrum stock, and the tide appears to be turning.

I will go to my grave... believing that really loose monetary policy greatly contributed to the Financial Crisis. There were obviously problems with regulation, but when we had a 1% Fed Funds rate in 2003 after, to me, it was pretty obvious that the economy had turned (up) and I think the economy was growing at 7% to 9% nominal in the fourth quarter of 2003 and that wasn't enough for the Fed. They had this little thing called 'considerable period' on top of the 1% rate just so we would make sure that their meaning was clear. And it was all wrapped around this concept of an insurance cut… I've made some money predicting boom-bust cycles. It's what I do. Sometimes I am right. Sometimes I am wrong, but every bust I had ever seen was proceeded by an asset bubble generally set up by too loose policy…"

- Stanley Druckenmiller

"Try to buy assets at a discount rather than earnings. Earnings can change dramatically in a short time. Usually, assets change slowly. One has to know how much more about a company if one buys earnings."

- Walter Schloss

"A 60:40 allocation to passive long-only equities and bonds has been a great proposition for the last 35 years… We are profoundly worried that this could be a risky allocation over the next 10."

- Sanford C. Bernstein & Company Analysts (January 2017)

"Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria."

- Sir John Templeton

"Life and investing are long ballgames."

- Julian Robertson

Introduction

In their simplest form, the financial markets, and price action for a majority of the current bull market, can be distilled into the belief and expectation for ever lower interest rates, and expectations for lower for longer long-term interest rates, driving valuation multiples higher.

Said another way, market participants are willing to pay into the stratosphere, as I demonstrated with my analysis of Procter & Gamble (PG), for a perceived stream of safe future cash flows and/or dividends.

On the opposite side of the investment ledger are companies whose cash flows are relatively uncertain, including commodity-oriented producers, even though many of these companies, such as Range Resources, which I profiled here, are materially undervalued, and companies who are impaired by low interest rates.

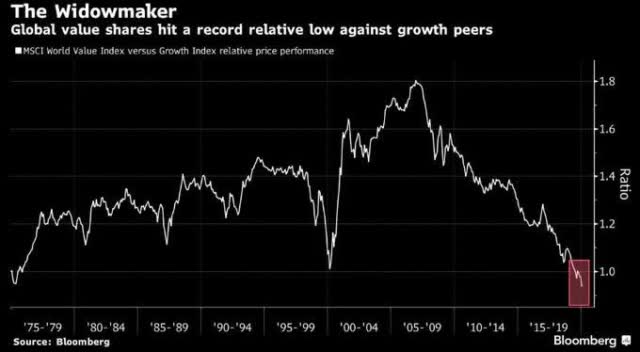

Collectively, these out-of-favor, harder-to-value investments have been driven to unprecedented low valuation multiples, creating a historic bifurcation between "have" and "have not" stocks.

Within the financial sector, this bifurcation of "haves" and "have nots" can be clearly demonstrated by the performance of U.S. large-cap banks and their European banking peers.

Deutsche Bank (DB) happens to be the most loathed of these European banks, with a clear bullish and bearish divide, which I have illustrated privately in a member article.

Building on this narrative, Deutsche Bank has become a fulcrum security, held lower by those who espouse Steve Eisman's view that Deutsche Bank is a "problem bank" (keep in my that Eisman shorted Tesla (TSLA) too so he has had his successes and failures like we all have had), and more importantly, held lower by those that believe interest rates will stay lower for longer.

Investment Thesis

Deutsche Bank is a fulcrum security that stands on the dividing line of the lower for longer narrative that dominates financial markets today. Rising global sovereign interest rates, particularly at the long end of the curve, would be massively bullish for Deutsche Bank, the financial sector in general, and this development has the potential to spark a historic capital rotation.

Deutsche Bank Shares Have Been Crushed

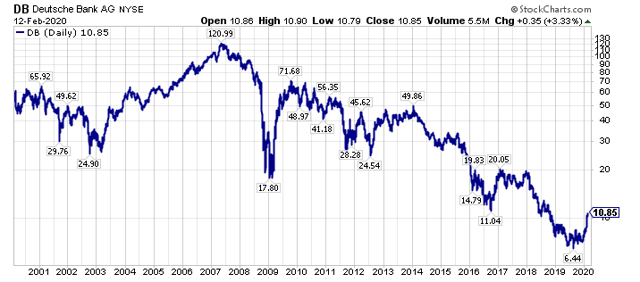

Over the past decade, in a roaring global equity bull market, Deutsche Bank shares have lost a majority of their value, as the long-term chart below shows.

Strikingly, Deutsche Bank shares trade materially below their 2008/2009 lows and a shockingly far distance from their 2009 recovery highs, let alone their 2007 peak levels.

Interestingly, as noted in the introduction, there has been a notable bounce from the lows in Deutsche Bank shares that we will address more later in this article.

Relative Performance Has Been Abysmal Too

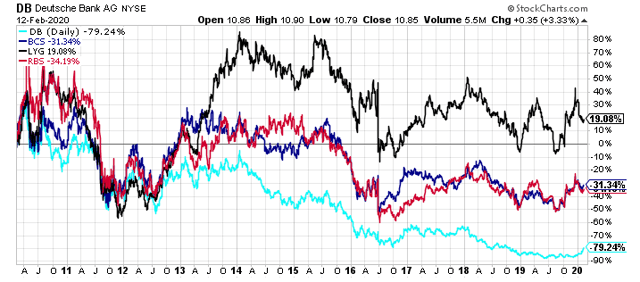

Compared to its European banking peers, including Barclays (BCS), Lloyds Group (LYG), and Royal Bank of Scotland (RBS), Deutsche Bank has been at the bottom of the pack in terms of performance the past decade.

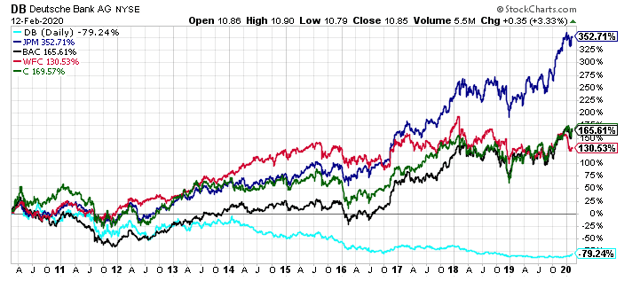

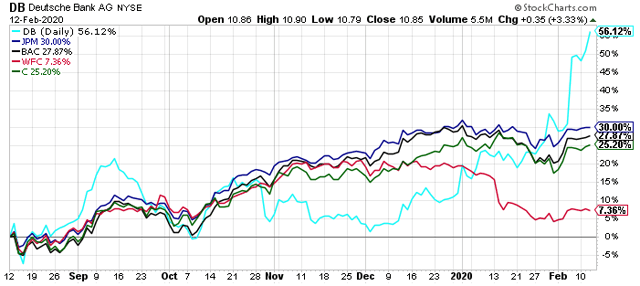

Looking at the above, Deutsche Bank's relative performance has been very poor compared to its European banking peers over the past decade, however, that is nothing compared to how Deutsche Bank has fared vs. its U.S. banking large-cap peers, JPMorgan Chase (JPM), Bank of America (NYSE:BAC), Wells Fargo (WFC), and Citigroup (NYSE:C) over the past 10 years.

(Source: Author, StockCharts.com)

(Source: Author, StockCharts.com)

The performance numbers above make it hard to believe that Deutsche Bank is operating a similar businesses, specifically western developed market banking, including often competing against their U.S. peers in capital markets businesses.

A Ray Of Light At The End Of The Tunnel

Over the last six months, Deutsche Bank shares have actually outperformed both their U.S. and European banking peers, gaining 56.1%, including a 39.5% year-to-date rise in 2019.

What is sparking this recent out-performance?

From my view, it is two factors.

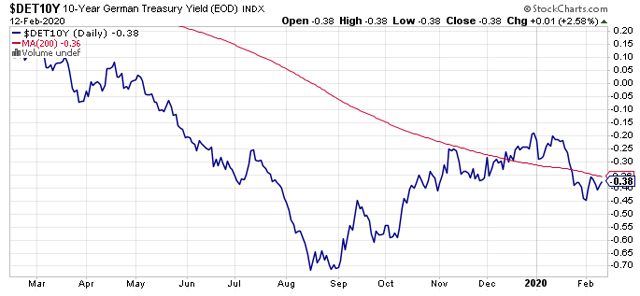

First, German interest rates, specifically longer-term interest rates, have recovered from their late summer 2019 lows, as the chart below of the German 10-Year Treasury Yield shows.

German 10-Year Treasury Yields actually traded above their 200-day moving average in December 2019 and January 2020, before retreating, as global sovereign bond yields have been dragged lower by coronavirus fears, specifically fears of the virus negatively impacting global economic growth (in addition to its devastating human impact) for an undetermined amount of time.

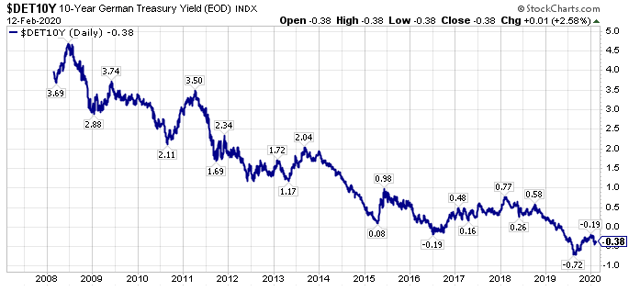

Bigger picture, German 10-Year Treasury Yields have been trending lower ever since the Great Financial Crisis, putting tremendous pressure on the European banking sector.

Put into perspective, the fledgling upturn in German 10-Year Treasury yields is a blip on the long-term chart.

Having said that, German Treasury Yields have been leading global sovereign bond yields lower, and a sustainable upturn may very well lead global sovereign bond yields higher.

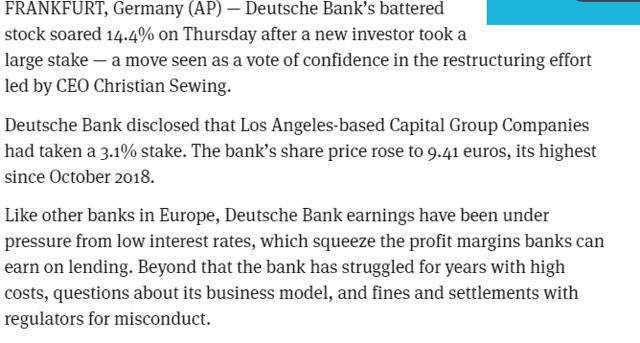

The second factor driving the recent surge in Deutsche Bank shares is the return of a prominent investor, specifically the Capital Group Companies, which many investors may know from their retail oriented mutual fund business, which is branded American Funds. This article in the Seattle Times from last Thursday highlights the re-entry of Capital Group in Deutsche Bank shares.

With roughly $2 trillion in assets under management, Capital Group Companies is one of the largest active asset managers, so their return to Deutsche Bank shares, after previously exiting, is an encouraging sign.

For perspective, Vanguard has roughly $6 trillion in AUM, and Blackrock (BLK) has roughly $7 trillion in AUM, so Capital Group has tremendous reach, size, and scale.

Personally, I have experience working with Capital Group directly, including visiting their Los Angeles offices on multiple occasions. From my personal experience, I can attest to the rigorous nature of their due diligence, and additionally to the fact that they are long-term oriented value investors, tending to hold their positions for many years.

Their 3.1% stake in Deutsche Bank is right behind Hudson Executive Capital's 3.14% stake, a hedge-fund founded by a JPMorgan alumni, and Blackrock's 4.5% position in DB shares.

Notably, Deutsche Bank is Hudson Executive Capital's largest position, showing that even a former JPMorgan executive sees the value disparity between U.S. banks and their European peers.

Closing Thoughts - Change Is In The Air and Deutsche Bank Is Leading The Charge

Deutsche Bank, one of the worst performing large-cap European banks, is the poster child between the disparity of returns between the in-favor equities and their out-of-favor counterparts.

Additionally, Deutsche Bank has become a fulcrum security for many market participants who believe interest rates will be lower for the foreseeable future.

These twin narratives, the bifurcation of performance and the belief in lower interest rates forever, have driven growth investments to a greater period of out-performance vs. value investments than we even saw in late 1999/early 2000.

(Source: Bloomberg)

(Source: Bloomberg)

With capital flows increasingly directed toward price insensitive and valuation insensitive passive index funds and ETFs, many rightly question what could reverse the tide.

The rationale is that the leading market capitalization stocks, specifically Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), (GOOG), Amazon (AMZN), and Facebook (FB), which collectively compromise a greater percentage of the S&P 500 Index, as measured by the SPDR S&P 500 ETF (SPY), than even Microsoft, General Electric (GE), Cisco (CSCO), Exxon Mobil (XOM), and Walmart (NYSE:WMT) comprised at the end of 1999, will continue to be the recipient of market inflows.

This is one of the main reasons by the way, specifically the influx of fund flows where larger market capitalization firms benefit disproportionately, for the out-performance of JPMorgan Chase's common equity, which was detailed earlier in the article.

The answer to this concern is that very similar to 1999/2000, narrative follows price action.

Thus, when the current equity market bubble bursts, and rest assured, it's a market bubble in U.S. equities that is greater than the ones we saw in late 1999/early 2000, or in 2007, the leading market capitalization equities today, will see the brunt of the selling pressure.

(Source: Advisor Perspectives)

When the dam breaks, the "have not" stocks, like Deutsche Bank (DB) will be out of harms way, as they have built their current homes nowhere near the raging rivers and tides of market liquidity.

In closing, ironically, Deutsche Bank, a poster child for the negative impact of lower for longer sovereign interest rates, might be sending a warning signal, rising as German long-term interest rates move off what has the potential to be a secular bottom. As Mark Cuban said recently, only one thing matters, and that's interest rates, and the rise in Deutsche Bank's equity may be a sign that they are headed higher.

0 comments:

Publicar un comentario